Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need only to answer question number 7 ? i found that v = 41,540, vu = 44,450 and vd= 44,448 thank you. Consider a

i need only to answer question number 7 ?

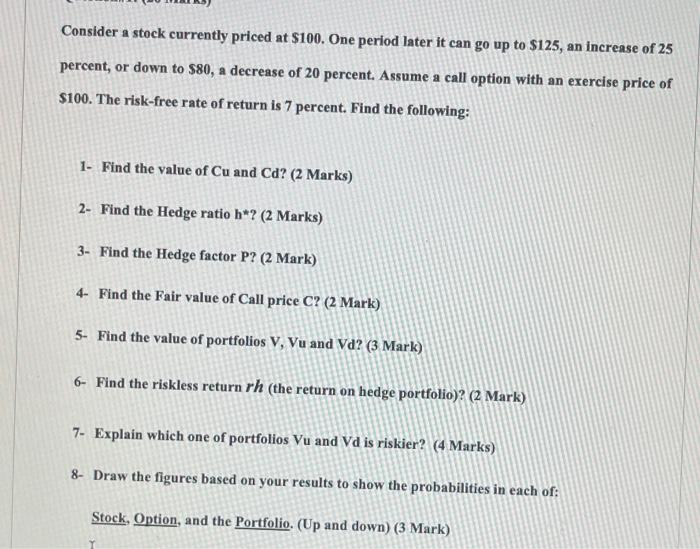

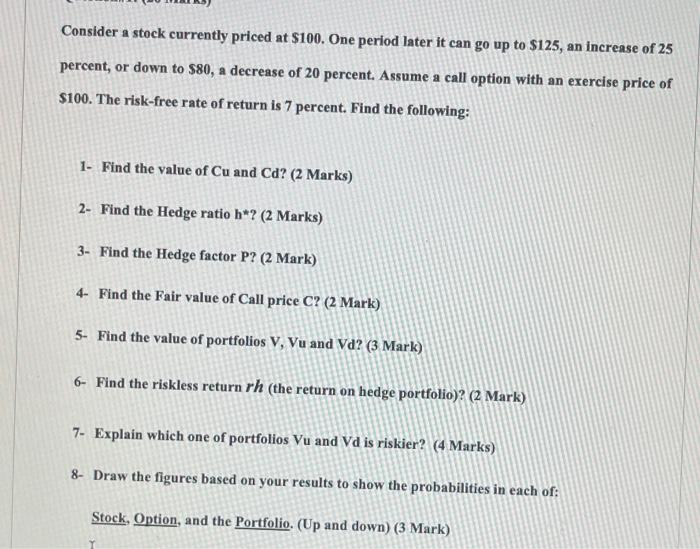

Consider a stock currently priced at $100. One period later it can go up to $125, an increase of 25 percent, or down to $80, a decrease of 20 percent. Assume a call option with an exercise price of $100. The risk-free rate of return is 7 percent. Find the following: 1. Find the value of Cu and Cd? (2 Marks) 2- Find the Hedge ratio h*? (2 Marks) 3- Find the Hedge factor P? (2 Mark) 4- Find the Fair value of Call price C? (2 Mark) 5. Find the value of portfolios V, Vu and Vd? (3 Mark) 6- Find the riskless return rh (the return on hedge portfolio)? (2 Mark) 7. Explain which one of portfolios Vu and Vd is riskier? (4 Marks) 8- Draw the figures based on your results to show the probabilities in each of: Stock, Option, and the Portfolio. (Up and down) (3 Mark) i found that v = 41,540, vu = 44,450 and vd= 44,448 thank you.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started