Question

I need help with this case study! Jeff Ritchie and Ryan Collins have just finished fourth-year university and are passionate about starting their own business.

I need help with this case study!

I need help with this case study!

Jeff Ritchie and Ryan Collins have just finished fourth-year university and are passionate about starting their own business. Jeff has a bachelor of commerce degree and specialized in marketing. Ryan also has a bachelor of commerce and specialized in accounting. After a significant amount of research, they have two potential ideas. Their first idea is to manufacture hockey sticks and their second idea is to make a gluten-free energy bar. They have already rented a manufacturing facility; 80% of the space will be used for manufacturing the product and 20% will be for administration.

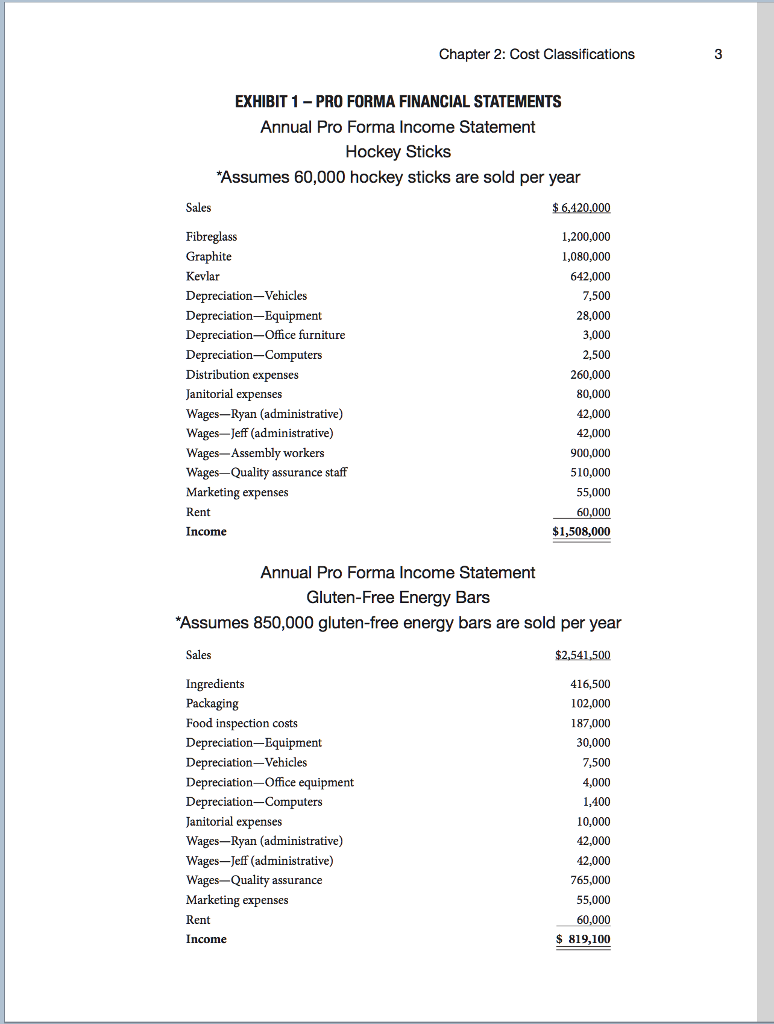

In order to get enough funding to start up their business, Jeff and Ryan have booked a preliminary meet- ing with the bank to determine if either of the ideas would allow their company to be eligible for a bank loan. The bank has asked them to prepare a schedule of the estimated costs associated with each of the ideas and to classify each cost as either a product cost or a period cost, and as either a fixed cost or a variable cost. The bank tends to favour ventures that have a low amount of fixed period costs relative to sales earned. Ryan and Jeff had prepared a pro forma income statement (Exhibit 1) for each option, but did not think to classify the costs in the manner that the bank had requested. As Ryan has a strong accounting background, he offered to prepare a memo to the bank with the cost classifications it is asking for. Jeff also asked him to determine which venture he believes the bank will favour.

Required

Assume the role of Ryan and write a letter to the bank addressing its request. Also write a letter to Jeff describing which manufacturing venture would likely be favoured by the bank. (Carty)

Chapter 2: Cost Classifications EXHIBIT 1- PRO FORMA FINANCIAL STATEMENTS Annual Pro Forma Income Statement Hockey Sticks Assumes 60,000 hockey sticks are sold per year Sales Fibreglass Graphite Kevlar Depreciation-Vehicles Depreciation-Equipment Depreciation-Office furniture Depreciation-Computers Distribution expenses Janitorial Wages-Ryan (administrative) Wages-Jeff (administrative) Wages-Assembly workers Wages-Quality assurance staff Marketing expenses Rent Income 1,200,000 1,080,000 642,000 7,500 28,000 3,000 2,500 260,000 80,000 42,000 42,000 900,000 510,000 55,000 60,000 $1,508,000 Annual Pro Forma Income Statement Gluten-Free Energy Bars Assumes 850,000 gluten-free energy bars are sold per year $2,541,500 Ingredients Packaging Food inspection costs Depreciation-Equipment Depreciation-Vehicles Depreciation-Office equipment Depreciation-Computers Janitorial expenses Wages-Ryan (administrative) Wages Jeff (administrative) Wages -Quality assurance Marketing expenses Rent Income 416,500 102,000 187,000 30,000 7,500 4,000 1,400 10,000 42,000 12,000 765,000 55,000 60,000 $ 819,100Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started