Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help with this scenario please: Directions: After the success of the company's first two months, K. Wilson continues to operate Business Solutions. The

I need help with this scenario please:

Directions:

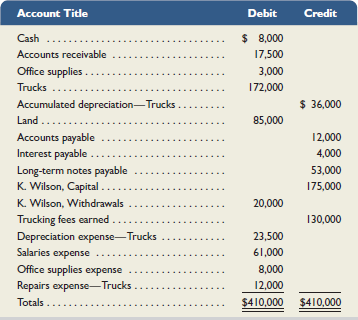

After the success of the company's first two months, K. Wilson continues to operate Business Solutions. The December 31, adjusted trial balance of Business Solutions follows:

- Prepare an income statement for the month ended December 31.

- Prepare a statement of owner's equity for the month ended December 31. (Note: The company just began operations on January 1)

- Prepare a balance sheet as of December 31.

- Record and post the necessary closing entries for Business Solutions. Then prepare a post-closing trial balance as of December 31.

- Based on your knowledge of GAAP, evaluate the financial statements you have prepared. How do you think the business is doing in its first year of operations? Would you invest in this business? Why or Why not?

| Business Solutions | |

| Income Statement | |

| For Year Ended December 31 | |

|

|

|

|

|

|

|

|

|

|

| |

| Business Solutions |

| Statement of Owners Equity |

| For Year Ended December 31 |

| Business Solutions | |

| Balance Sheet | |

| For Year Ended December 31 | |

|

| |

Closing Entries:

| Date | Account

| Debit | Credit |

| Business Solutions |

| Post Closing Trial Balance |

| December 31 |

Account Title Credit $ 8,000 7,500 3,000 172,000 Office supplies Trucks $ 36,000 Accounts payable Interest payable Long-term notes payable K Wilson, Capital K. Wilson, Withdrawals 2,000 4,000 53,000 175,000 20,000 30,000 Depreciation expense Trucks Salaries expense Office supplies expense Repairs expense-Trucks 61,000 8,000 2,000 $410,000 $410,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started