I need journal entries and a trial balance

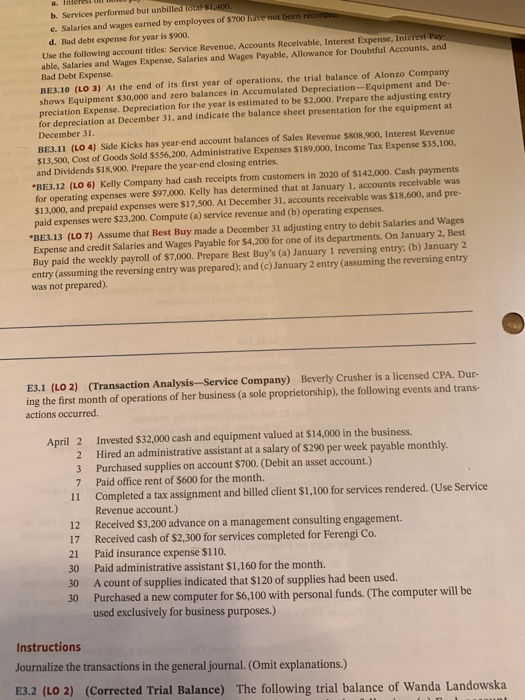

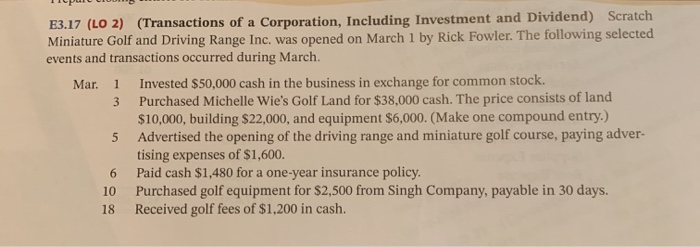

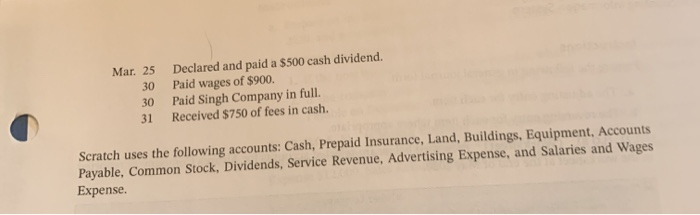

a. Interest b. Services performed but unbilled Total $1400 c. Salaries and wages earned by employees of 5700 have not been recordeu d. Bad debt expense for year is 500. Use the following account titles: Service Revenue, Accounts Receivable, Interest Expense, Interest Pay. able, Salaries and Wages Expense, Salaries and Wages Payable, Allowance for Doubtful Accounts, and Bad Debt Expense. BE3.10 (LO 3) At the end of its first year of operations, the trial balance of Alonzo Company shows Equipment $30,000 and zero balances in Accumulated Depreciation Equipment and De preciation Expense. Depreciation for the year is estimated to be $2,000. Prepare the adjusting entry for depreciation at December 31, and indicate the balance sheet presentation for the equipment at December 31. BE11 (LO 4) Side Kicks has year end account balances of Sales Revenue SO3,200, Interest Revenue $13.500. Cost of Goods Sold $556,200, Administrative Expenses $189.000. Income Tax Expense $35.100. and Dividends $18,900. Prepare the year-end closing entries. *BE3.12 (LO 6) Kelly Company had cash receipts from customers in 2020 of $142,000. Cash payments for operating expenses were $97,000. Kelly has determined that at January 1, accounts receivable was $13,000, and prepaid expenses were $17.500. At December 31, accounts receivable was $18,600, and pre- paid expenses were $23,200. Compute(a) service revenue and (b) operating expenses. "BE3.13 (LO 7) Assume that Best Buy made a December 31 adjusting entry to debit Salaries and Wages Expense and credit Salaries and Wages Payable for $4,200 for one of its departments. On January 2, Best Buy paid the weekly payroll of $7,000. Prepare Best Buy's (a) January 1 reversing entry: (b) January 2 entry (assuming the reversing entry was prepared); and (c) January 2 entry (assuming the reversing entry was not prepared). E3.1 (LO 2) (Transaction Analysis-Service Company) Beverly Crusher is a licensed CPA. Dur. ing the first month of operations of her business (a sole proprietorship), the following events and trans actions occurred. April 2 2 3 7 11 12 17 21 30 30 30 Invested $32,000 cash and equipment valued at $14,000 in the business. Hired an administrative assistant at a salary of $290 per week payable monthly. Purchased supplies on account $700. (Debit an asset account.) Paid office rent of $600 for the month. Completed a tax assignment and billed client $1,100 for services rendered. (Use Service Revenue account.) Received $3,200 advance on a management consulting engagement. Received cash of $2,300 for services completed for Ferengi Co. Paid insurance expense $110. Paid administrative assistant $1,160 for the month. A count of supplies indicated that $120 of supplies had been used. Purchased a new computer for $6,100 with personal funds. The computer will be used exclusively for business purposes.) Instructions Journalize the transactions in the general journal. (Omit explanations.) E3.2 (LO 2) (Corrected Trial Balance) The following trial balance of Wanda Landowska E3.17 (LO 2) (Transactions of a Corporation, Including Investment and Dividend) Scratch Miniature Golf and Driving Range Inc. was opened on March 1 by Rick Fowler. The following selected events and transactions occurred during March Mar. 1 Invested $50,000 cash in the business in exchange for common stock. 3 Purchased Michelle Wie's Golf Land for $38,000 cash. The price consists of land $10,000, building $22,000, and equipment $6,000. (Make one compound entry.) 5 Advertised the opening of the driving range and miniature golf course, paying adver- tising expenses of $1,600. 6 Paid cash $1,480 for a one-year insurance policy. 10 Purchased golf equipment for $2,500 from Singh Company, payable in 30 days. 18 Received golf fees of $1,200 in cash. Mar. 25 30 30 31 Declared and paid a $500 cash dividend. Paid wages of $900. Paid Singh Company in full. Received $750 of fees in cash Scratch uses the following accounts: Cash, Prepaid Insurance, Land, Buildings, Equipment, Accounts Payable, Common Stock, Dividends, Service Revenue, Advertising Expense, and Salaries and Wages Expense