I need help with this assignment.

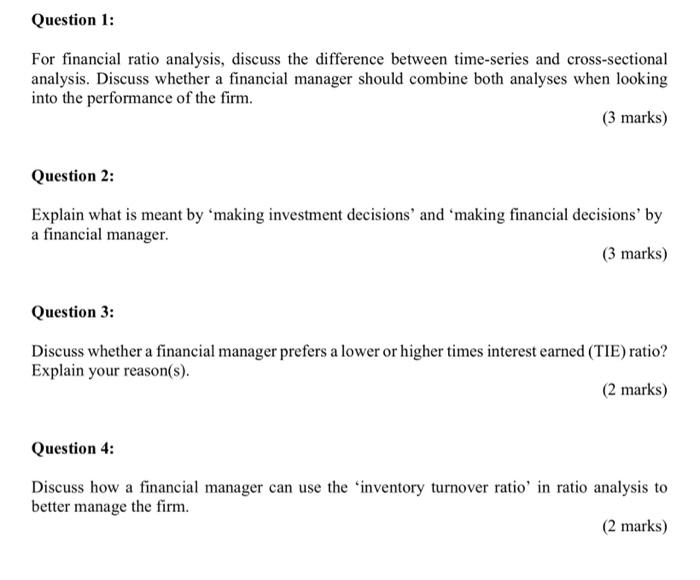

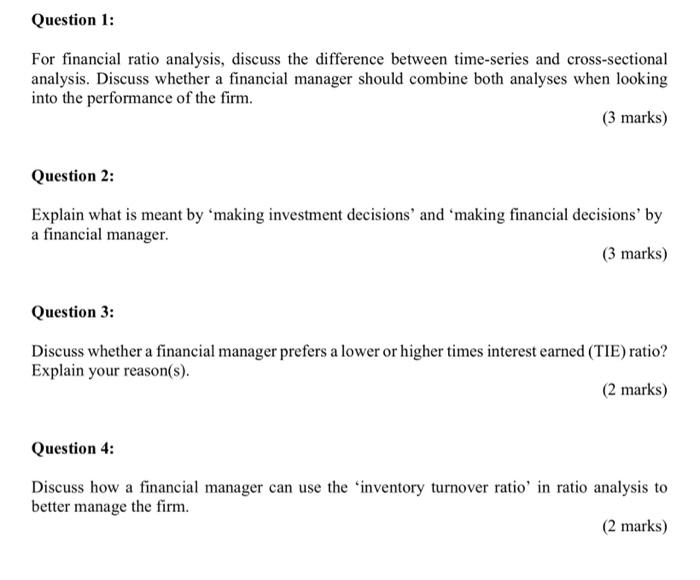

Business Finance

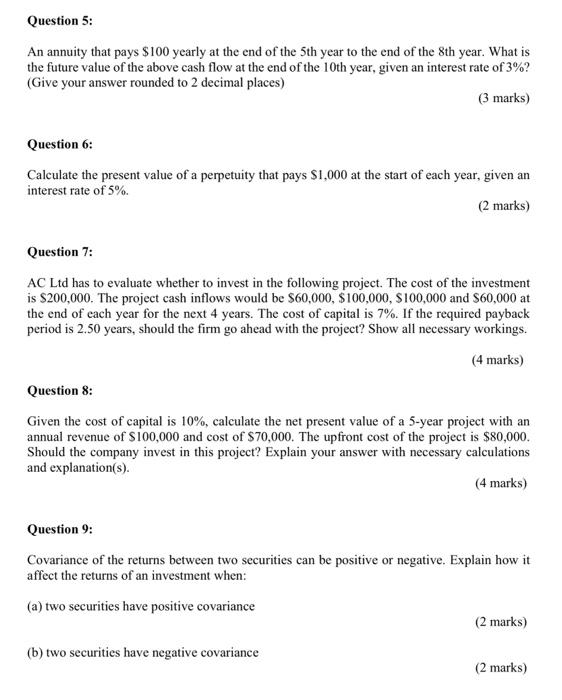

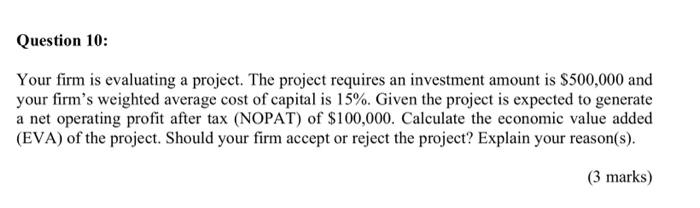

Question 1: For financial ratio analysis, discuss the difference between time-series and cross-sectional analysis. Discuss whether a financial manager should combine both analyses when looking into the performance of the firm. (3 marks) Question 2: Explain what is meant by making investment decisions' and 'making financial decisions' by a financial manager (3 marks) Question 3: Discuss whether a financial manager prefers a lower or higher times interest earned (TIE) ratio? Explain your reason(s). (2 marks) Question 4: Discuss how a financial manager can use the 'inventory turnover ratio' in ratio analysis to better manage the firm. (2 marks) Question 5: An annuity that pays $100 yearly at the end of the 5th year to the end of the 8th year. What is the future value of the above cash flow at the end of the 10th year, given an interest rate of 3%? (Give your answer rounded to 2 decimal places) (3 marks) Question 6: Calculate the present value of a perpetuity that pays $1,000 at the start of each year, given an interest rate of 5%. (2 marks) Question 7: AC Ltd has to evaluate whether to invest in the following project. The cost of the investment is $200,000. The project cash inflows would be $60,000, $100,000, S100,000 and $60,000 at the end of each year for the next 4 years. The cost of capital is 7%. If the required payback period is 2.50 years, should the firm go ahead with the project? Show all necessary workings. (4 marks) Question 8: Given the cost of capital is 10%, calculate the net present value of a 5-year project with an annual revenue of $100,000 and cost of $70,000. The upfre cost of the project is $80,000. Should the company invest in this project? Explain your answer with necessary calculations and explanation(s). (4 marks) Question : Covariance of the returns between two securities can be positive or negative. Explain how it affect the returns of an investment when: (a) two securities have positive covariance (2 marks) (b) two securities have negative covariance (2 marks) Question 10: Your firm is evaluating a project. The project requires an investment amount is $500,000 and your firm's weighted average cost of capital is 15%. Given the project is expected to generate a net operating profit after tax (NOPAT) of $100,000. Calculate the economic value added (EVA) of the project. Should your firm accept or reject the project? Explain your reason(s)