Question

7) Large Co. pays its employees $20,000 gross salary each week. 30% of salary is withheld for income taxes and 5% is withheld to

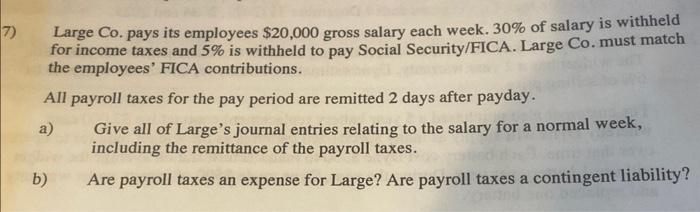

7) Large Co. pays its employees $20,000 gross salary each week. 30% of salary is withheld for income taxes and 5% is withheld to pay Social Security/FICA. Large Co. must match the employees' FICA contributions. All payroll taxes for the pay period are remitted 2 days after payday. a) b) Give all of Large's journal entries relating to the salary for a normal week, including the remittance of the payroll taxes. Are payroll taxes an expense for Large? Are payroll taxes a contingent liability?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Here are the journal entries for Large Co relating to the salary for a normal week 1 On payday Deb...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting with IFRS Fold Out Primer

Authors: John Wild

5th edition

978-0077408770, 77408772, 978-0077413804

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App