Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need help with this Research and communicating information are important skills to have in tax. The research assignments are to provide students with an

i need help with this

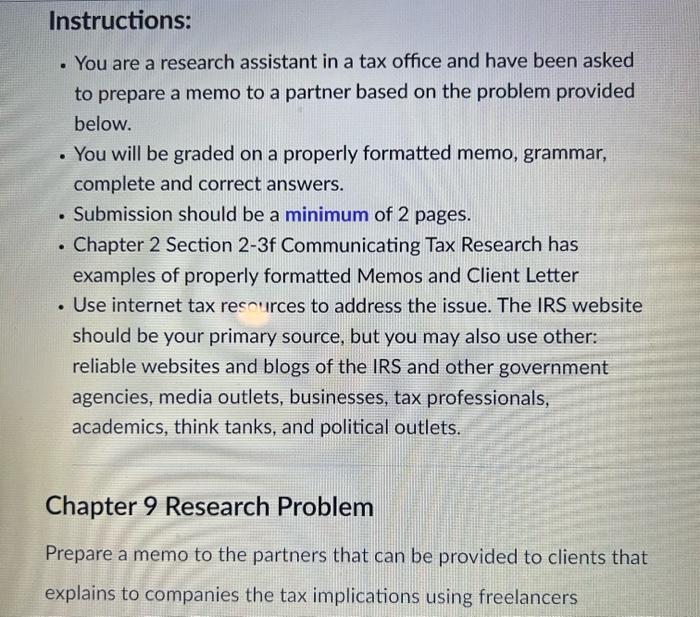

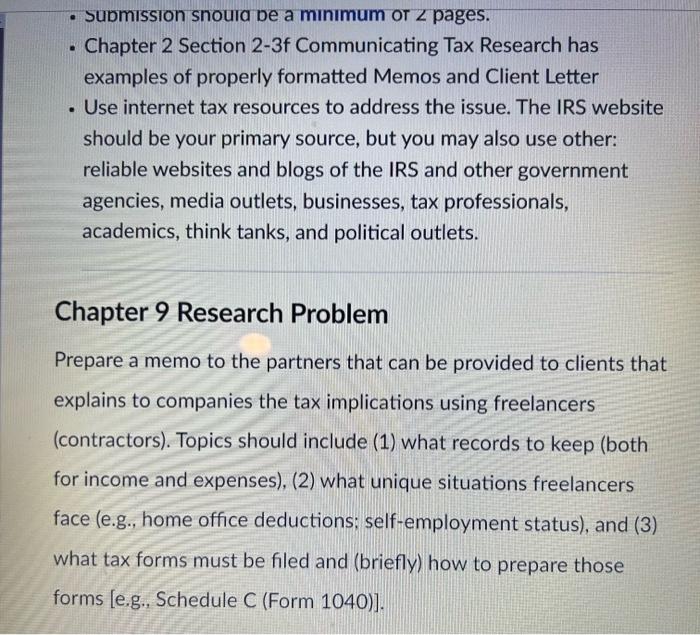

Research and communicating information are important skills to have in tax. The research assignments are to provide students with an opportunity to enhance their research skills, increase their knowledge, apply what it is learned, and communicate that information thoughtfully, concisely, and professionally. Instructions: - You are a research assistant in a tax office and have been asked to prepare a memo to a partner based on the problem provided below. - You will be graded on a properly formatted memo, grammar, complete and correct answers. - Submission should be a minimum of 2 pages. - Chapter 2 Section 2-3f Communicating Tax Research has examples of properly formatted Memos and Client Letter - Use internet tax resources to address the issue. The IRS website should be your primary source, but you may also use other: reliable websites and blogs of the IRS and other government aopnries media nutlets husinesces tax nrnfecsinnale - You are a research assistant in a tax office and have been asked to prepare a memo to a partner based on the problem provided below. - You will be graded on a properly formatted memo, grammar, complete and correct answers. - Submission should be a minimum of 2 pages. - Chapter 2 Section 2-3f Communicating Tax Research has examples of properly formatted Memos and Client Letter - Use internet tax rescurces to address the issue. The IRS website should be your primary source, but you may also use other: reliable websites and blogs of the IRS and other government agencies, media outlets, businesses, tax professionals, academics, think tanks, and political outlets. Chapter 9 Research Problem Prepare a memo to the partners that can be provided to clients that explains to companies the tax implications using freelancers - submission snoula de a minimum or pages. - Chapter 2 Section 2-3f Communicating Tax Research has examples of properly formatted Memos and Client Letter - Use internet tax resources to address the issue. The IRS website should be your primary source, but you may also use other: reliable websites and blogs of the IRS and other government agencies, media outlets, businesses, tax professionals, academics, think tanks, and political outlets. Chapter 9 Research Problem Prepare a memo to the partners that can be provided to clients that explains to companies the tax implications using freelancers (contractors). Topics should include (1) what records to keep (both for income and expenses), (2) what unique situations freelancers face (e.g., home office deductions; self-employment status), and (3) what tax forms must be filed and (briefly) how to prepare those forms [e.g., Schedule C (Form 1040)]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started