Answered step by step

Verified Expert Solution

Question

1 Approved Answer

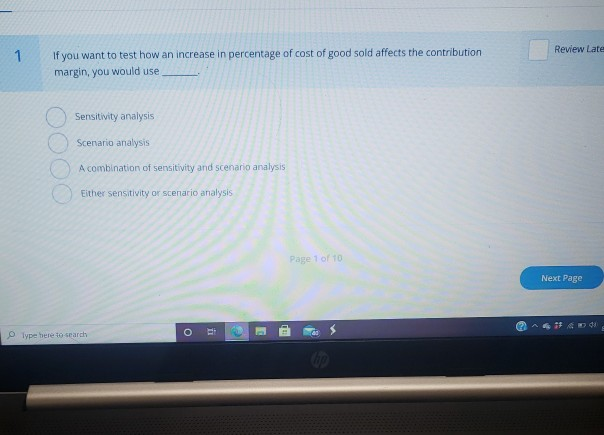

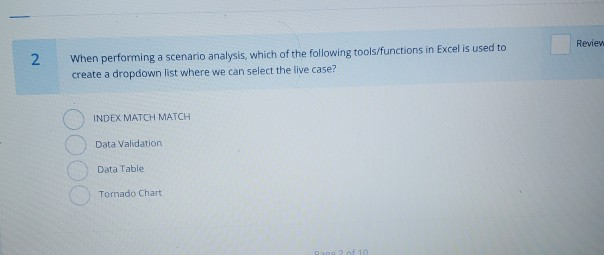

i need help with this one this one is for questions 4 and 5 Review Late 1 If you want to test how an increase

i need help with this one

this one is for questions 4 and 5

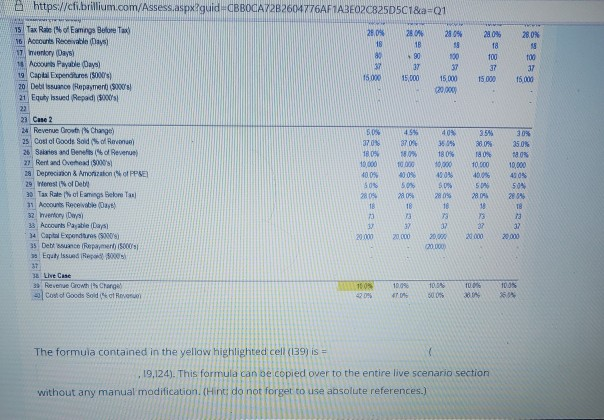

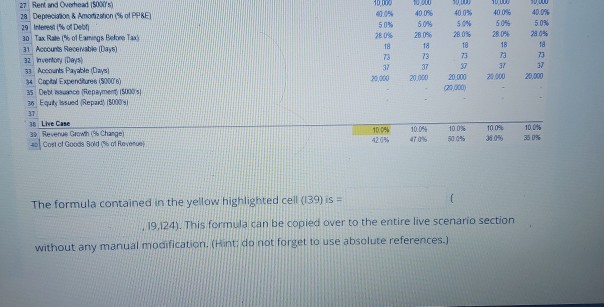

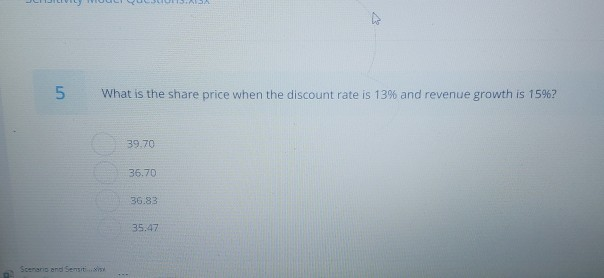

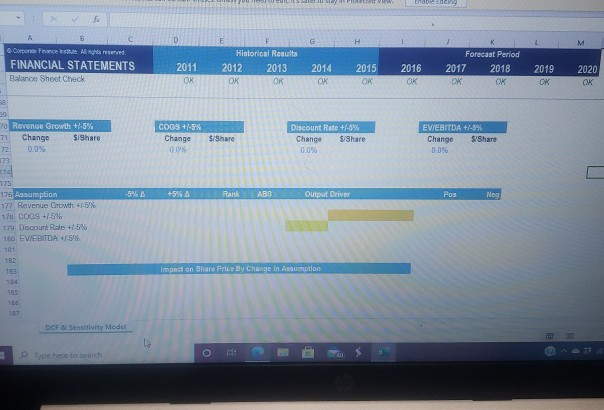

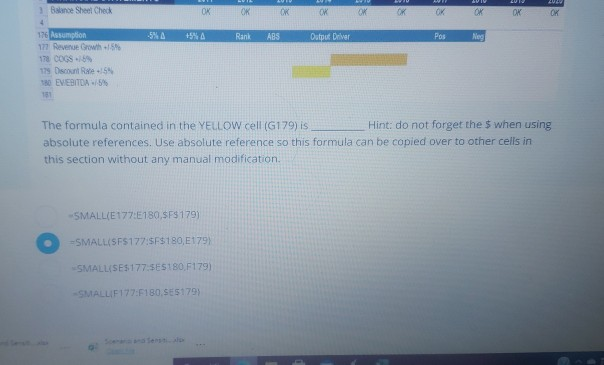

Review Late 1 If you want to test how an increase in percentage of cost of good sold affects the contribution margin, you would use Sensitivity analysis Scenario analysis A combination of sensitivity and scenario analysis Either sensitivity or scenario analysis Page 1 of 1 Next Page o ii Type here to search Review 2. When performing a scenario analysis, which of the following tools/functions in Excel is used to create a dropdown list where we can select the live case? INDEX MATCH MATCH Data Validation Data Table Tornado Chart & https://cl.brillium.com/Assess.aspx?guid=CBBOCA72B2604776AF1ABEO2C825D5C1&a=01 28.0% 28,0% 18 8. 37 15000 280% 18 90 17 15.000 280% $ 100 37 15.000 120.000 200% 18 100 37 15.000 100 37 15.000 455 15 Tax Rae of Eminos Before Tax 16 Accounts Receivable (Days 17 horory (Days 15 sore Payable Days Capital Expenditures (3030) 20 Debts Ropayment (3000's 21 Equity issued Repad($200's 22 23 Case 2 24 Revenue Cost Change) 25 Costal Goods Sold of Revol 26 Salaries and benefits of Revenue 27 Rent and Overhead (50008 29 Depreciation & Notization of PPU 29 Werest of Dell 30 Tax Rate of Emisore Tax 11 Accounts Rece) 32 nentory wyl 33 Accounts Payable Days 34 Capital Expenditures (0) 35 Debt cepamer 15000 Equity Issund 50% 37.0 18.0% 10,000 20.0% 601 87 0 18.0% 10000 2009 50% 2009 18 73 37 20.000 409 35 54 18 0% 10,000 100% SU 280% 10 13 12 20,000 20 000 3.5% 38.0% 180 10.000 100% 50 2804 18 13 37 20.000 30% 35.0% 10% 10,000 450 509 28 T8 2009 18 13 3/ 20.000 20.000 38 Live Case 39 Revenge Growth Charge Cost of Goods Soldat Room 100% 180 4209 100% 10 10.5 50.05 0.0% 31 The formula contained in the yellow highlighted cell (139) is = 19,124). This formula can be copied over to the entire live scenario section without any manual modification. (Hint: do not forget to use absolute references.) 10 000 27 Rent and Overhead (SOX) 28 Depreciation & Amortization of PPRE 29 Interest of Deb 30 Tax Rate of Earrings Before Taal 31 Accounts Receivable Days) 32 mettony wys 33 Accounts Payable Days) * Cpt Expenditures (50008) 35 Debrece payment 35 Equity issued Repard 15000 37 35 Live Case 3 Revenue Grow $ Change o Cosic Goods Sold Revenu 10 000 400% 5.04 280 18 73 37 21000 400% 50 200% 18 73 50 2804 18 78 32 20.000 40.0% 50% 2804 18 400% 50% 28.04 18 73 37 20 000 37 20,000 20.000 120,000 100 10.09 4205 10.04 470 10 04 38.09 10.04 38 % The formula contained in the yellow highlighted cell (139) is = 19.124). This formula can be copied over to the entire live scenario section without any manual modification. (Hint do not forget to use absolute references.) LA 5 What is the share price when the discount rate is 13% and revenue growth is 15%? 39.70 36.70 36.83 35.47 Scenario and Sesi be D G H M C Corpo Francese Altre FINANCIAL STATEMENTS Balance Shoot Check 2012 2011 OK Historical Results 2013 OK OK 2014 OK 2015 OK 2016 OK Forecast Period 2017 2018 OK OK 2019 OK 2020 OK 58 COGS +/-5% Change 009 S/Share Discount Rate +/-0% Change 5/Share 0.05. EVEBITDA +/-5% Change SIShare 0.096 ro Revenge Growth +-5%. 71 Change $iShare 0.0% 73 74 175 175 Assumption 177 Revenue Growth +1.57% in COCS +-5% 179 Discount Rate +/-5% 110 EVEBITDA 45% -5% +5% Rank ABS Output Driver Pos Neg Impact on Bhare Price By Change in Assumption 182 183 734 185 106 187 DCF Sensitivity Model Type Face to search WIV OK OK OK OK OK OK OK OK OK -5% +54 Rank ABS Output Driver Pos Neg 3 Balance Sheel Check 4 176 Assumption 177 Revenue Crow 178 COGS -15% 179 Oct 15 10 EVEBITDA -5% 180 The formula contained in the YELLOW cell (G179) is Hint: do not forget the $ when using absolute references. Use absolute reference so this formula can be copied over to other cells in this section without any manual modification -SMALL(E 177:180,578 179) =SMALL(SFS177:$E$180, E179) -SMALLISE$177 SES180,F179) -SMALLF177:F180 SE5179)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started