Answered step by step

Verified Expert Solution

Question

1 Approved Answer

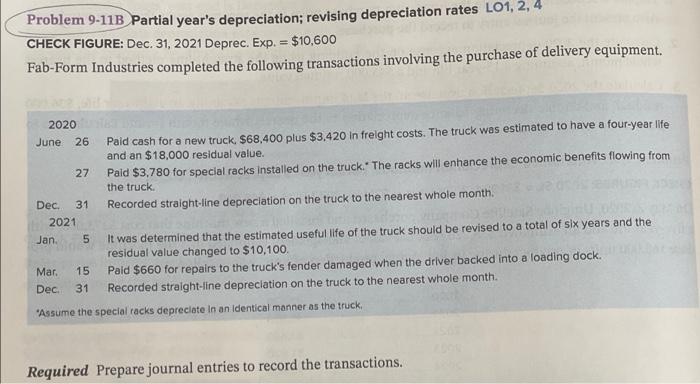

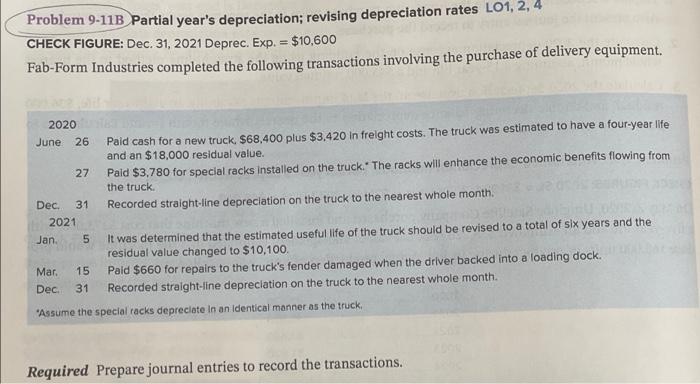

I need help with this question and please explain each step of how to figure out the answer. Thanks Problem 9-11B Partial year's depreciation; revising

I need help with this question and please explain each step of how to figure out the answer. Thanks

Problem 9-11B Partial year's depreciation; revising depreciation rates LO1, 2, 4 CHECK FIGURE: Dec. 31, 2021 Deprec. Exp. = $10,600 Fab-Form Industries completed the following transactions involving the purchase of delivery equipment. 2020 DIET DONE June 26 Paid cash for a new truck, $68,400 plus $3,420 in freight costs. The truck was estimated to have a four-year life and an $18,000 residual value. 27 Paid $3,780 for special racks installed on the truck. The racks will enhance the economic benefits flowing from the truck. Recorded straight-line depreciation on the truck to the nearest whole month. Dec. 31 2021 Jan. 5 It was determined that the estimated useful life of the truck should be revised to a total of six years and the residual value changed to $10,100. Mar. 15 Paid $660 for repairs to the truck's fender damaged when the driver backed into a loading dock. Dec. 31 Recorded straight-line depreciation on the truck to the nearest whole month. 'Assume the special racks depreciate In an identical manner as the truck. Required Prepare journal entries to record the transactions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started