Answered step by step

Verified Expert Solution

Question

1 Approved Answer

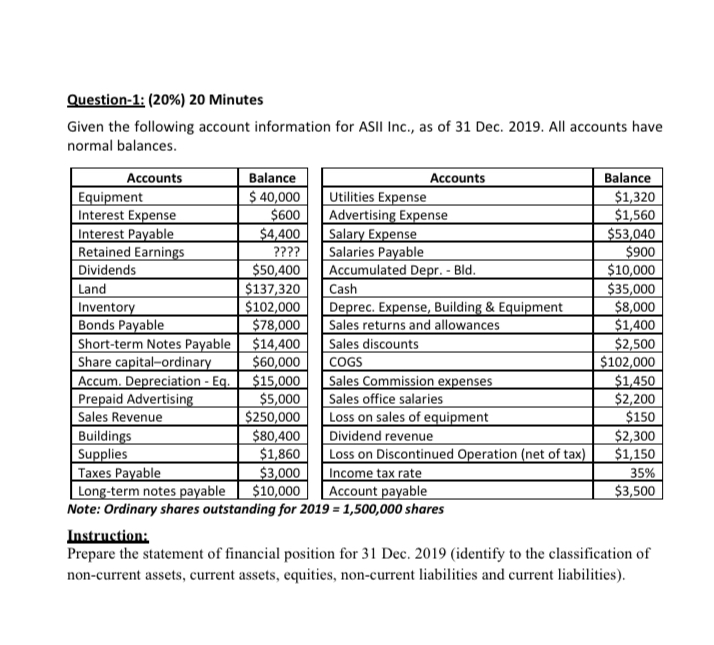

I need it asap Question-1: (20%) 20 Minutes Given the following account information for ASil Inc., as of 31 Dec. 2019. All accounts have normal

I need it asap

Question-1: (20%) 20 Minutes Given the following account information for ASil Inc., as of 31 Dec. 2019. All accounts have normal balances. Accounts Balance Accounts Balance Equipment $ 40,000 Utilities Expense $1,320 Interest Expense $600 Advertising Expense $1,560 Interest Payable $4,400 Salary Expense $53,040 Retained Earnings ???? Salaries Payable $900 Dividends $50,400 Accumulated Depr. - Bld. $10,000 Land $137,320 Cash $35,000 Inventory $102,000 Deprec. Expense, Building & Equipment $8,000 Bonds Payable $78,000 Sales returns and allowances $1,400 Short-term Notes Payable $14,400 Sales discounts $2,500 Share capital-ordinary $60,000 COGS $102,000 Accum. Depreciation - Eq. $15,000 Sales Commission expenses $1,450 Prepaid Advertising $5,000 Sales office salaries $2,200 Sales Revenue $250,000 Loss on sales of equipment $150 Buildings $80,400 Dividend revenue $2,300 Supplies $1,860 Loss on Discontinued Operation (net of tax) $1,150 Taxes Payable $3,000 Income tax rate 35% Long-term notes payable $10,000 Account payable $3,500 Note: Ordinary shares outstanding for 2019 = 1,500,000 shares Instruction: Prepare the statement of financial position for 31 Dec. 2019 (identify to the classification of non-current assets, current assets, equities, non-current liabilities and current liabilities). Question-1: (20%) 20 Minutes Given the following account information for ASil Inc., as of 31 Dec. 2019. All accounts have normal balances. Accounts Balance Accounts Balance Equipment $ 40,000 Utilities Expense $1,320 Interest Expense $600 Advertising Expense $1,560 Interest Payable $4,400 Salary Expense $53,040 Retained Earnings ???? Salaries Payable $900 Dividends $50,400 Accumulated Depr. - Bld. $10,000 Land $137,320 Cash $35,000 Inventory $102,000 Deprec. Expense, Building & Equipment $8,000 Bonds Payable $78,000 Sales returns and allowances $1,400 Short-term Notes Payable $14,400 Sales discounts $2,500 Share capital-ordinary $60,000 COGS $102,000 Accum. Depreciation - Eq. $15,000 Sales Commission expenses $1,450 Prepaid Advertising $5,000 Sales office salaries $2,200 Sales Revenue $250,000 Loss on sales of equipment $150 Buildings $80,400 Dividend revenue $2,300 Supplies $1,860 Loss on Discontinued Operation (net of tax) $1,150 Taxes Payable $3,000 Income tax rate 35% Long-term notes payable $10,000 Account payable $3,500 Note: Ordinary shares outstanding for 2019 = 1,500,000 shares Instruction: Prepare the statement of financial position for 31 Dec. 2019 (identify to the classification of non-current assets, current assets, equities, non-current liabilities and current liabilities)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started