I need help with this assignment

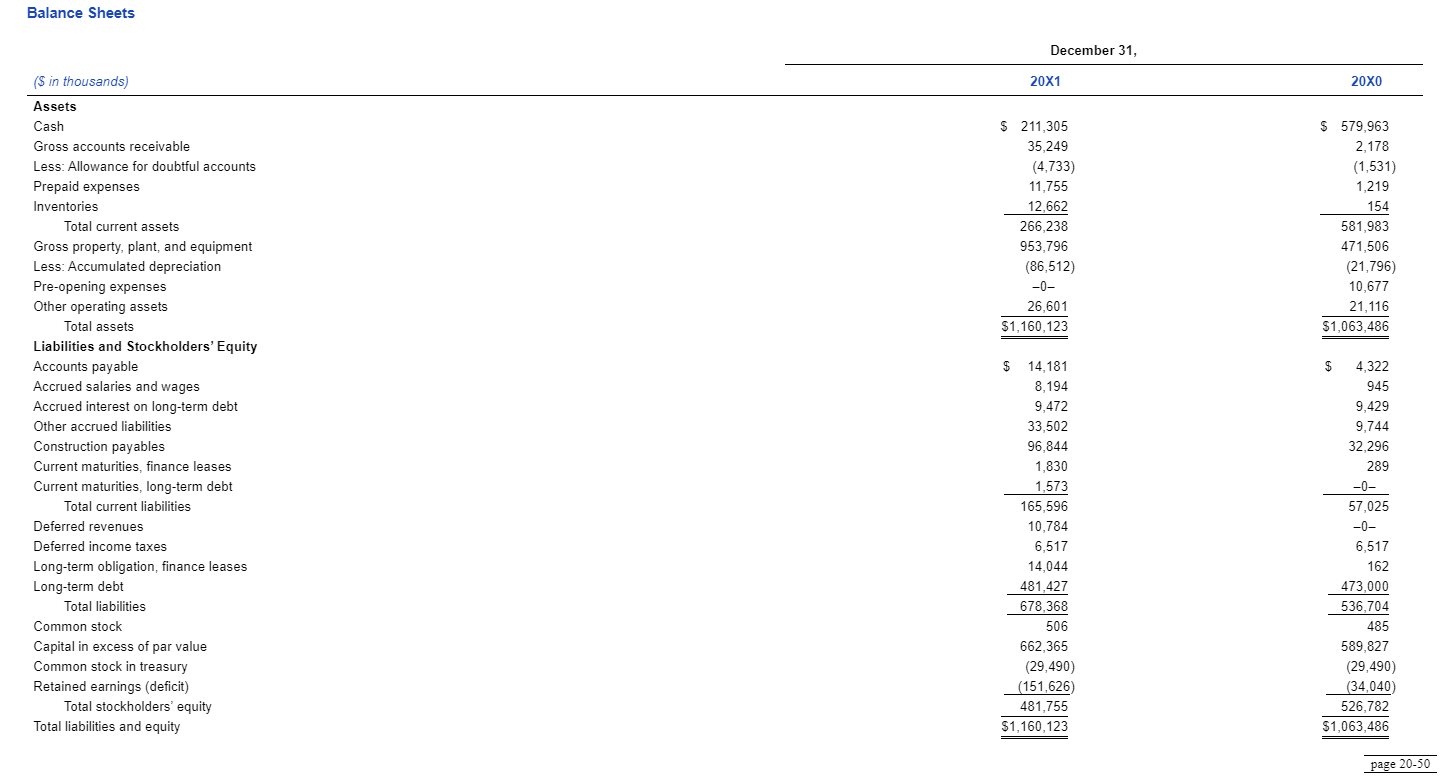

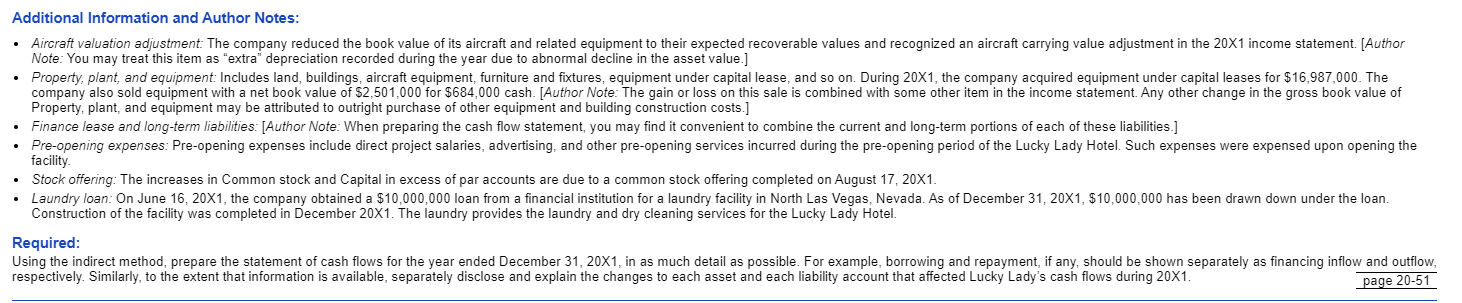

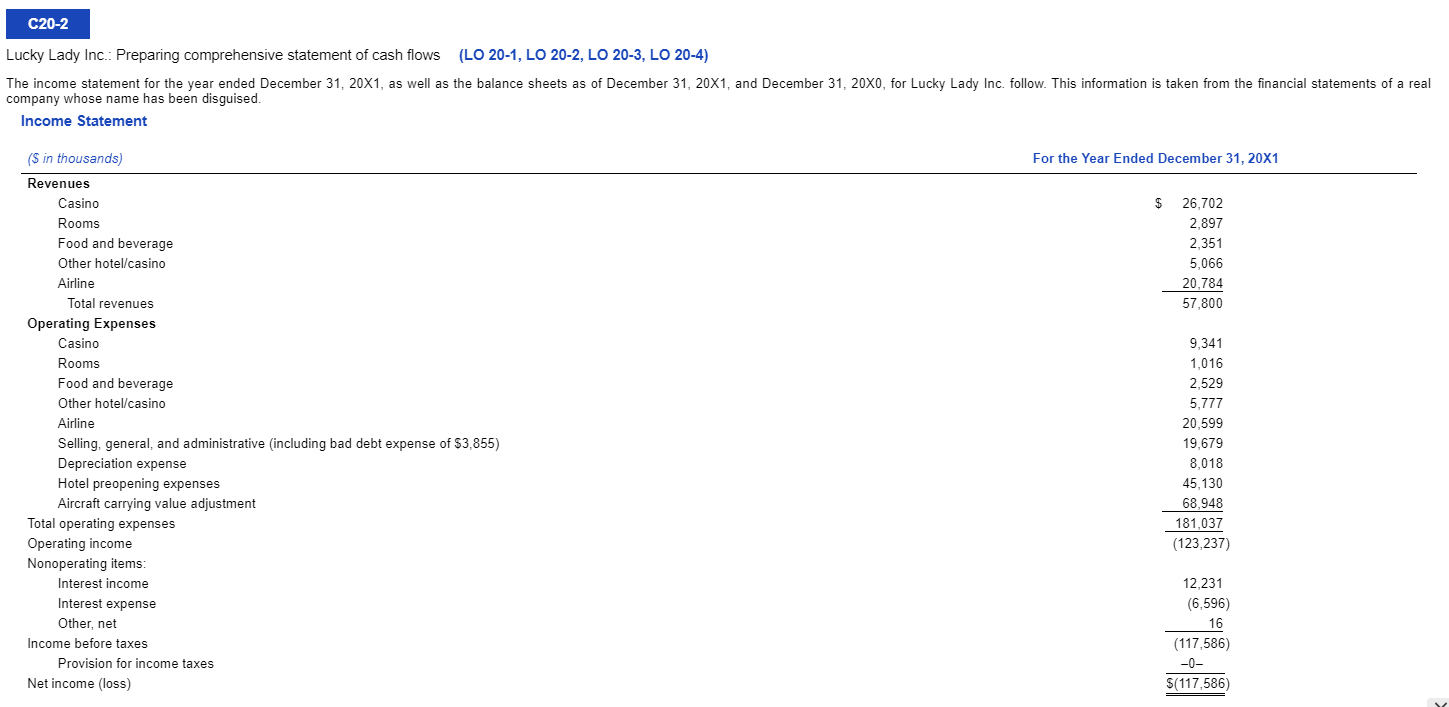

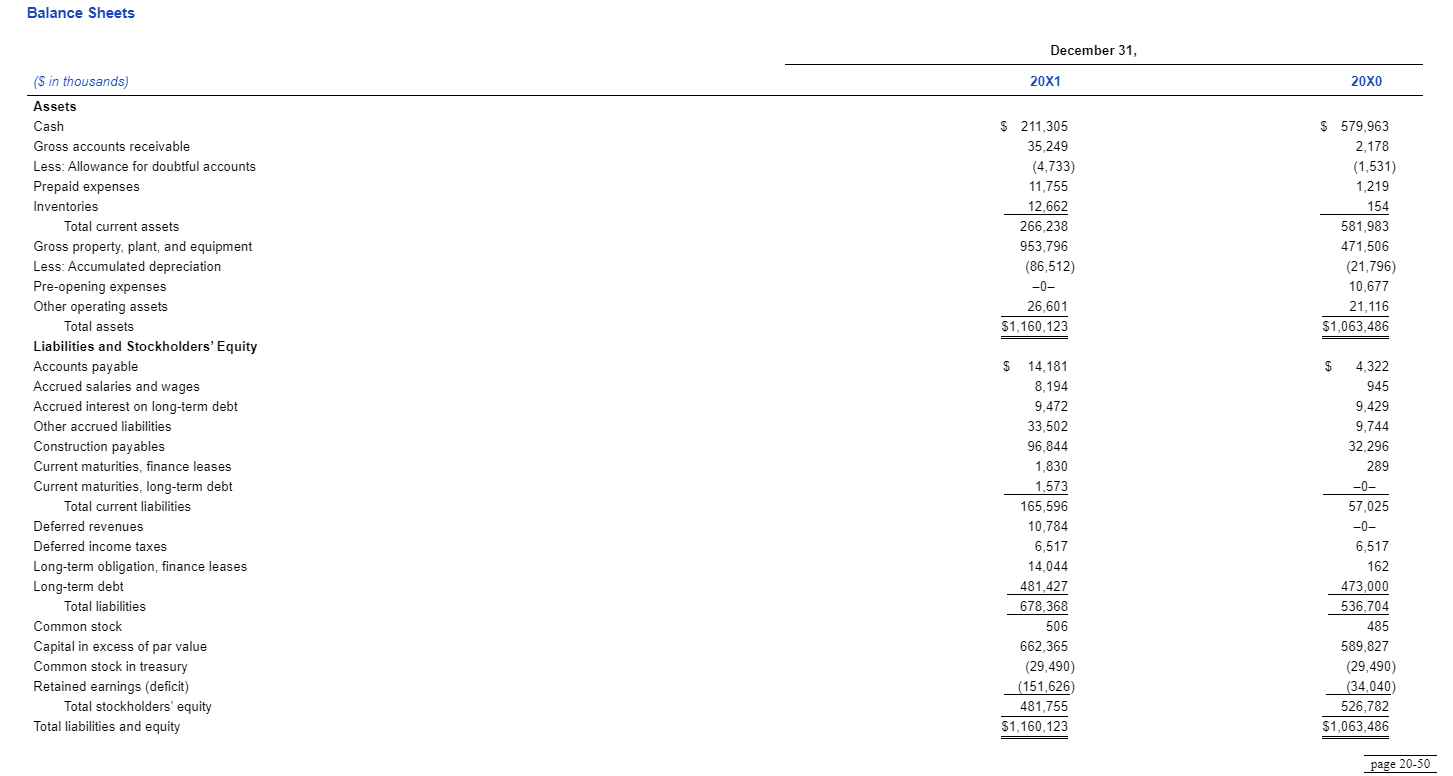

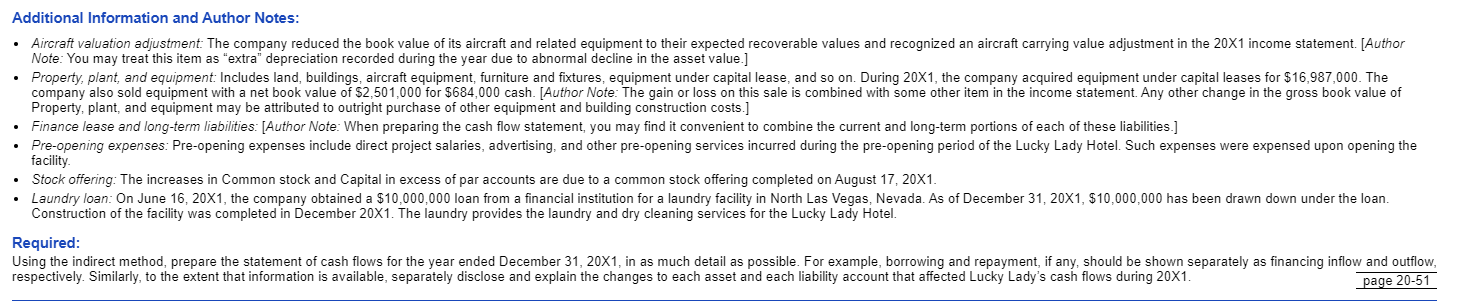

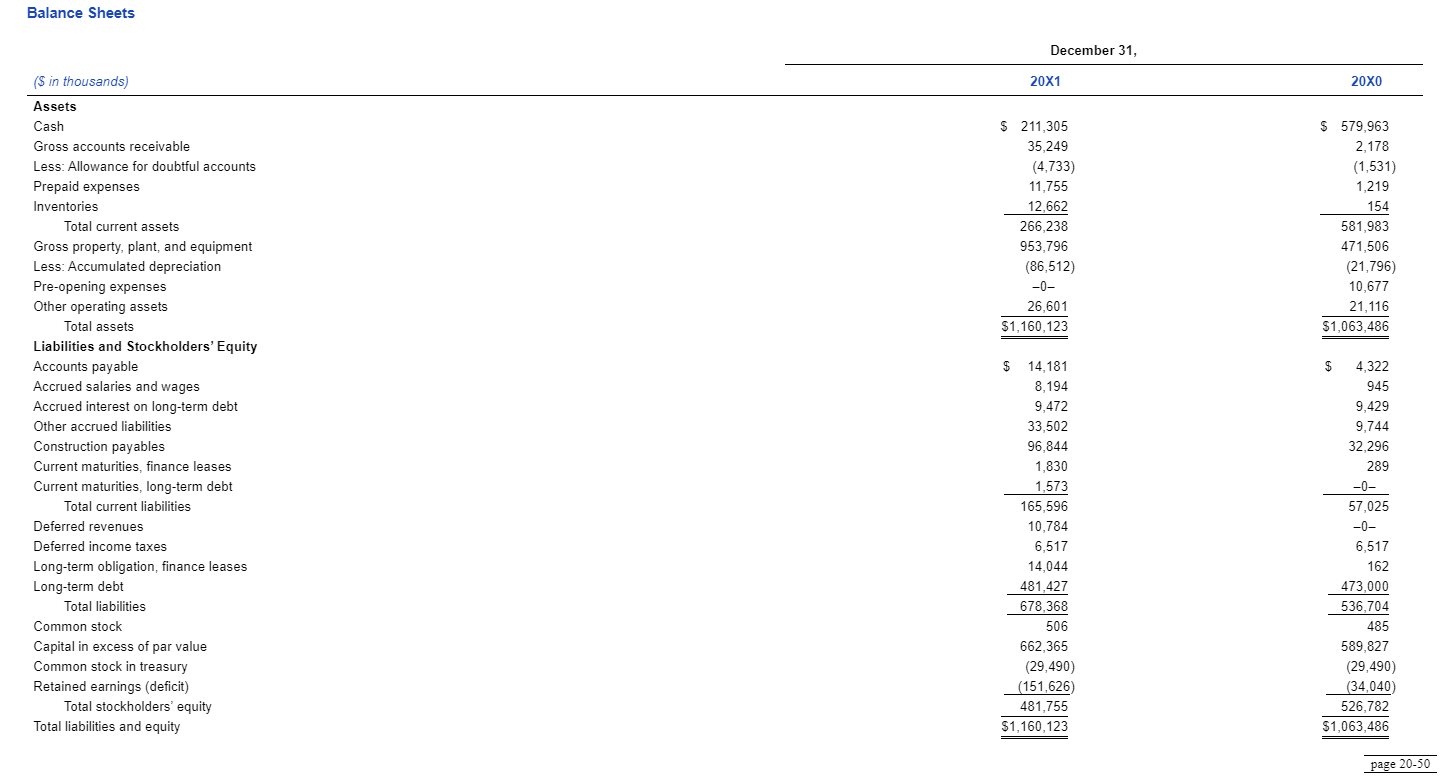

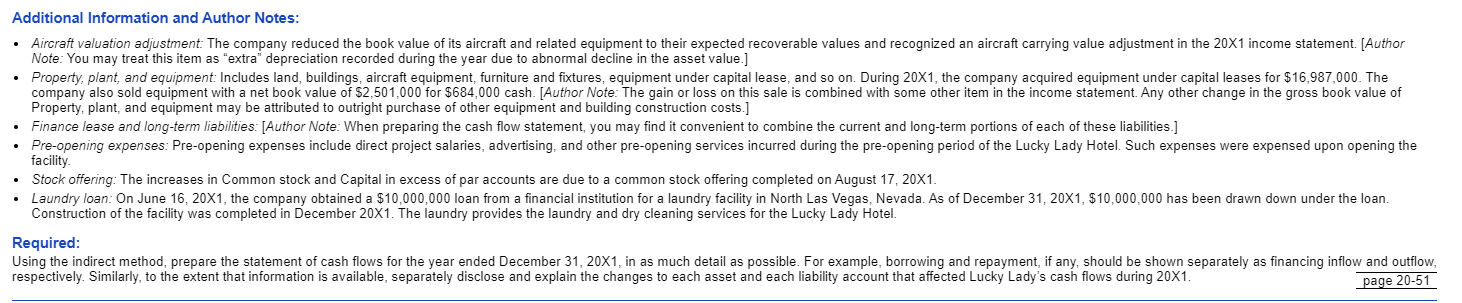

C20-2 Lucky Lady Inc.: Preparing comprehensive statement of cash flows (LO 20-1, LO 20-2, LO 20-3, LO 20-4) The income statement for the year ended December 31, 20X1, as well as the balance sheets as of December 31, 20X1, and December 31, 20X0, for Lucky Lady Inc. follow. This information is taken from the financial statements of a real company whose name has been disguised Income Statement ($ in thousands) For the Year Ended December 31, 20X1 Revenues Casino $ 26,702 Rooms 2,897 Food and beverage 2,351 Other hotel/casino 5,066 Airline 20,784 Total revenues 57,800 Operating Expenses Casino 9,341 Rooms 1,016 Food and beverage 2,529 Other hotel/casino 5,777 Airline 20,599 Selling, general, and administrative (including bad debt expense of $3,855) 19,679 8,018 Depreciation expense 45,130 Hotel preopening expenses Aircraft carrying value adjustment 68,948 Total operating expenses 181,037 Operating income (123,237) Nonoperating items: 12,231 Interest income Interest expense (6,596) 16 Other, net Income before taxes (117,586) Provision for income taxes -0- Net income (loss) $(117,586)Balance Sheets December 31, 20X1 20XO ($ in thousands) Assets $ 211,305 $ 579,963 Cash 35,249 2,178 Gross accounts receivable (1,531) Less: Allowance for doubtful accounts (4,733) 11,755 1,219 Prepaid expenses 12.662 154 Inventories 266,238 581,983 Total current assets 953,796 471,506 Gross property, plant, and equipment Less: Accumulated depreciation (86,512) (21,796) -0- 10,677 Pre-opening expenses 26,601 21, 116 Other operating assets $1,160,123 $1,063,486 Total assets Liabilities and Stockholders' Equity 14, 181 4,322 Accounts payable 8,194 945 Accrued salaries and wages 9,429 Accrued interest on long-term debt 9,472 33,502 9,744 Other accrued liabilities 96,844 32,296 Construction payables 1,830 289 Current maturities, finance leases 1,573 -0- Current maturities, long-term debt 165,596 57,025 Total current liabilities 10,784 -0- Deferred revenues 6,517 6,517 Deferred income taxes 14,044 162 Long-term obligation, finance leases 481,427 473,000 Long-term debt 678,368 536,704 Total liabilities 506 485 Common stock Capital in excess of par value 662,365 589,827 (29,490) (29,490) Common stock in treasury Retained earnings (deficit) (151,626) (34,040) 481,755 526,782 Total stockholders' equity Total liabilities and equity $1,160,123 $1,063,486 page 20-50Additional Information and Author Notes: Aircraft valuation adjustment: The company reduced the book value of its aircraft and related equipment to their expected recoverable values and recognized an aircraft carrying value adjustment in the 20X1 income statement. [Author Note: You may treat this item as "extra" depreciation recorded during the year due to abnormal decline in the asset value.] Property, plant, and equipment: Includes land, buildings, aircraft equipment, furniture and fixtures, equipment under capital lease, and so on. During 20X1, the company acquired equipment under capital leases for $16,987,000. The company also sold equipment with a net book value of $2,501,000 for $684,000 cash. [Author Note: The gain or loss on this sale is combined with some other item in the income statement. Any other change in the gross book value of Property, plant, and equipment may be attributed to outright purchase of other equipment and building construction costs.] Finance lease and long-term liabilities: [Author Note: When preparing the cash flow statement, you may find it convenient to combine the current and long-term portions of each of these liabilities.] Pre-opening expenses: Pre-opening expenses include direct project salaries, advertising, and other pre-opening services incurred during the pre-opening period of the Lucky Lady Hotel. Such expenses were expensed upon opening the facility. Stock offering: The increases in Common stock and Capital in excess of par accounts are due to a common stock offering completed on August 17, 20X1. Laundry loan: On June 16, 20X1, the company obtained a $10,000,000 loan from a financial institution for a laundry facility in North Las Vegas, Nevada. As of December 31, 20X1, $10,000,000 has been drawn down under the loan. Construction of the facility was completed in December 20X1. The laundry provides the laundry and dry cleaning services for the Lucky Lady Hotel. Required: Using the indirect method, prepare the statement of cash flows for the year ended December 31, 20X1, in as much detail as possible. For example, borrowing and repayment, if any, should be shown separately as financing inflow and outflow, respectively. Similarly, to the extent that information is available, separately disclose and explain the changes to each asset and each liability account that affected Lucky Lady's cash flows during 20X1. page 20-51