I need help with this question. My trial balance will not balance therefore I cannot continue to proceeding questions. Would appreciate journal entries and adjusting entries as well as general ledger accounts.

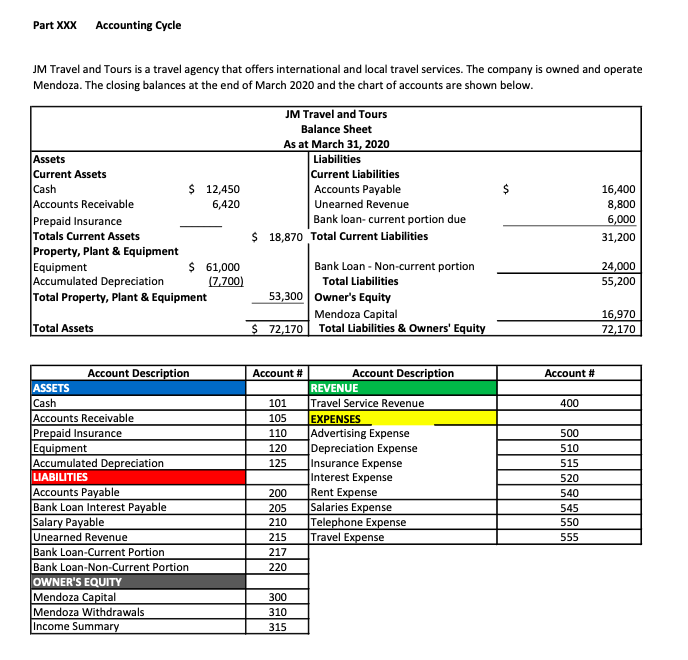

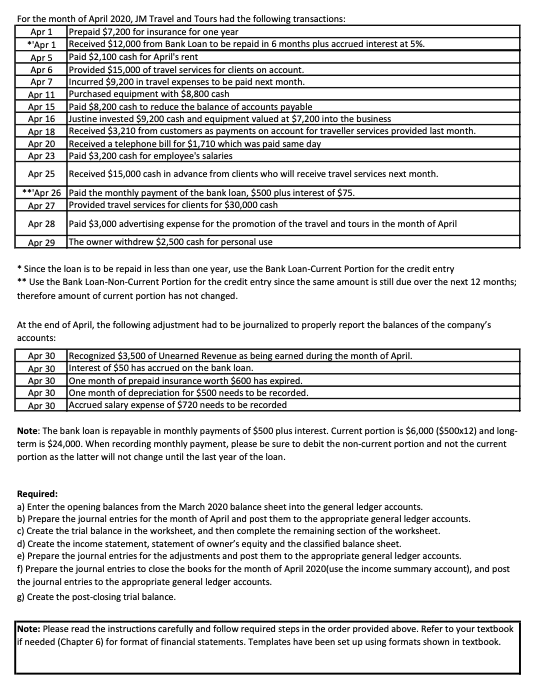

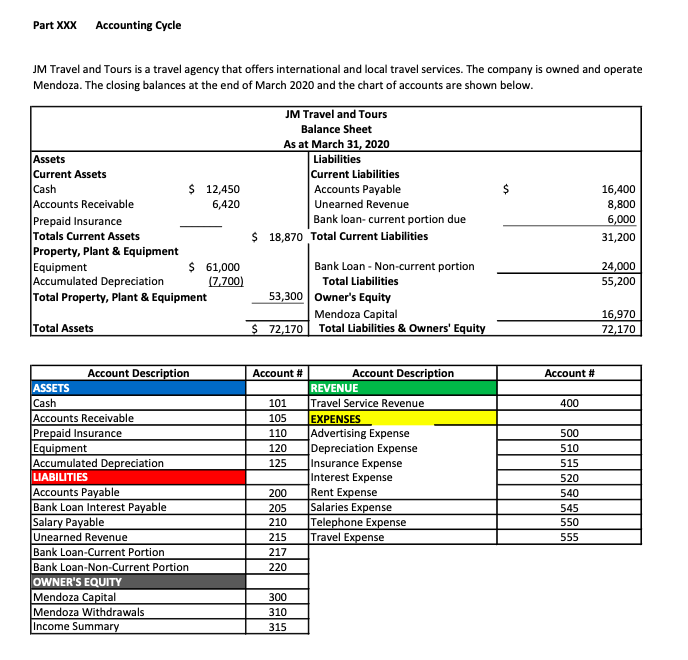

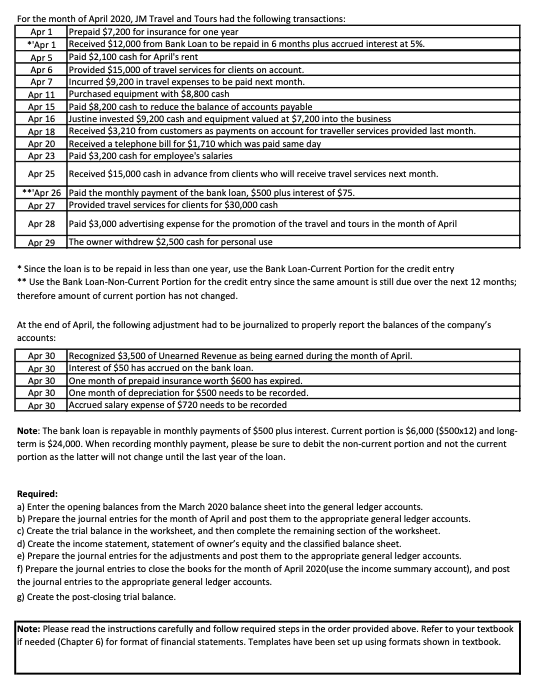

Part XXX Accounting Cycle JM Travel and Tours is a travel agency that offers international and local travel services. The company is owned and operate Mendoza. The closing balances at the end of March 2020 and the chart of accounts are shown below. Assets Current Assets Cash $ 12,450 Accounts Receivable 6,420 Prepaid Insurance Totals Current Assets Property, Plant & Equipment Equipment $ 61,000 Accumulated Depreciation (7.700) Total Property, Plant & Equipment JM Travel and Tours Balance Sheet As at March 31, 2020 Liabilities Current Liabilities Accounts Payable Unearned Revenue Bank loan-current portion due $ 18,870 Total Current Liabilities 16,400 8,800 6,000 31,200 24,000 55,200 Bank Loan - Non-current portion Total Liabilities 53,300 Owner's Equity Mendoza Capital $ 72,170 Total Liabilities & Owners' Equity Total Assets 16,970 72,170 Account # 400 500 510 Account Description ASSETS Cash Accounts Receivable Prepaid Insurance Equipment Accumulated Depreciation LIABILITIES Accounts Payable Bank Loan Interest Payable Salary Payable Unearned Revenue Bank Loan-Current Portion Bank Loan-Non-Current Portion OWNER'S EQUITY Mendoza Capital Mendoza Withdrawals Income Summary Account # Account Description REVENUE 101 Travel Service Revenue 105 EXPENSES 110 Advertising Expense 120 Depreciation Expense 125 Insurance Expense Interest Expense 200 Rent Expense 205 Salaries Expense 210 Telephone Expense 215 Travel Expense 217 220 515 520 540 545 550 555 300 310 315 For the month of April 2020, JM Travel and Tours had the following transactions: Apr 1 Prepaid $7,200 for insurance for one year *'Apr 1 Received $12,000 from Bank Loan to be repaid in 6 months plus accrued interest at 5%. Apr 5 Paid $2,100 cash for April's rent Apr 6 Provided $15,000 of travel services for clients on account. Apr 7 Incurred $9,200 in travel expenses to be paid next month. Apr 11 Purchased equipment with $8,800 cash Apr 15 Paid $8,200 cash to reduce the balance of accounts payable Apr 16 Justine invested $9,200 cash and equipment valued at $7,200 into the business Apr 18 Received $3,210 from customers as payments on account for traveller services provided last month. Apr 20 Received a telephone bill for $1,710 which was paid same day Apr 23 Paid $3,200 cash for employee's salaries Apr 25 Received $15,000 cash in advance from clients who will receive travel services next month. **'Apr 26 Paid the monthly payment of the bank loan, $500 plus interest of $75. Apr 27 Provided travel Services for clients for $30,000 cash Apr 28 Paid $3,000 advertising expense for the promotion of the travel and tours in the month of April Apr 29 The owner withdrew $2,500 cash for personal use * Since the loan is to be repaid in less than one year, use the Bank Loan-Current Portion for the credit entry ** Use the Bank Loan-Non-Current Portion for the credit entry since the same amount is still due over the next 12 months; therefore amount of current portion has not changed. At the end of April, the following adjustment had to be journalized to properly report the balances of the company's accounts: Apr 30 Recognized $3,500 of Unearned Revenue as being earned during the month of April. Apr 30 Interest of $50 has accrued on the bank loan. Apr 30 One month of prepaid insurance worth $600 has expired. Apr 30 One month of depreciation for $500 needs to be recorded. Apr 30 Accrued salary expense of $720 needs to be recorded Note: The bank loan is repayable in monthly payments of $500 plus interest. Current portion is $6,000 ($500x12) and long- term is $24,000. When recording monthly payment, please be sure to debit the non-current portion and not the current portion as the latter will not change until the last year of the loan. Required: a) Enter the opening balances from the March 2020 balance sheet into the general ledger accounts. b) Prepare the journal entries for the month of April and post them to the appropriate general ledger accounts. c) Create the trial balance in the worksheet, and then complete the remaining section of the worksheet. d) Create the income statement, statement of owner's equity and the classified balance sheet. e) Prepare the journal entries for the adjustments and post them to the appropriate general ledger accounts. f) Prepare the journal entries to close the books for the month of April 2020(use the income summary account), and post the journal entries to the appropriate general ledger accounts. g) Create the post-closing trial balance. Note: Please read the instructions carefully and follow required steps in the order provided above. Refer to your textbook if needed (Chapter 6) for format of financial statements. Templates have been set up using formats shown in textbook