Question

I need it urgent...within 24 hr Requirement detail: Research all the issueseeds/questions the clients have and create a comprehensive report which should include, but not

I need it urgent...within 24 hr

Requirement detail:

Research all the issueseeds/questions the clients have and create a comprehensive report which should include, but not limited to, a two-page executive summary with actionable recommendations, and an organized analysis of the case, assumptions, and findings. so it should be on excel but the 2 page executive summary should be based on what the excel file shows the family is capable of the 2 page summary is more of a recommendation as if you were the financial advisor to the client, you got that correct? but with you findings from the excel that should be created with the data provided in the file,

Case study

Luke and Jen Affluent are 51 and 49 years old. Luke is an engineer at a local engineering firm and Jen is a special education teacher at an elementary school. Both have Master degrees in their respective fields. They both enjoy reasonable health and have two children 13 and 15, Jimmy and Jessica. Jimmy is in 7th grade and Jessica is a 10th grader.

Even though they received a significant inheritance when Jens mother passed away six years ago, they still enjoy working and plan to work through age 60 or at least until their children are out of college. They wonder if that is really feasibledo they need to work longer or could they retire earlier? They are also concerned that they are pulling a little each year from their inheritance and hope that isnt a problem. They have not provided Social Security estimates and are relying on you to estimate their Social Security from their current salary information. Jen will receive a pension from her School District roughly equal to 2% of salary for each year of service. She currently has 21 years of service.

Luke gets upset each year when he completes his taxes and wonders if there is anything they can do to decrease their tax liability. They have also heard about the death tax and would like to implement strategies to avoid estate tax. The family paid over $2,000,000 in estate tax at her mothers passing. They currently have no estate plan in place.

They would like to set aside some money specifically for their childrens educationtuition, room and board at a State School.

Besides the 250,000 life insurance policy on Lukethey each have a $50,000 term life insurance policy through work. The whole life policy has a premium of $300/month and a current cash value of $24,000. Additionally, they each have a 60% of salary disability policy through work.

Regarding investments, they always obsess over the volatility in the market and are constantly monitoring their investments. They have a brokerage account at Fidelity that he manages himself with a portfolio of individual stocks. They have a small E*Trade account that Jen manages and is also 100% allocated to stocks. They are wondering if they should allocate some of their portfolio to crypto currencies. All other accounts are managed by a local investment firm with a target 60% Equity and 40% Bond mix. They would like specific investment advice on how to allocate his 401(k). He has provided the investment options.

They have good cash flow. Luke makes about $125,000 each year and Jen makes $53,000. However, they are currently spending (net of taxes and savings) about $240,000 each year. Once the kids are out of the house and college is over, they expect that number will shrink a bit to $18,000 a month (measured in todays dollars). In addition to the $240,000 in annual spending, they also spend $1,610 each month on their mortgage and about $6,000 a year in insurance premiums.

The Affluents have hired you to complete a comprehensive financial plan and give them recommendations on every aspect of their financial life based on your analysis.

Plz provide solution asap....

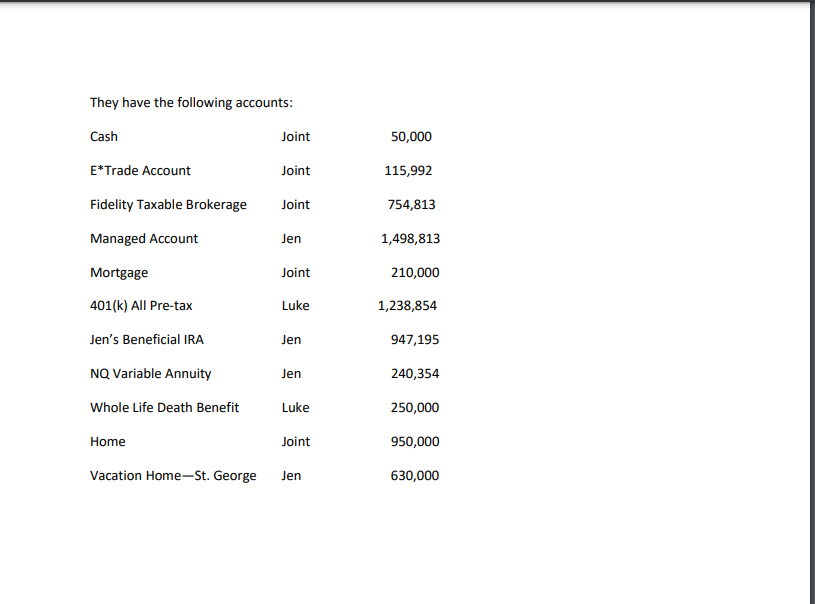

They have the following accounts: They have the following accountsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started