I need help with this problem.

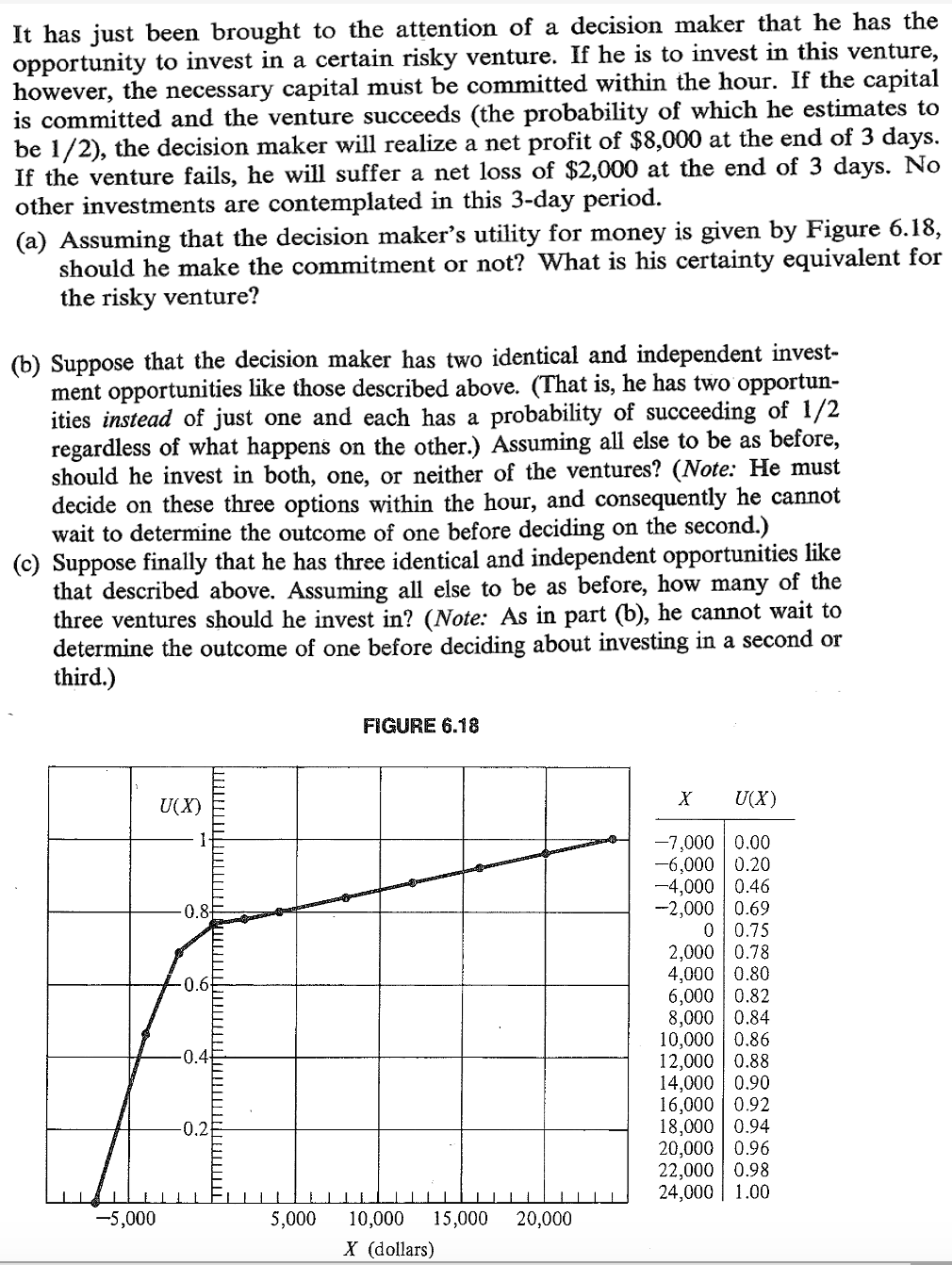

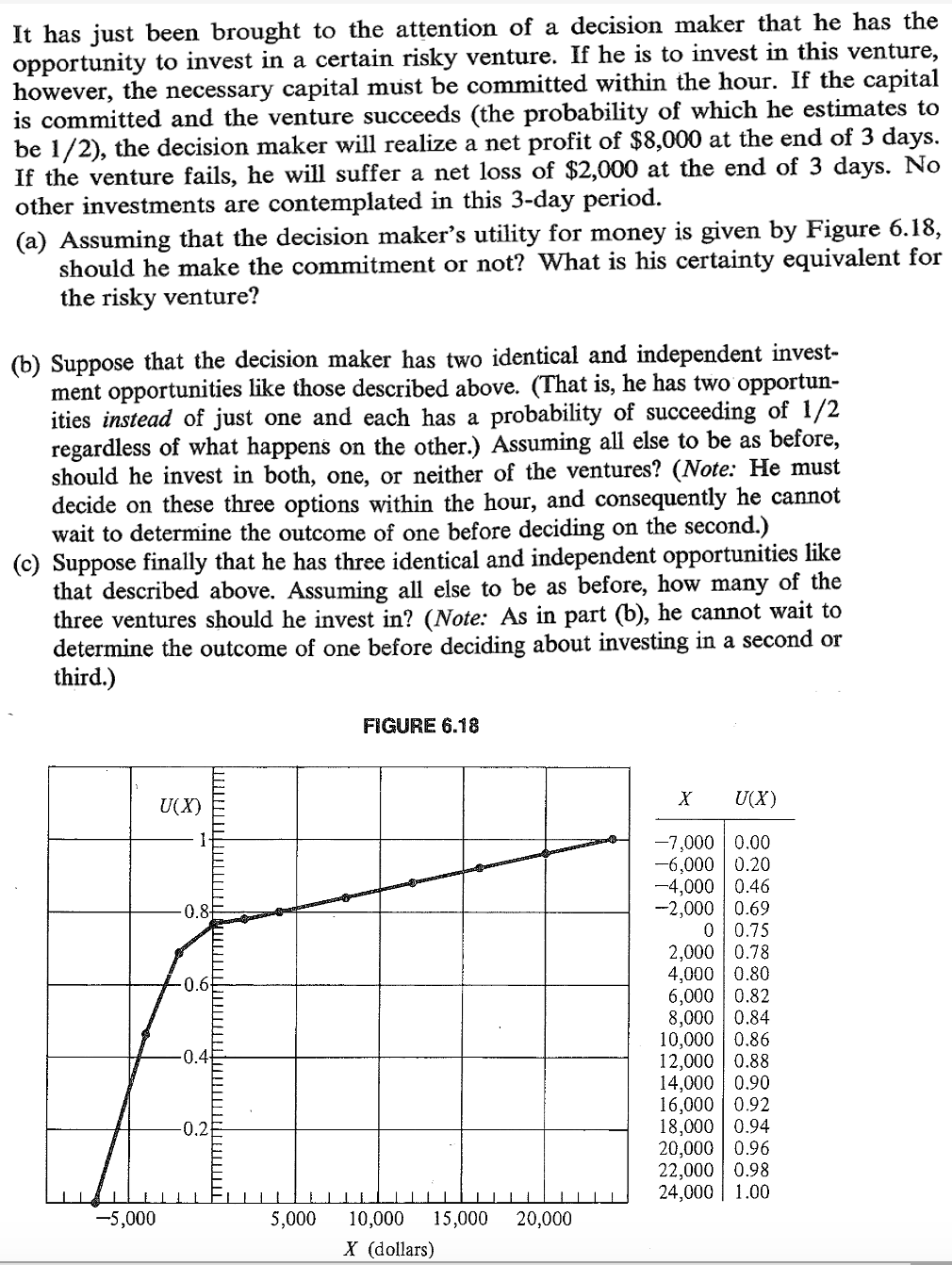

It has just been brought to the attention of a decision maker that he has the opportunity to invest in a certain risky venture. If he is to invest in this venture, however, the necessary capital must be committed within the hour. If the capital is committed and the venture succeeds (the probability of which he estimates to be 1/2), the decision maker will realize a net profit of $8,000 at the end of 3 days. If the venture fails, he will suffer a net loss of $2,000 at the end of 3 days. No other investments are contemplated in this 3-day period. (a) Assuming that the decision maker's utility for money is given by Figure 6.18, should he make the commitment or not? What is his certainty equivalent for the risky venture? (b) Suppose that the decision maker has two identical and independent invest- ment opportunities like those described above. (That is, he has two opportun- ities instead of just one and each has a probability of succeeding of 1/2 regardless of what happens on the other.) Assuming all else to be as before, should he invest in both, one, or neither of the ventures? (Note: He must decide on these three options within the hour, and consequently he cannot wait to determine the outcome of one before deciding on the second.) (C) Suppose finally that he has three identical and independent opportunities like that described above. Assuming all else to be as before, how many of the three ventures should he invest in? (Note: As in part (b), he cannot wait to determine the outcome of one before deciding about investing in a second or third.) FIGURE 6.18 U(X) U(X) 1 0.8+ 0.61 -7,000 0.00 -6,000 0.20 -4,000 0.46 --2,000 0.69 0 0.75 2,000 0.78 4,000 0.80 6,000 0.82 8,000 0.84 10,000 0.86 12,000 0.88 14,000 0.90 16,000 | 0.92 18,000 0.94 20,000 0.96 22,000 0.98 24,000 1.00 -0.4 -0.2 -5,000 5,000 20,000 10,000 15,000 X (dollars) It has just been brought to the attention of a decision maker that he has the opportunity to invest in a certain risky venture. If he is to invest in this venture, however, the necessary capital must be committed within the hour. If the capital is committed and the venture succeeds (the probability of which he estimates to be 1/2), the decision maker will realize a net profit of $8,000 at the end of 3 days. If the venture fails, he will suffer a net loss of $2,000 at the end of 3 days. No other investments are contemplated in this 3-day period. (a) Assuming that the decision maker's utility for money is given by Figure 6.18, should he make the commitment or not? What is his certainty equivalent for the risky venture? (b) Suppose that the decision maker has two identical and independent invest- ment opportunities like those described above. (That is, he has two opportun- ities instead of just one and each has a probability of succeeding of 1/2 regardless of what happens on the other.) Assuming all else to be as before, should he invest in both, one, or neither of the ventures? (Note: He must decide on these three options within the hour, and consequently he cannot wait to determine the outcome of one before deciding on the second.) (C) Suppose finally that he has three identical and independent opportunities like that described above. Assuming all else to be as before, how many of the three ventures should he invest in? (Note: As in part (b), he cannot wait to determine the outcome of one before deciding about investing in a second or third.) FIGURE 6.18 U(X) U(X) 1 0.8+ 0.61 -7,000 0.00 -6,000 0.20 -4,000 0.46 --2,000 0.69 0 0.75 2,000 0.78 4,000 0.80 6,000 0.82 8,000 0.84 10,000 0.86 12,000 0.88 14,000 0.90 16,000 | 0.92 18,000 0.94 20,000 0.96 22,000 0.98 24,000 1.00 -0.4 -0.2 -5,000 5,000 20,000 10,000 15,000 X (dollars)