Answered step by step

Verified Expert Solution

Question

1 Approved Answer

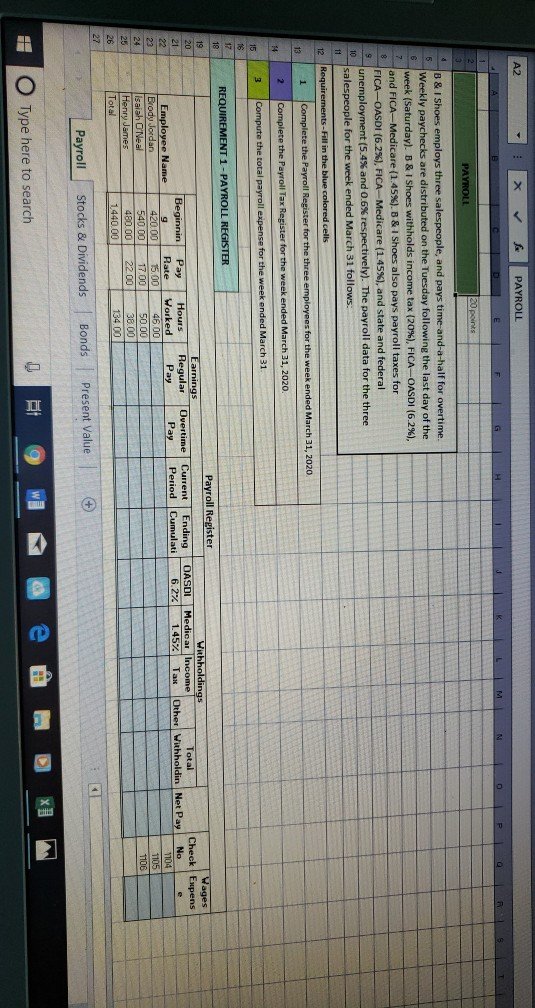

I need help with this spreadsheet A2 : * & PAYROLL 120 points PAYROLL B & I Shoes employs three salespeople, and pays time-and-a-half for

I need help with this spreadsheet

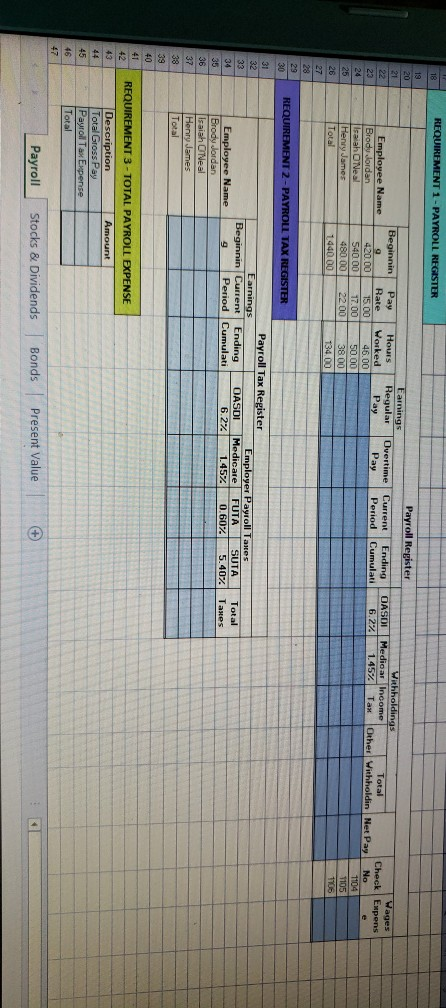

A2 : * & PAYROLL 120 points PAYROLL B & I Shoes employs three salespeople, and pays time-and-a-half for overtime. Weekly paychecks are distributed on the Tuesday following the last day of the week (Saturday). B & I Shoes withholds income tax (20%), FICA-OASDI (6.2%), and FICA-Medicare (1.45%). B & I Shoes also pays payroll taxes for FICA-OASDI (6.2%), FICA-Medicare (1.45%), and state and federal unemployment (5.4% and 0.6% respectively). The payroll data for the three salespeople for the week ended March 31 follows: 12 Requirements - Fill in the blue colored cells 1 Complete the Payroll Register for the three employees for the week ended March 31, 2020 2 Complete the Payroll Tax Register for the week ended March 31, 2020. 3 Compute the total payroll expense for the week ended March 31. REQUIREMENT 1 - PAYROLL REGISTER Payroll Register SURESH Earnings Regular Overtime Pay Wages Check Expens No Withholdings OASDI Medicar Income Total 6.2% 1.45% Tax Other Withholdin Net Pay Current Ending Period Cumulati Pay Employee Name Brody Jordan Isaiah O'Neal Henry James Total Beginnin g 420.00 540.00 480.00 1440.00 Pay Rate 15.00 17.00 2200 Hours Worked 46.00 50.00 38.00 134 00 1105 106 Payroll Stocks & Dividends Bonds Present Value + Type here to search E o wla e @HDXI REQUIREMENT 1 - PAYROLL REGISTER Payroll Register Earnings Regular Pay Uvertime Pay Current Ending Period Cumulati Wages Check Empens Withholdings OASOL MedioarIncome Total 6.27 1.457 Tax Other Withholdin Net Pay Employee Name Brody Jordan Isaiah O'Neal Henry James Total Beginnin 9 420.00 540.00 480.00 1440.00 Pay Rate 15.00 17.00 22.00 Hours Worked 46.00 50.00 38.00 134 00 T04 REQUIREMENT 2-PAYROLL TAX REGISTER Payroll Tax Register Earnings Beginnin Current Ending OASDI Period Cumulati 6.2% Employer Payroll Taxes Medicare FUTA SUTA 1.457 0.60% 5.40% Total Taxes Employee Name Brody Jordan Isaiah O'Neal Henry James Total REQUIREMENT 3 - TOTAL PAYROLL EXPENSE Amount Description Total Gross Pay Payroll Tax Expense Total Payroll Stocks & Dividends Bonds Present Value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started