Answered step by step

Verified Expert Solution

Question

1 Approved Answer

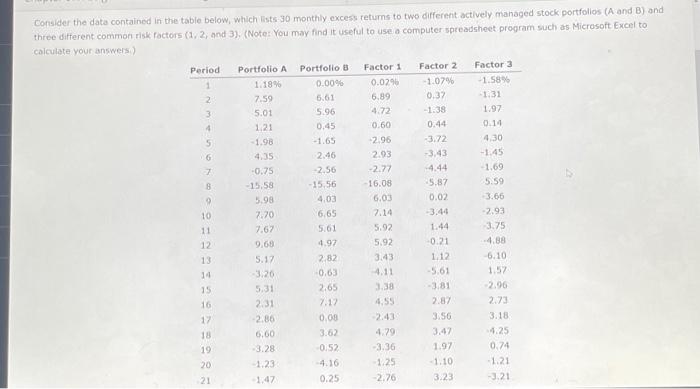

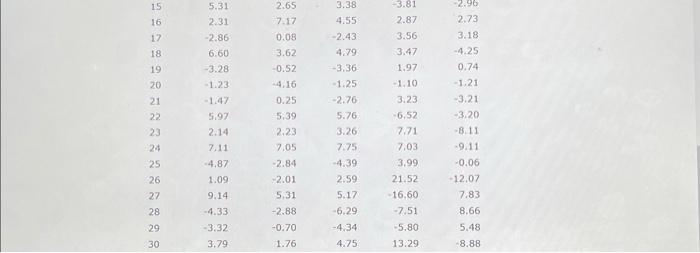

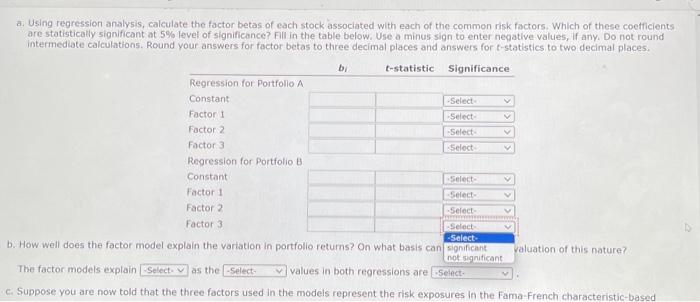

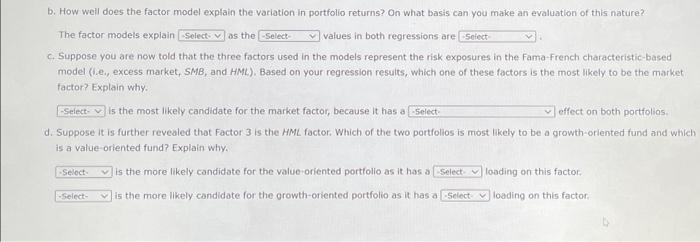

I need help with this please do an Excel show me how you did it with formulas 151617181920212223242526272829305.312.312.866.603.281.231.475.972.147.114.871.099.144.333.323.792.657.170.083.620.524.160.255.392.237.052.842.015.312.880.701.763.384.552.434.793.361.252.765.763.267.754.392.595.176.294.344.753.812.873.563.471.971.103.236.527.717.033.9921.5216.607.515.8013.292.962.733.184.250.741.213.213.208.119.110.0612.077.838.665.488.88 a. Using regression analysis, calculate the factor

I need help with this please do an Excel show me how you did it with formulas

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started