i need help with this please

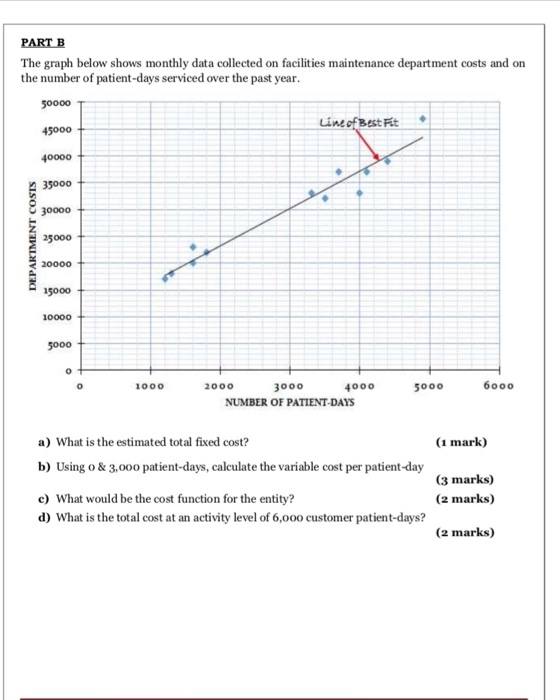

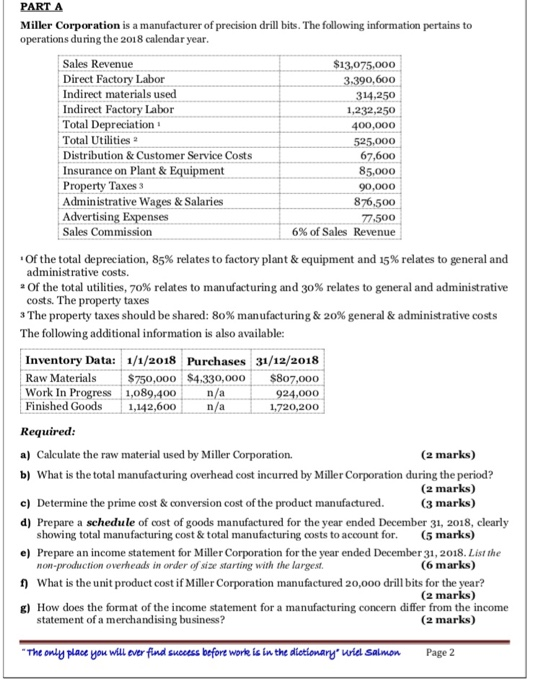

PART B The graph below shows monthly data collected on facilities maintenance department costs and on the number of patient-days serviced over the past year. 50000 Line of Best Fit 45000 40000 35000 30000 DEPARTMENT COSTS 25000 20000 15000 10000 5000 + 1000 5000 5000 2000 3000 4000 NUMBER OF PATIENT-DAYS 6000 a) What is the estimated total fixed cost? (1 mark) b) Using o& 3,000 patient-days, calculate the variable cost per patient-day (3 marks) (2 marks) c) What would be the cost function for the entity? d) What is the total cost at an activity level of 6,000 customer patient-days? (2 marks) PART A Miller Corporation is a manufacturer of precision drill bits. The following information pertains to operations during the 2018 calendar year. Sales Revenue Direct Factory Labor Indirect materials used Indirect Factory Labor Total Depreciation Total Utilities Distribution & Customer Service Costs Insurance on Plant & Equipment Property Taxes 3 Administrative Wages & Salaries Advertising Expenses Sales Commission $13,075,000 3.390, 600 314,250 1,232,250 400,000 525,000 67,600 85.000 90,000 876,500 77.500 6% of Sales Revenue of the total depreciation, 85% relates to factory plant & equipment and 15% relates to general and administrative costs. * Of the total utilities, 70% relates to manufacturing and 30% relates to general and administrative costs. The property taxes 3 The property taxes should be shared: 80% manufacturing & 20% general & administrative costs The following additional information is also available: Inventory Data: 1/1/2018 Purchases 31/12/2018 Raw Materials $750,000 $4,330,000 $807,000 Work In Progress 1,089,400 n/a 924,000 Finished Goods 1,142,600 n/a 1,720,200 Required: a) Calculate the raw material used by Miller Corporation. (2 marks) b) What is the total manufacturing overhead cost incurred by Miller Corporation during the period? (2 marks) c) Determine the prime cost & conversion cost of the product manufactured. (3 marks) d) Prepare a schedule of cost of goods manufactured for the year ended December 31, 2018, clearly showing total manufacturing cost & total manufacturing costs to account for. (5 marks) e) Prepare an income statement for Miller Corporation for the year ended December 31, 2018. List the non-production overheads in order of size starting with the largest (6 marks) 1) What is the unit product cost if Miller Corporation manufactured 20,000 drill bits for the year? (2 marks) g) How does the format of the income statement for a manufacturing concern differ from the income statement of a merchandising business? (2 marks) * The only place you will ever find success before worte is in the dictionary'urid Salmon Page 2 PART B The graph below shows monthly data collected on facilities maintenance department costs and on the number of patient-days serviced over the past year. 50000 Line of Best Fit 45000 40000 35000 30000 DEPARTMENT COSTS 25000 20000 15000 10000 5000 + 1000 5000 5000 2000 3000 4000 NUMBER OF PATIENT-DAYS 6000 a) What is the estimated total fixed cost? (1 mark) b) Using o& 3,000 patient-days, calculate the variable cost per patient-day (3 marks) (2 marks) c) What would be the cost function for the entity? d) What is the total cost at an activity level of 6,000 customer patient-days? (2 marks) PART A Miller Corporation is a manufacturer of precision drill bits. The following information pertains to operations during the 2018 calendar year. Sales Revenue Direct Factory Labor Indirect materials used Indirect Factory Labor Total Depreciation Total Utilities Distribution & Customer Service Costs Insurance on Plant & Equipment Property Taxes 3 Administrative Wages & Salaries Advertising Expenses Sales Commission $13,075,000 3.390, 600 314,250 1,232,250 400,000 525,000 67,600 85.000 90,000 876,500 77.500 6% of Sales Revenue of the total depreciation, 85% relates to factory plant & equipment and 15% relates to general and administrative costs. * Of the total utilities, 70% relates to manufacturing and 30% relates to general and administrative costs. The property taxes 3 The property taxes should be shared: 80% manufacturing & 20% general & administrative costs The following additional information is also available: Inventory Data: 1/1/2018 Purchases 31/12/2018 Raw Materials $750,000 $4,330,000 $807,000 Work In Progress 1,089,400 n/a 924,000 Finished Goods 1,142,600 n/a 1,720,200 Required: a) Calculate the raw material used by Miller Corporation. (2 marks) b) What is the total manufacturing overhead cost incurred by Miller Corporation during the period? (2 marks) c) Determine the prime cost & conversion cost of the product manufactured. (3 marks) d) Prepare a schedule of cost of goods manufactured for the year ended December 31, 2018, clearly showing total manufacturing cost & total manufacturing costs to account for. (5 marks) e) Prepare an income statement for Miller Corporation for the year ended December 31, 2018. List the non-production overheads in order of size starting with the largest (6 marks) 1) What is the unit product cost if Miller Corporation manufactured 20,000 drill bits for the year? (2 marks) g) How does the format of the income statement for a manufacturing concern differ from the income statement of a merchandising business? (2 marks) * The only place you will ever find success before worte is in the dictionary'urid Salmon Page 2