Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need help with this problem i need help. part 1 and part 2 of question 14 Required information Use the following information for the

i need help with this problem

i need help. part 1 and part 2 of question 14

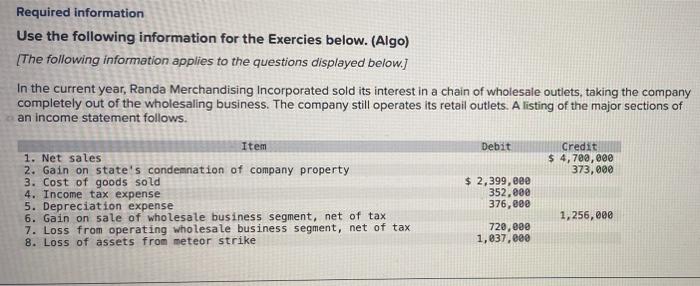

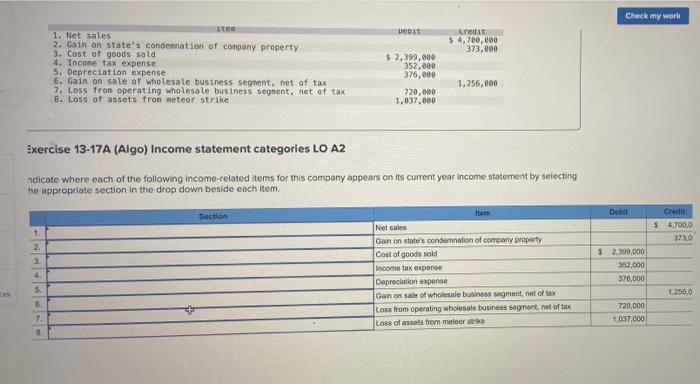

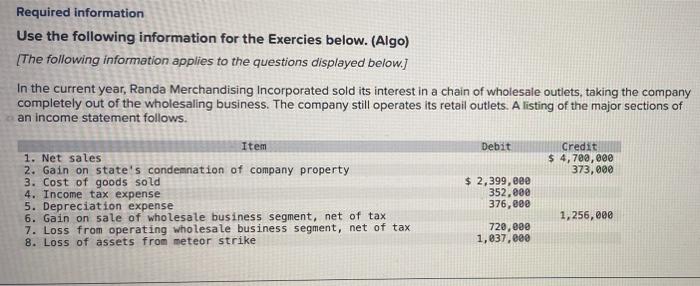

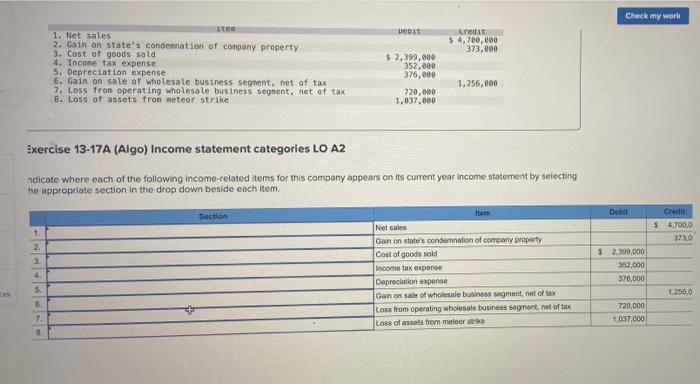

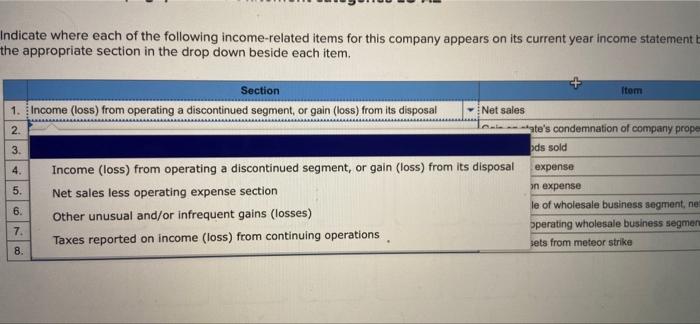

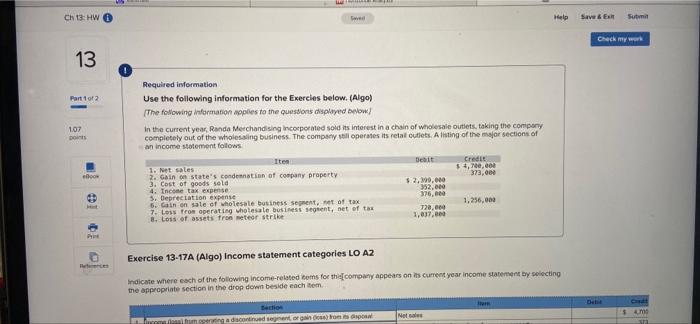

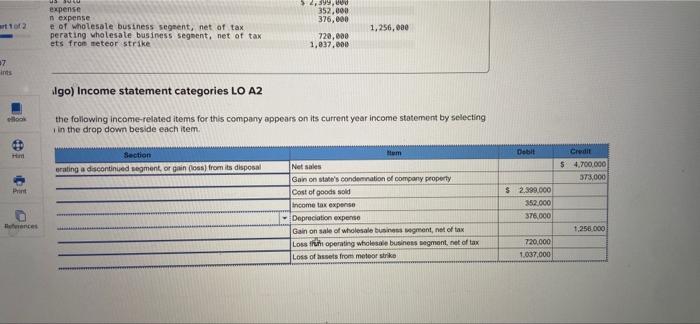

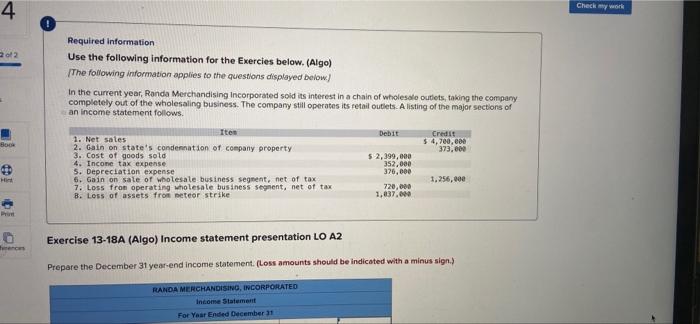

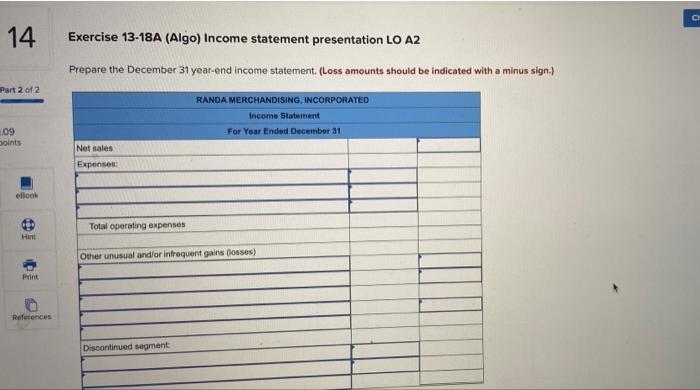

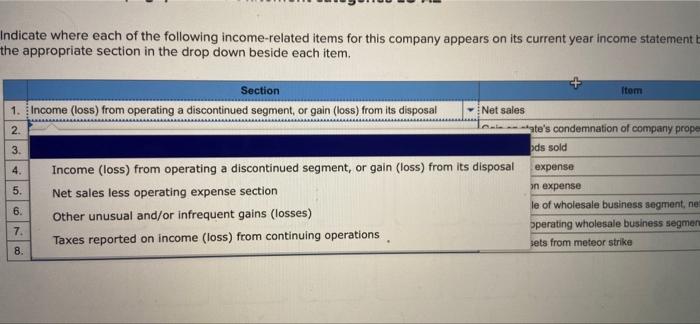

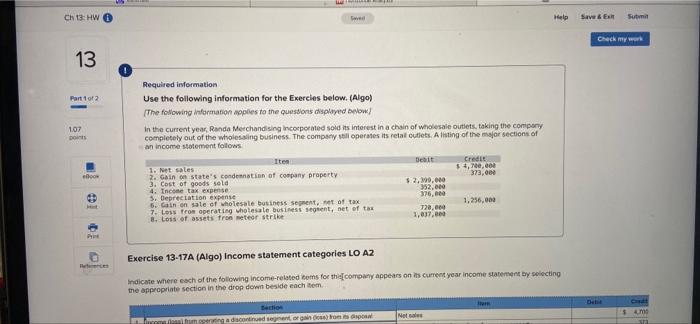

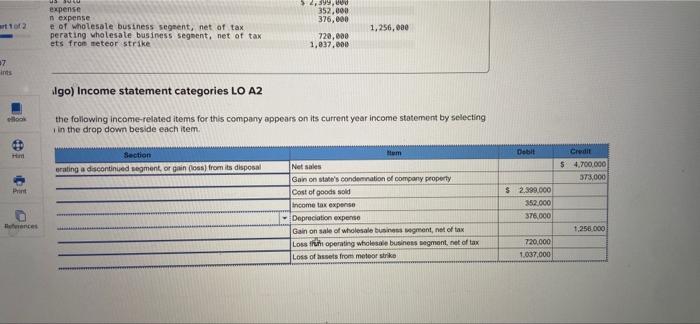

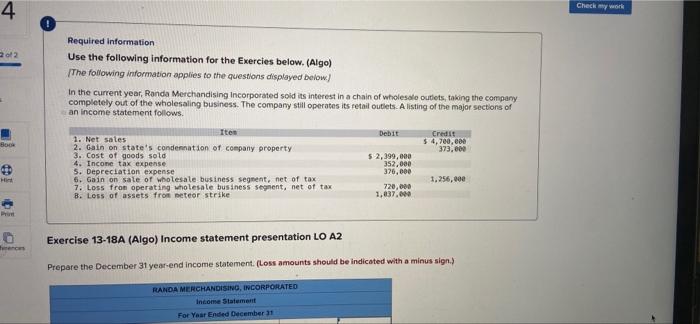

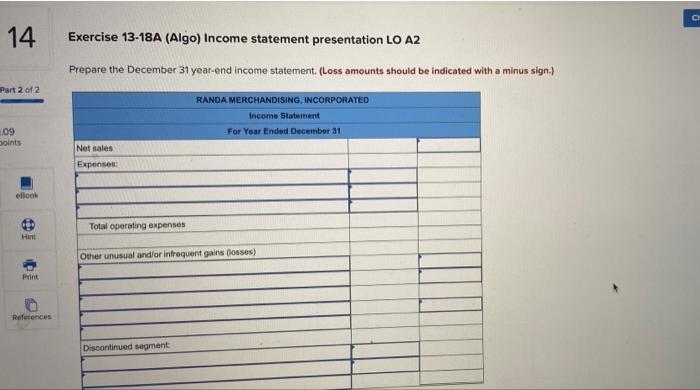

Required information Use the following information for the Exercies below. (Algo) The following information applies to the questions displayed below.) In the current year, Randa Merchandising Incorporated sold its interest in a chain of wholesale outlets, taking the company completely out of the wholesaling business. The company still operates its retail outlets. A listing of the major sections of an income statement follows. Debit Credit $ 4,700,000 373,000 Item 1. Net sales 2. Gain on state's condemnation of company property 3. Cost of goods sold 4. Income tax expense 5. Depreciation expense 6. Gain on sale of wholesale business segment, net of tax 7. Loss from operating wholesale business segment, net of tax 8. Loss of assets from meteor strike $ 2,399, eee 352,808 376,000 1,256,000 720,000 1,037,000 Check Check my work UeDit Lras 54,700,000 373,000 Iten 1. Net sales 2. Gain on state's condemnation of company property 3. Cost of goods sold 4. Income tax expense 5. Depreciation expense 6. Gain on sale of wholesale business segment, net of tax 7. Loss Tron operating wholesale business segment, net of tax 8. Loss of assets fron meteor strike $ 2,399,000 352,000 376,000 1,256,000 720,000 1,037.000 Exercise 13-17A (Algo) Income statement categories LO A2 ndicate where each of the following income-related items for this company appears on its current year income statement by selecting he appropriate section in the drop down beside each item. Dobil Credit Section 5 4.700,0 373.0 1 2 3 Itaen Net sales Gain on state's condemnation of comany property Cost of goods sold Income tax expense Depreciation expense Gan on sale of wholesale business segment, net of tax Loss from operating wholesale business segment, net of tax Loss of assets from meteorske $ 2.399,000 352,000 376,000 4. 5 0 1.256,0 720,000 1,037,000 1. Indicate where each of the following income-related items for this company appears on its current year income statement the appropriate section in the drop down beside each item. Section Item 1. Income (loss) from operating a discontinued segment, or gain (loss) from its disposal Net sales 2. -te's condemnation of company prope 3. ods sold 4. Income (loss) from operating a discontinued segment, or gain (loss) from its disposal expense 5. Net sales less operating expense section on expense 6. le of wholesale business segment, ne Other unusual and/or infrequent gains (losses) 7 operating wholesale business segmen Taxes reported on income (loss) from continuing operations sets from meteor strike 8. 5. Ch 13: HW Help Save & E Suma Check my work 13 Part 1 of 2 107 Required information Use the following information for the Exercies below. (Algo) The following information applies to the questions displayed below) In the current year, Randa Merchandising incorporated sold its interest in a chain of wholesale outlets, taking the company completely out of the wholessing business. The company still operates its retail outlets. A listing of the major sections of an income statement follows Item Beat Credit 1. Net sales 54,700,00 2. Gain state's condemnation of company property 373,000 3. Cost of goods sold $ 2,990,000 4. Income tax expense 352,00 3. Depreciation expense 376,00 5. Cain on sale of wholesale business spent of tax 1.256.000 7. Los from operating wholesale business serent, net of tax 720,000 8. Loss of assets fro meteor strike 1,017, 000 P Exercise 13-17A (Algo) Income statement categories LO A2 Indicate where each of the following income-related tons for the company appears on its current year income statement by selecting the appropriate section in the drop down beside each em 5 Decios na sering discontinued tegnant orgas) from a Net 102 expense nexpense e of wholesale business segment, net of tax perating wholesale business segment, net of tax ets from meteor strike 52,399.00 352,000 376,000 720,000 1,037,000 1,256,000 07 ints ilgo) Income statement categories LO A2 lo the following income-related items for this company appears on its current year income statement by selecting in the drop down beside each item. Him Debit Section erating a discontinued segment, orghin Gloss) from its disposal Credit $ 4.700.000 375,000 Print Net sales Goin on state's condemnation of company property Cost of goods sold Income tax expense Depreciation expense Gain on sale of wholesale business segment, net of tax Loss operating wholesale business segment, net of tax Loss of husets from meteor strike $ 2.399.000 352.000 376,000 rences 1,258,000 720,000 1.037.000 Check my work 4 of 2 Required information Use the following information for the Exercies below. (Algo) The following information applies to the questions displayed below) In the current year, Ronde Merchandising Incorporated sold its interest in a chain of wholesale outlets, taking the company completely out of the wholesaling business. The company still operates its retail outlets. A listing of the major sections of an income statement follows. Debit Credit 1. Net sates $ 4,700,000 2. Gain on state's condemnation of company property 373.000 3. Cost of goods sold 5 2,399,000 4. Income tax expense 5. Depreciation expense 376,000 6. Gain on sale of wholesale business segment, net of tax 1.256,000 7. Loss from operating wholesale business Segnent, net of tax 720,000 8. Loss of assets fronter strike 1,037.000 Ten 50 352.000 Exercise 13-18A (Algo) Income statement presentation LO A2 Prepare the December 31 year-end income statement. (Loss amounts should be indicated with a minus sign.) RANDA MERCHANDISING, INCORPORATED Income Statement For Year Ended December 31 CH 14 Exercise 13-18A (Algo) Income statement presentation LO A2 Prepare the December 31 year-end income statement. (Loss amounts should be indicated with a minus sign.) Part 2 of 2 RANDA MERCHANDISING, INCORPORATED Income Statement For Year Ended December 31 09 soints Net sales Expenses elbook Total operating expenses Hint Other unusual and/or infrequent gains (losses) Print References Discontinued segment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started