Answered step by step

Verified Expert Solution

Question

1 Approved Answer

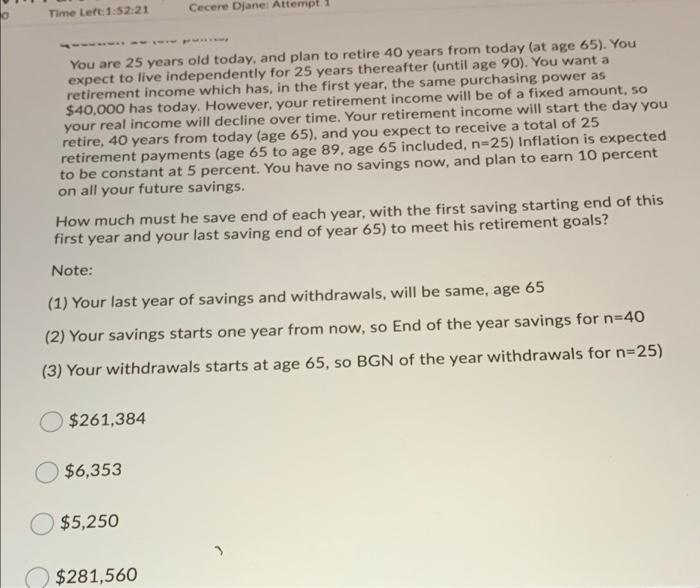

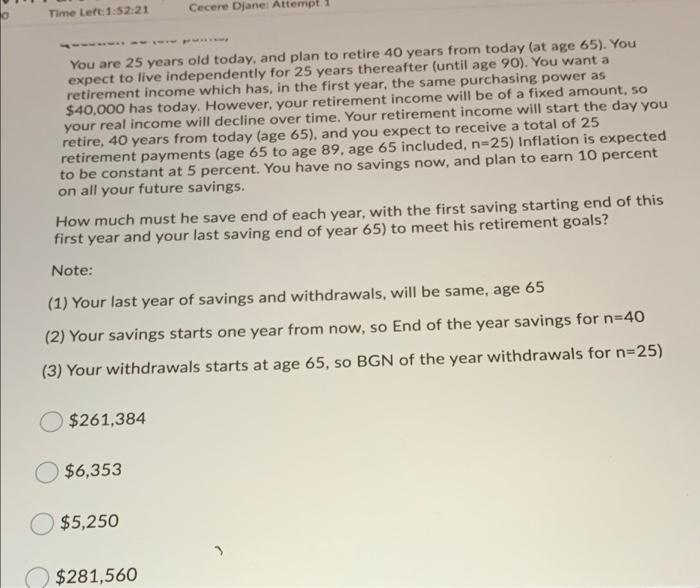

i need help with this question in 10 min please Time Left: 1:52:21 Cecere Djane: Attempt -- You are 25 years old today, and plan

i need help with this question in 10 min please

Time Left: 1:52:21 Cecere Djane: Attempt -- You are 25 years old today, and plan to retire 40 years from today (at age 65). You expect to live independently for 25 years thereafter (until age 90). You want a retirement income which has, in the first year, the same purchasing power as $40,000 has today. However, your retirement income will be of a fixed amount, so your real income will decline over time. Your retirement income will start the day you retire, 40 years from today (age 65), and you expect to receive a total of 25 retirement payments (age 65 to age 89. age 65 included, n=25) Inflation is expected to be constant at 5 percent. You have no savings now, and plan to earn 10 percent on all your future savings. How much must he save end of each year, with the first saving starting end of this first year and your last saving end of year 65) to meet his retirement goals? Note: (1) Your last year of savings and withdrawals, will be same, age 65 (2) Your savings starts one year from now, so End of the year savings for n=40 (3) Your withdrawals starts at age 65, so BGN of the year withdrawals for n=25) $261,384 $6,353 $5,250 $281,560

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started