I need help with this questions, thanks!

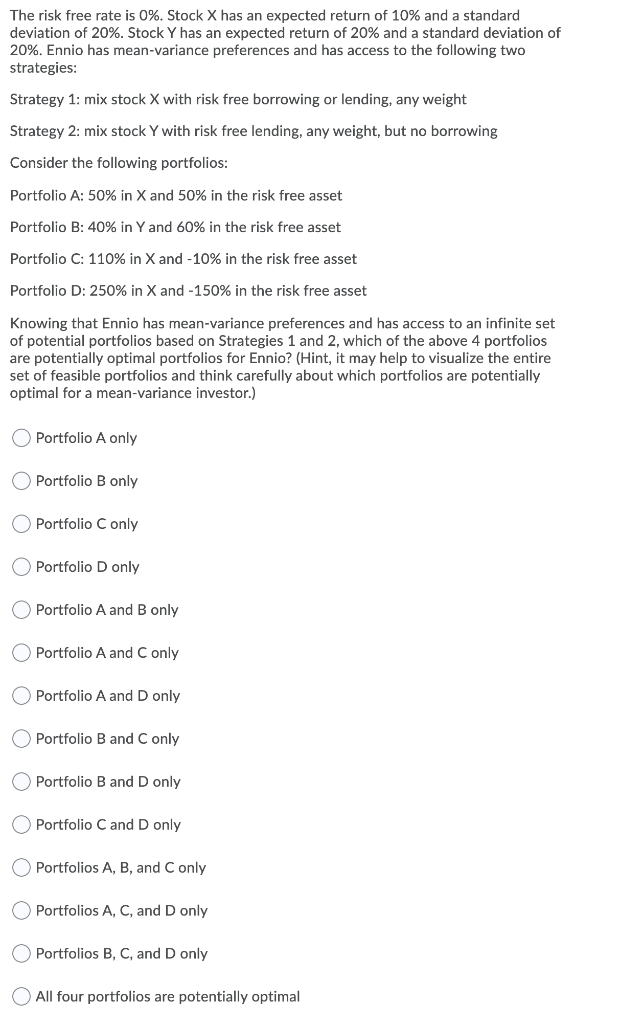

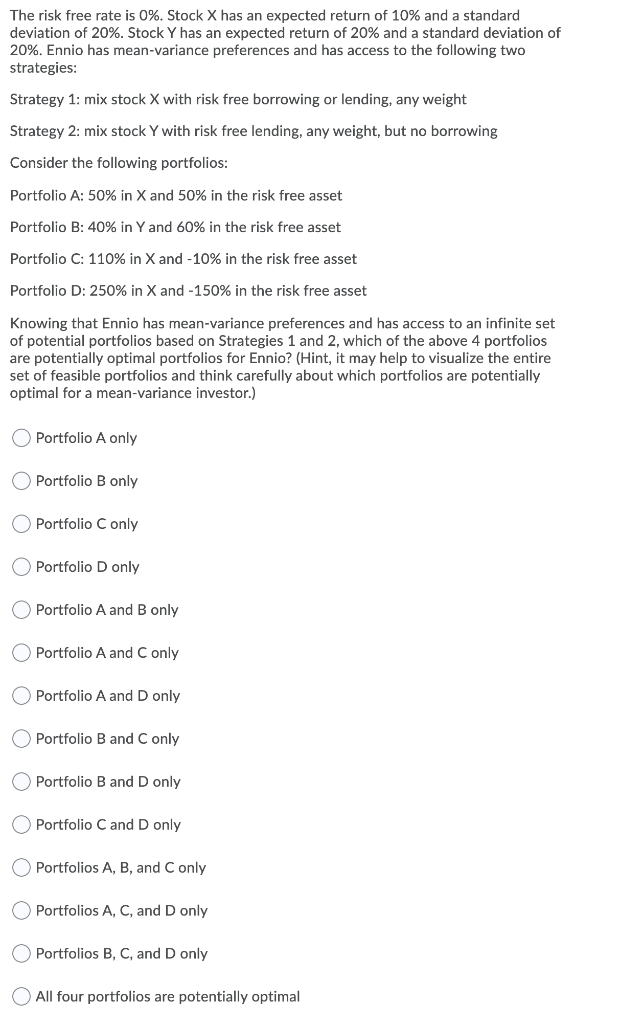

The risk free rate is 0%. Stock X has an expected return of 10% and a standard deviation of 20%. Stock Y has an expected return of 20% and a standard deviation of 20%. Ennio has mean-variance preferences and has access to the following two strategies: Strategy 1: mix stock X with risk free borrowing or lending, any weight Strategy 2: mix stock Y with risk free lending, any weight, but no borrowing Consider the following portfolios: Portfolio A: 50% in X and 50% in the risk free asset Portfolio B: 40% in Y and 60% in the risk free asset Portfolio C: 110% in X and -10% in the risk free asset Portfolio D: 250% in X and -150% in the risk free asset Knowing that Ennio has mean-variance preferences and has access to an infinite set of potential portfolios based on Strategies 1 and 2, which of the above 4 portfolios are potentially optimal portfolios for Ennio? (Hint, it may help to visualize the entire set of feasible portfolios and think carefully about which portfolios are potentially optimal for a mean-variance investor.) Portfolio A only Portfolio B only Portfolio Conly Portfolio D only O Portfolio A and B only Portfolio A and C only O Portfolio A and D only O Portfolio B and C only Portfolio B and D only Portfolio C and D only Portfolios A, B, and C only Portfolios A, C, and D only Portfolios B, C, and D only O All four portfolios are potentially optimal The risk free rate is 0%. Stock X has an expected return of 10% and a standard deviation of 20%. Stock Y has an expected return of 20% and a standard deviation of 20%. Ennio has mean-variance preferences and has access to the following two strategies: Strategy 1: mix stock X with risk free borrowing or lending, any weight Strategy 2: mix stock Y with risk free lending, any weight, but no borrowing Consider the following portfolios: Portfolio A: 50% in X and 50% in the risk free asset Portfolio B: 40% in Y and 60% in the risk free asset Portfolio C: 110% in X and -10% in the risk free asset Portfolio D: 250% in X and -150% in the risk free asset Knowing that Ennio has mean-variance preferences and has access to an infinite set of potential portfolios based on Strategies 1 and 2, which of the above 4 portfolios are potentially optimal portfolios for Ennio? (Hint, it may help to visualize the entire set of feasible portfolios and think carefully about which portfolios are potentially optimal for a mean-variance investor.) Portfolio A only Portfolio B only Portfolio Conly Portfolio D only O Portfolio A and B only Portfolio A and C only O Portfolio A and D only O Portfolio B and C only Portfolio B and D only Portfolio C and D only Portfolios A, B, and C only Portfolios A, C, and D only Portfolios B, C, and D only O All four portfolios are potentially optimal