Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help with this question 5 / 7 100% + Question 5 You work as an analyst for a real-estate company called Blue Sky

I need help with this question

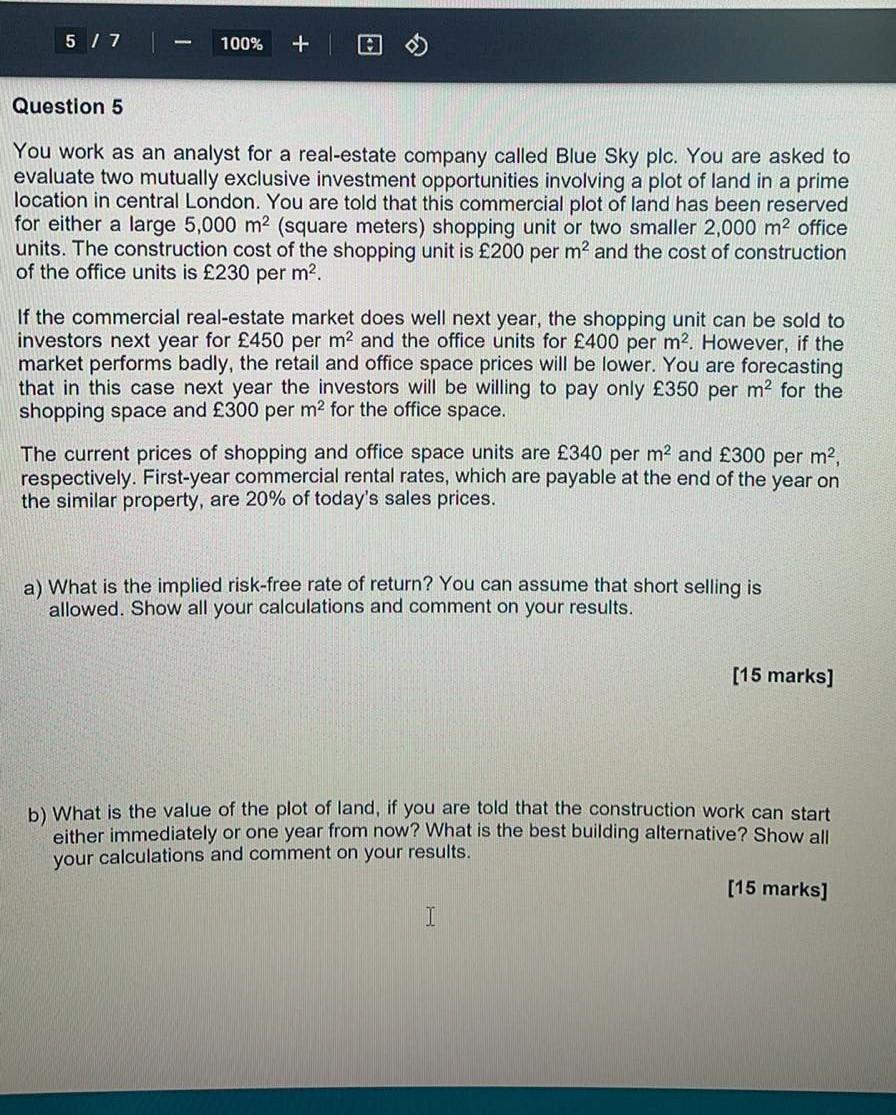

5 / 7 100% + Question 5 You work as an analyst for a real-estate company called Blue Sky plc. You are asked to evaluate two mutually exclusive investment opportunities involving a plot of land in a prime location in central London. You are told that this commercial plot of land has been reserved for either a large 5,000 m2 (square meters) shopping unit or two smaller 2,000 m2 office units. The construction cost of the shopping unit is 200 per m2 and the cost of construction of the office units is 230 per m2. If the commercial real-estate market does well next year, the shopping unit can be sold to investors next year for 450 per m2 and the office units for 400 per m2. However, if the market performs badly, the retail and office space prices will be lower. You are forecasting that in this case next year the investors will be willing to pay only 350 per m2 for the shopping space and 300 per m2 for the office space. The current prices of shopping and office space units are 340 per m2 and 300 per m2, respectively. First-year commercial rental rates, which are payable at the end of the year on the similar property, are 20% of today's sales prices. a) What is the implied risk-free rate of return? You can assume that short selling is allowed. Show all your calculations and comment on your results. [15 marks] b) What is the value of the plot of land, if you are told that the construction work can start either immediately or one year from now? What is the best building alternative? Show all your calculations and comment on your results. (15 marks] I 5 / 7 100% + Question 5 You work as an analyst for a real-estate company called Blue Sky plc. You are asked to evaluate two mutually exclusive investment opportunities involving a plot of land in a prime location in central London. You are told that this commercial plot of land has been reserved for either a large 5,000 m2 (square meters) shopping unit or two smaller 2,000 m2 office units. The construction cost of the shopping unit is 200 per m2 and the cost of construction of the office units is 230 per m2. If the commercial real-estate market does well next year, the shopping unit can be sold to investors next year for 450 per m2 and the office units for 400 per m2. However, if the market performs badly, the retail and office space prices will be lower. You are forecasting that in this case next year the investors will be willing to pay only 350 per m2 for the shopping space and 300 per m2 for the office space. The current prices of shopping and office space units are 340 per m2 and 300 per m2, respectively. First-year commercial rental rates, which are payable at the end of the year on the similar property, are 20% of today's sales prices. a) What is the implied risk-free rate of return? You can assume that short selling is allowed. Show all your calculations and comment on your results. [15 marks] b) What is the value of the plot of land, if you are told that the construction work can start either immediately or one year from now? What is the best building alternative? Show all your calculations and comment on your results. (15 marks]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started