Answered step by step

Verified Expert Solution

Question

1 Approved Answer

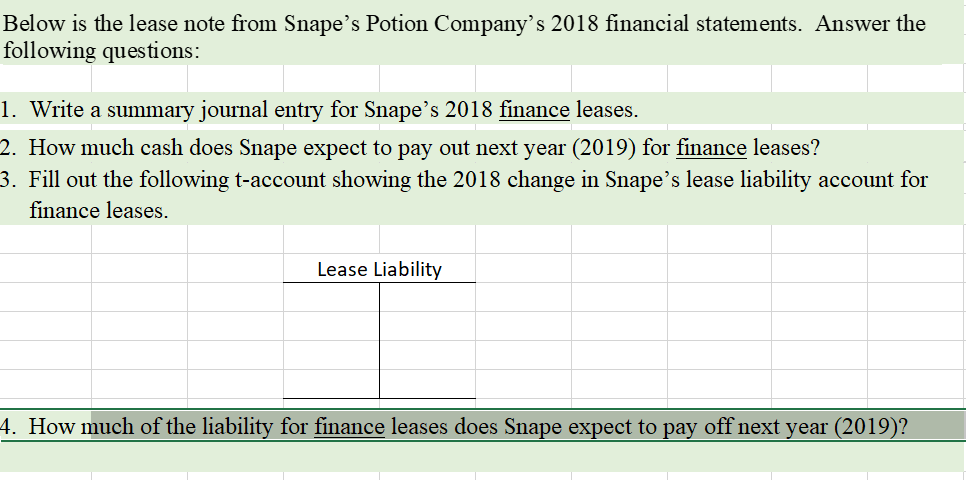

I need it as soon as possible please Below is the lease note from Snape's Potion Company's 2018 financial statements. Answer the following questions: 1.

I need it as soon as possible please

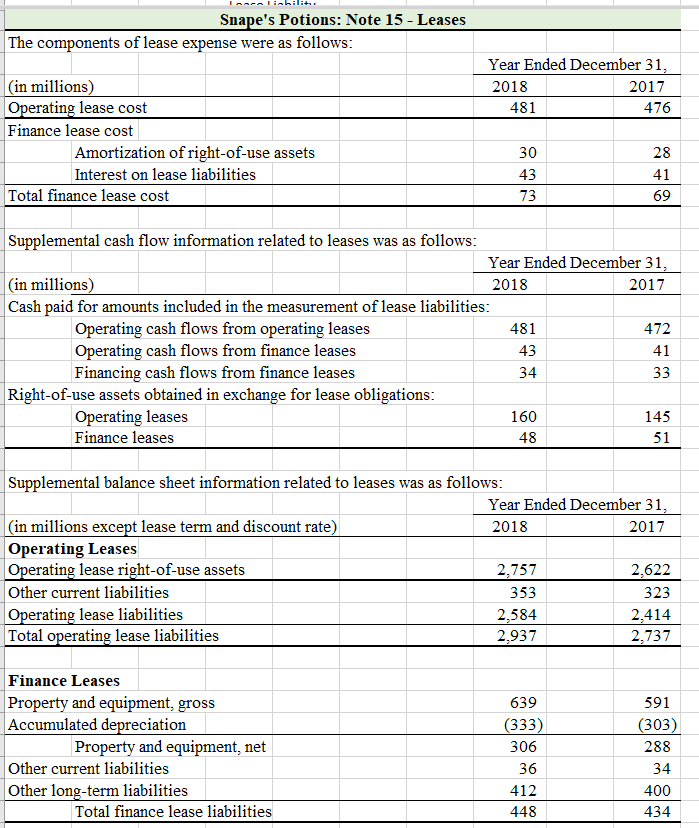

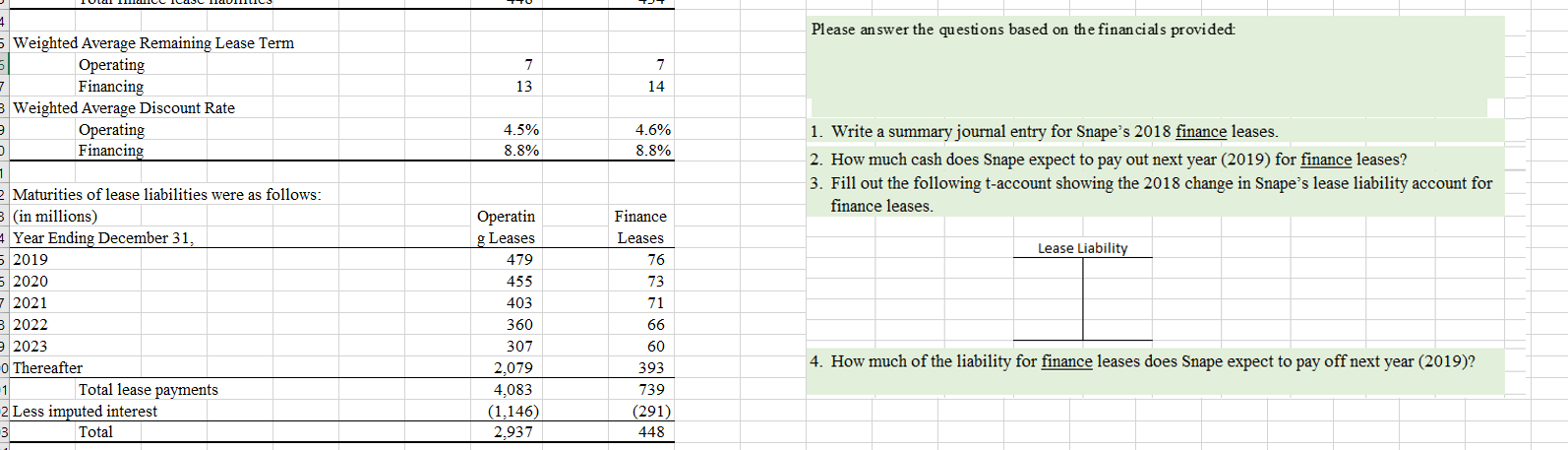

Below is the lease note from Snape's Potion Company's 2018 financial statements. Answer the following questions: 1. Write a summary journal entry for Snape's 2018 finance leases. 2. How much cash does Snape expect to pay out next year (2019) for finance leases? 3. Fill out the following t-account showing the 2018 change in Snape's lease liability account for finance leases. Lease Liability 4. How much of the liability for finance leases does Snape expect to pay off next year (2019)? Snape's Potions: Note 15 - Leases The components of lease expense were as follows: Year Ended December 31, 2018 2017 481 476 (in millions) Operating lease cost Finance lease cost Amortization of right-of-use assets Interest on lease liabilities Total finance lease cost 30 43 73 28 41 69 Supplemental cash flow information related to leases was as follows: Year Ended December 31, (in millions) 2018 2017 Cash paid for amounts included in the measurement of lease liabilities: Operating cash flows from operating leases 481 472 Operating cash flows from finance leases 41 Financing cash flows from finance leases 34 33 Right-of-use assets obtained in exchange for lease obligations: Operating leases 160 145 Finance leases 48 51 43 Supplemental balance sheet information related to leases was as follows: Year Ended December 31, (in millions except lease term and discount rate) 2018 2017 Operating Leases Operating lease right-of-use assets 2,757 2,622 Other current liabilities 353 323 Operating lease liabilities 2,584 2,414 Total operating lease liabilities 2,937 2,737 Finance Leases Property and equipment, gross Accumulated depreciation Property and equipment, net Other current liabilities Other long-term liabilities Total finance lease liabilities 639 (333) 306 36 412 448 591 (303) 288 34 400 434 1 Please answer the questions based on the financials provided 7 13 7 14 4.5% 8.8% 4.6% 8.8% 1. Write a summary journal entry for Snape's 2018 finance leases. 2. How much cash does Snape expect to pay out next year (2019) for finance leases? 3. Fill out the following t-account showing the 2018 change in Snape's lease liability account for finance leases. 5 Weighted Average Remaining Lease Term Operating 7 Financing B Weighted Average Discount Rate Operating Financing 1 Maturities of lease liabilities were as follows: (in millions) 4 Year Ending December 31, 5 2019 5 2020 7 2021 3 2022 2023 o Thereafter -1 Total lease payments 2 Less imputed interest 3 Total Finance Leases 76 Lease Liability 73 Operatin g Leases 479 455 403 360 307 2,079 4,083 (1,146) 2,937 71 66 60 393 739 (291) 448 4. How much of the liability for finance leases does Snape expect to pay off next year (2019)? Below is the lease note from Snape's Potion Company's 2018 financial statements. Answer the following questions: 1. Write a summary journal entry for Snape's 2018 finance leases. 2. How much cash does Snape expect to pay out next year (2019) for finance leases? 3. Fill out the following t-account showing the 2018 change in Snape's lease liability account for finance leases. Lease Liability 4. How much of the liability for finance leases does Snape expect to pay off next year (2019)? Snape's Potions: Note 15 - Leases The components of lease expense were as follows: Year Ended December 31, 2018 2017 481 476 (in millions) Operating lease cost Finance lease cost Amortization of right-of-use assets Interest on lease liabilities Total finance lease cost 30 43 73 28 41 69 Supplemental cash flow information related to leases was as follows: Year Ended December 31, (in millions) 2018 2017 Cash paid for amounts included in the measurement of lease liabilities: Operating cash flows from operating leases 481 472 Operating cash flows from finance leases 41 Financing cash flows from finance leases 34 33 Right-of-use assets obtained in exchange for lease obligations: Operating leases 160 145 Finance leases 48 51 43 Supplemental balance sheet information related to leases was as follows: Year Ended December 31, (in millions except lease term and discount rate) 2018 2017 Operating Leases Operating lease right-of-use assets 2,757 2,622 Other current liabilities 353 323 Operating lease liabilities 2,584 2,414 Total operating lease liabilities 2,937 2,737 Finance Leases Property and equipment, gross Accumulated depreciation Property and equipment, net Other current liabilities Other long-term liabilities Total finance lease liabilities 639 (333) 306 36 412 448 591 (303) 288 34 400 434 1 Please answer the questions based on the financials provided 7 13 7 14 4.5% 8.8% 4.6% 8.8% 1. Write a summary journal entry for Snape's 2018 finance leases. 2. How much cash does Snape expect to pay out next year (2019) for finance leases? 3. Fill out the following t-account showing the 2018 change in Snape's lease liability account for finance leases. 5 Weighted Average Remaining Lease Term Operating 7 Financing B Weighted Average Discount Rate Operating Financing 1 Maturities of lease liabilities were as follows: (in millions) 4 Year Ending December 31, 5 2019 5 2020 7 2021 3 2022 2023 o Thereafter -1 Total lease payments 2 Less imputed interest 3 Total Finance Leases 76 Lease Liability 73 Operatin g Leases 479 455 403 360 307 2,079 4,083 (1,146) 2,937 71 66 60 393 739 (291) 448 4. How much of the liability for finance leases does Snape expect to pay off next year (2019)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started