I need part b

I need part b

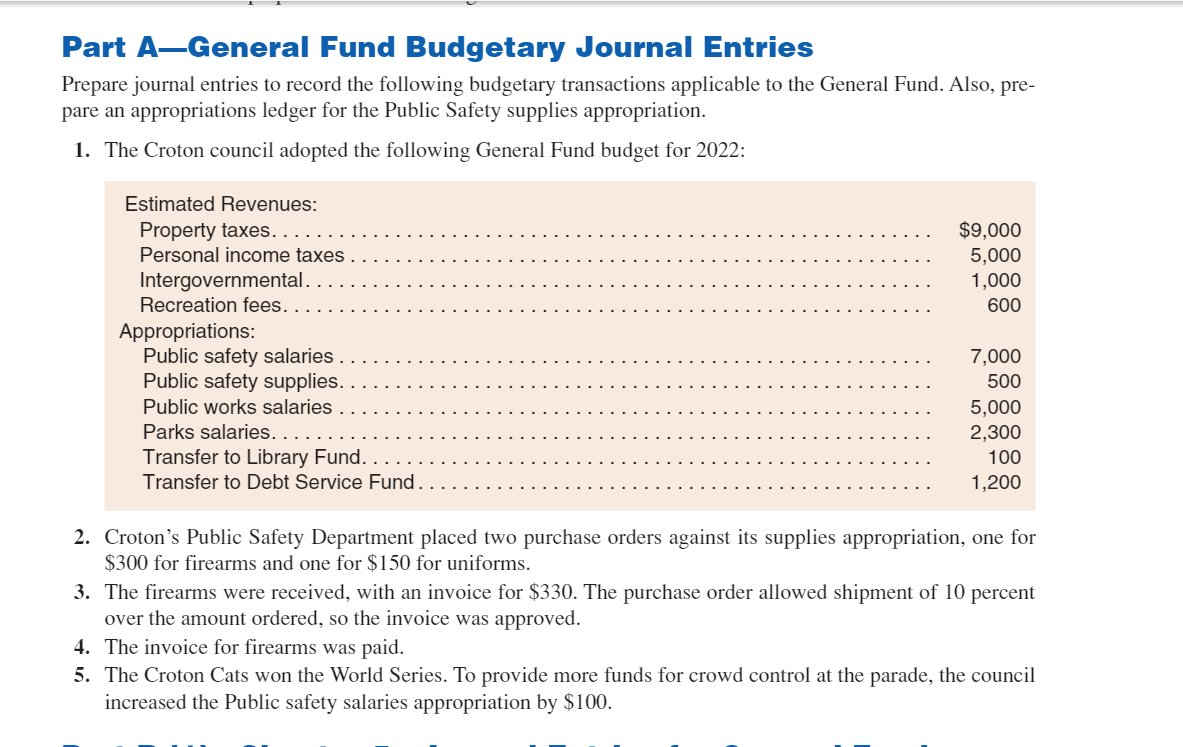

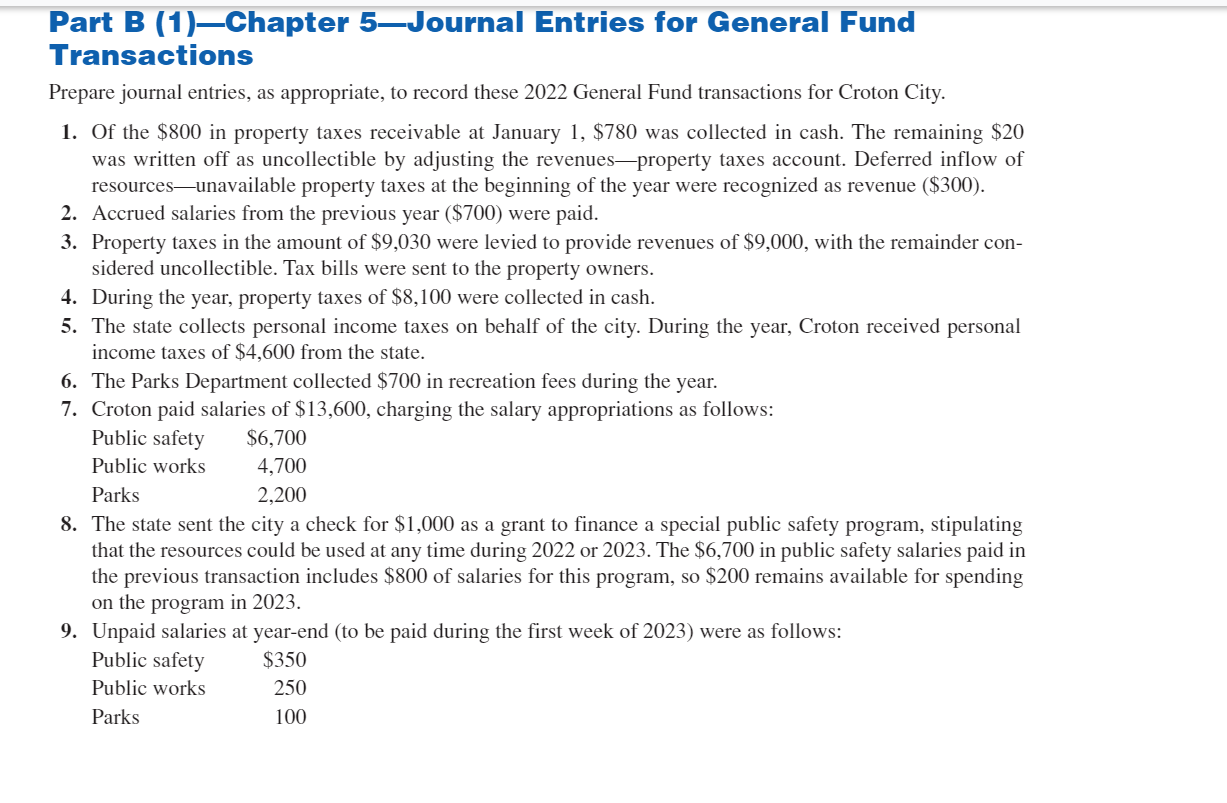

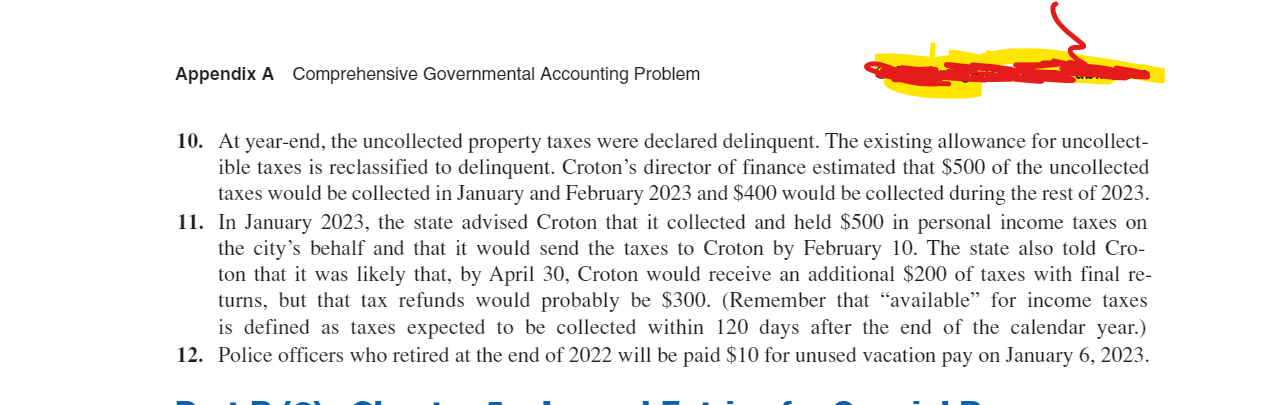

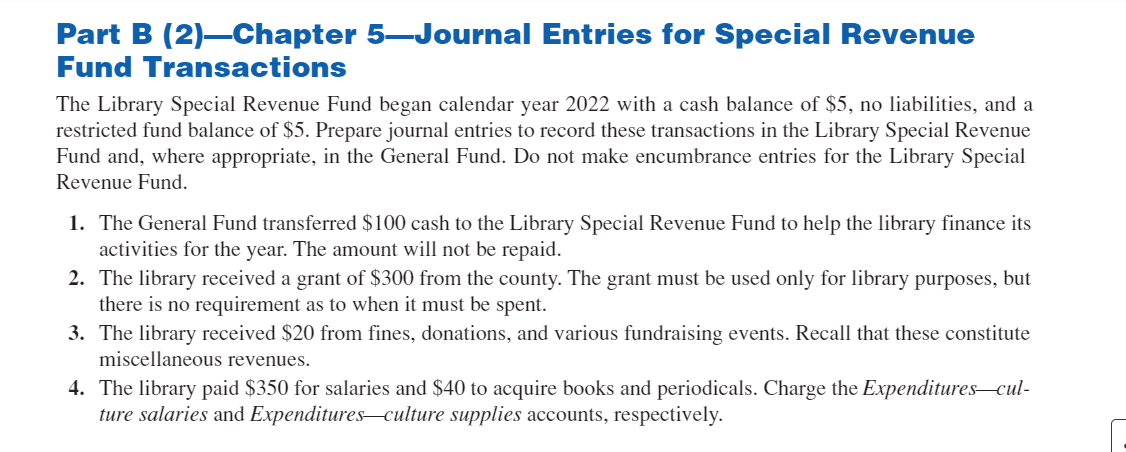

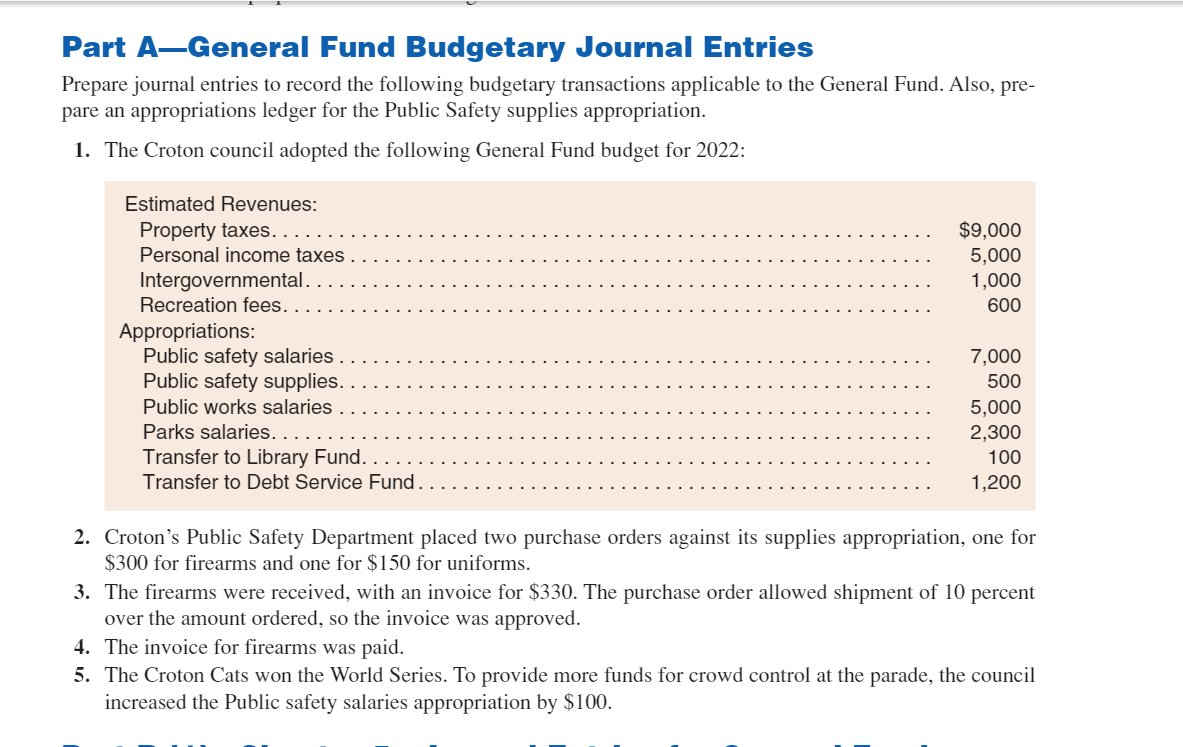

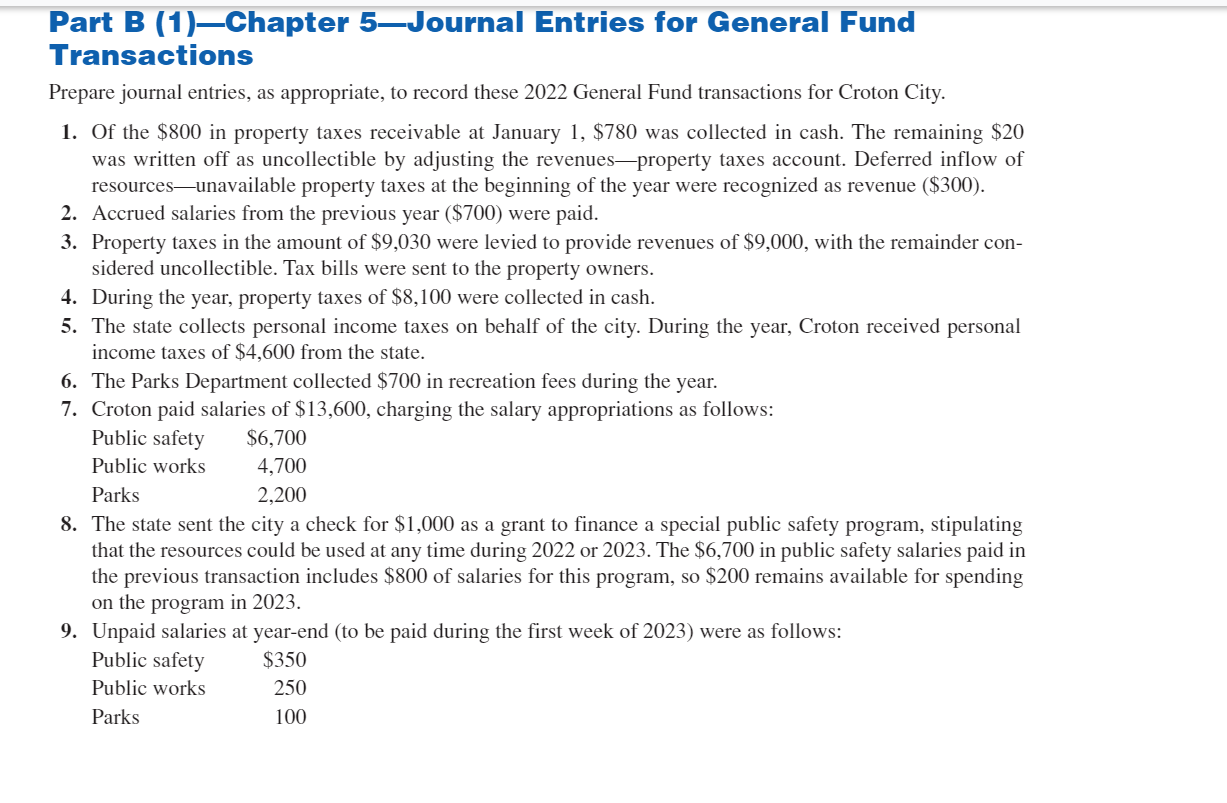

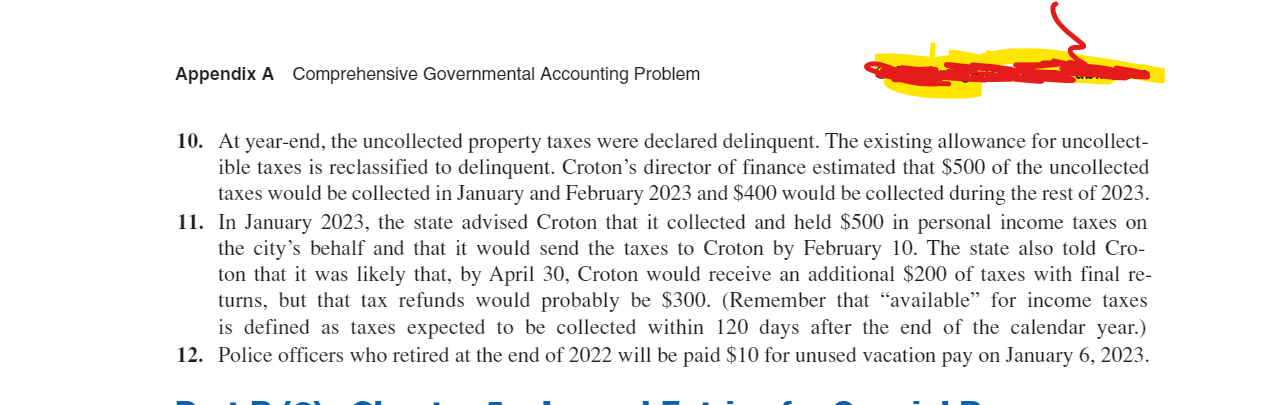

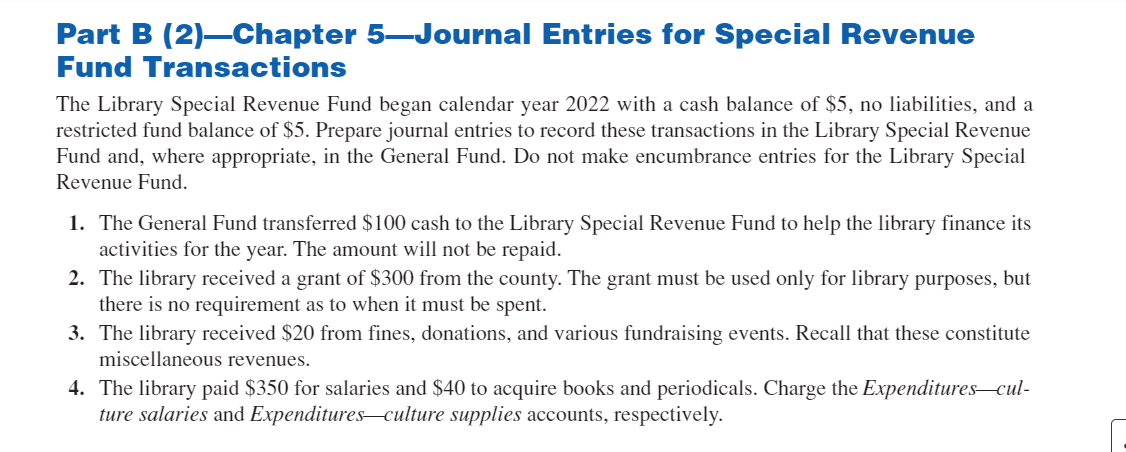

Part A-General Fund Budgetary Journal Entries Prepare journal entries to record the following budgetary transactions applicable to the General Fund. Also, prepare an appropriations ledger for the Public Safety supplies appropriation. 1. The Croton council adopted the following General Fund budget for 2022 : 2. Croton's Public Safety Department placed two purchase orders against its supplies appropriation, one for $300 for firearms and one for $150 for uniforms. 3. The firearms were received, with an invoice for $330. The purchase order allowed shipment of 10 percent over the amount ordered, so the invoice was approved. 4. The invoice for firearms was paid. 5. The Croton Cats won the World Series. To provide more funds for crowd control at the parade, the council increased the Public safety salaries appropriation by $100. Part B (1)-Chapter 5-Journal Entries for General Fund Transactions Prepare journal entries, as appropriate, to record these 2022 General Fund transactions for Croton City. 1. Of the $800 in property taxes receivable at January 1,$780 was collected in cash. The remaining $20 was written off as uncollectible by adjusting the revenues-property taxes account. Deferred inflow of resources-unavailable property taxes at the beginning of the year were recognized as revenue ($300). 2. Accrued salaries from the previous year ($700) were paid. 3. Property taxes in the amount of $9,030 were levied to provide revenues of $9,000, with the remainder considered uncollectible. Tax bills were sent to the property owners. 4. During the year, property taxes of $8,100 were collected in cash. 5. The state collects personal income taxes on behalf of the city. During the year, Croton received personal income taxes of $4,600 from the state. 6. The Parks Department collected $700 in recreation fees during the year. 7. Croton paid salaries of $13,600, charging the salary appropriations as follows: Public safety $6,700 Public works 4,700 Parks 2,200 8. The state sent the city a check for $1,000 as a grant to finance a special public safety program, stipulating that the resources could be used at any time during 2022 or 2023 . The $6,700 in public safety salaries paid in the previous transaction includes $800 of salaries for this program, so $200 remains available for spending on the program in 2023. 9. I Innaid salaries at vear_end (to be paid during the first week of 2023) were as follows: 10. At year-end, the uncollected property taxes were declared delinquent. The existing allowance for uncollectible taxes is reclassified to delinquent. Croton's director of finance estimated that $500 of the uncollected taxes would be collected in January and February 2023 and $400 would be collected during the rest of 2023. 11. In January 2023, the state advised Croton that it collected and held $500 in personal income taxes on the city's behalf and that it would send the taxes to Croton by February 10. The state also told Croton that it was likely that, by April 30 , Croton would receive an additional $200 of taxes with final returns, but that tax refunds would probably be $300. (Remember that "available" for income taxes is defined as taxes expected to be collected within 120 days after the end of the calendar year.) 12. Police officers who retired at the end of 2022 will be paid $10 for unused vacation pay on January 6, 2023 . Part B (2)-Chapter 5-Journal Entries for Special Revenue Fund Transactions The Library Special Revenue Fund began calendar year 2022 with a cash balance of $5, no liabilities, and a restricted fund balance of $5. Prepare journal entries to record these transactions in the Library Special Revenue Fund and, where appropriate, in the General Fund. Do not make encumbrance entries for the Library Special Revenue Fund. 1. The General Fund transferred $100 cash to the Library Special Revenue Fund to help the library finance its activities for the year. The amount will not be repaid. 2. The library received a grant of $300 from the county. The grant must be used only for library purposes, but there is no requirement as to when it must be spent. 3. The library received $20 from fines, donations, and various fundraising events. Recall that these constitute miscellaneous revenues. 4. The library paid $350 for salaries and $40 to acquire books and periodicals. Charge the Expenditures-culture salaries and Expenditures-culture supplies accounts, respectively

I need part b

I need part b