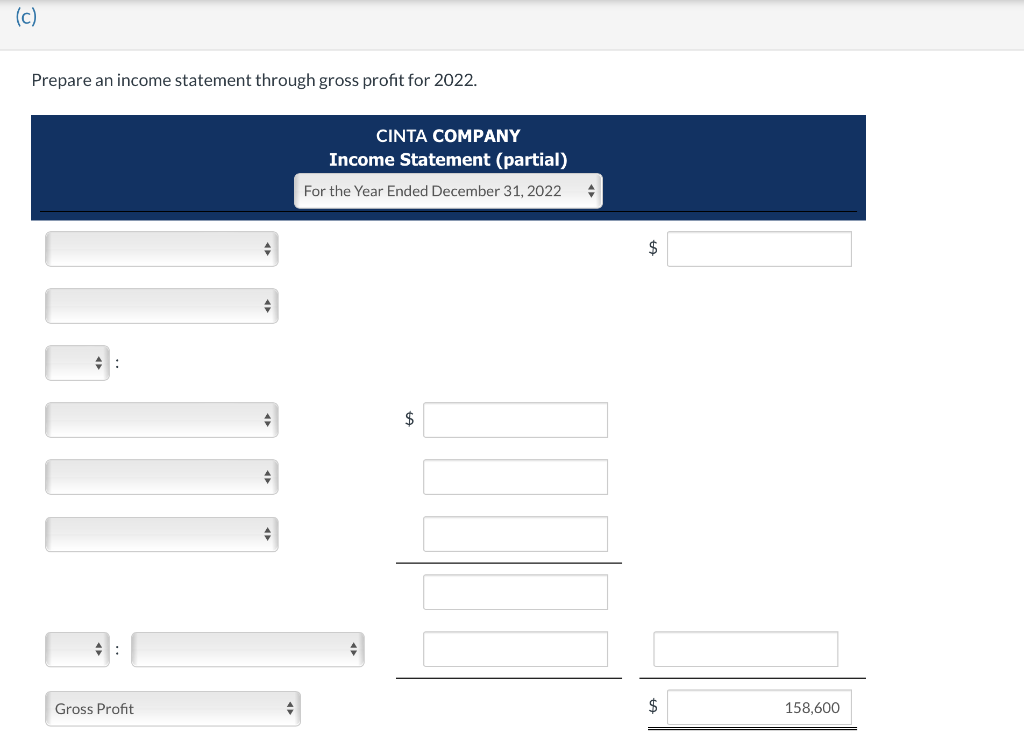

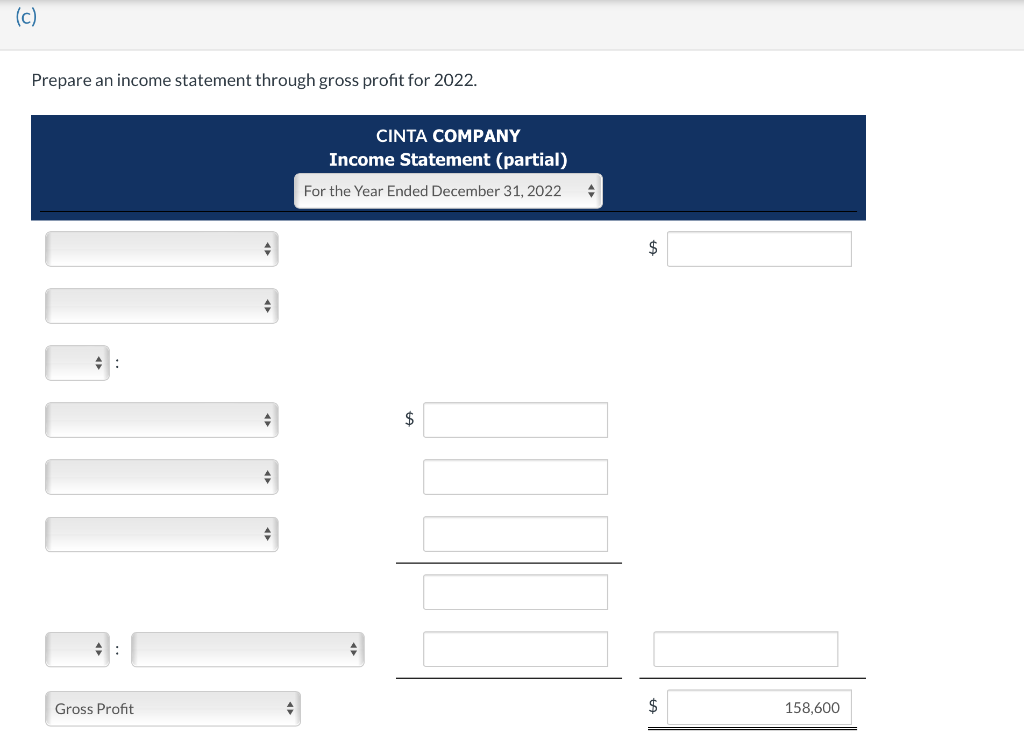

I need part c please. I just know according to my book that the final answer is $158,600.

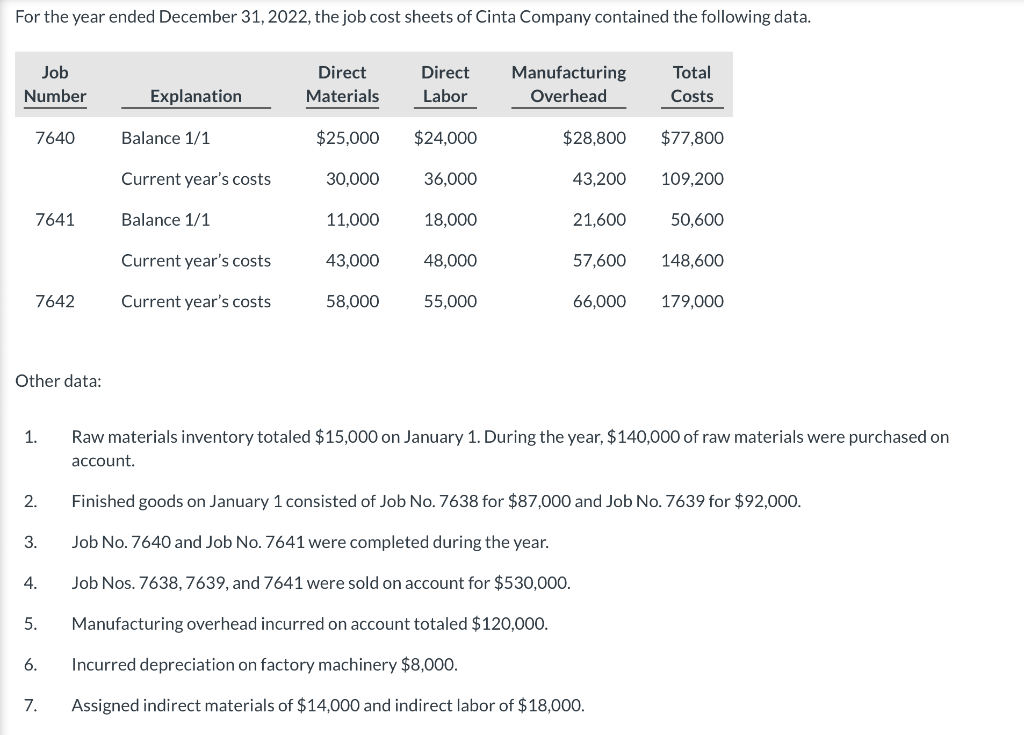

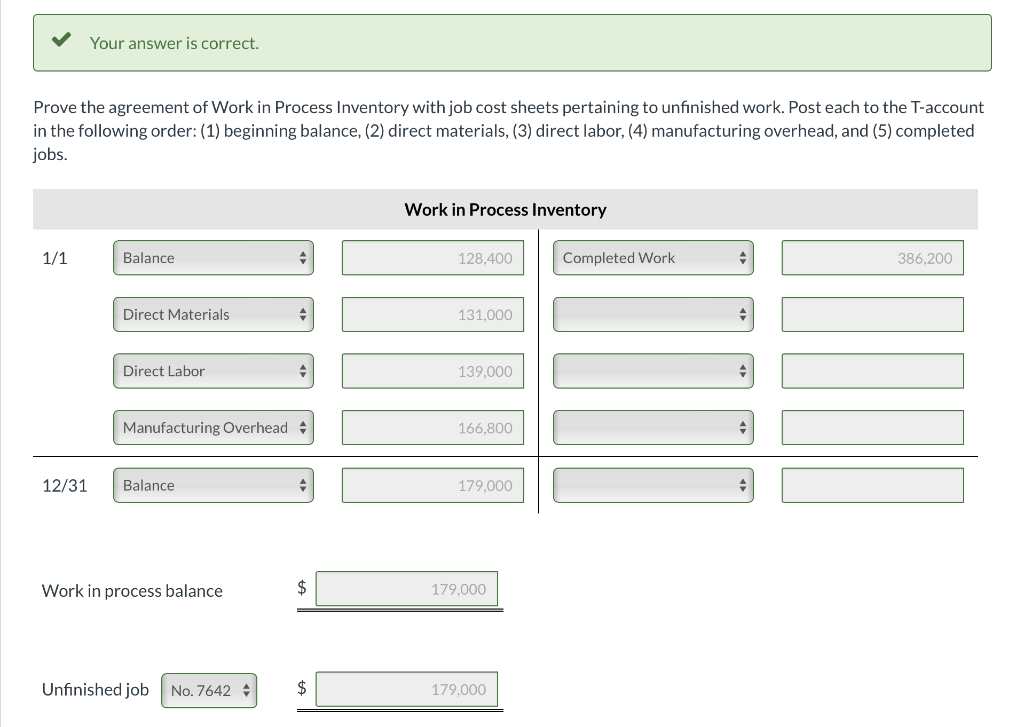

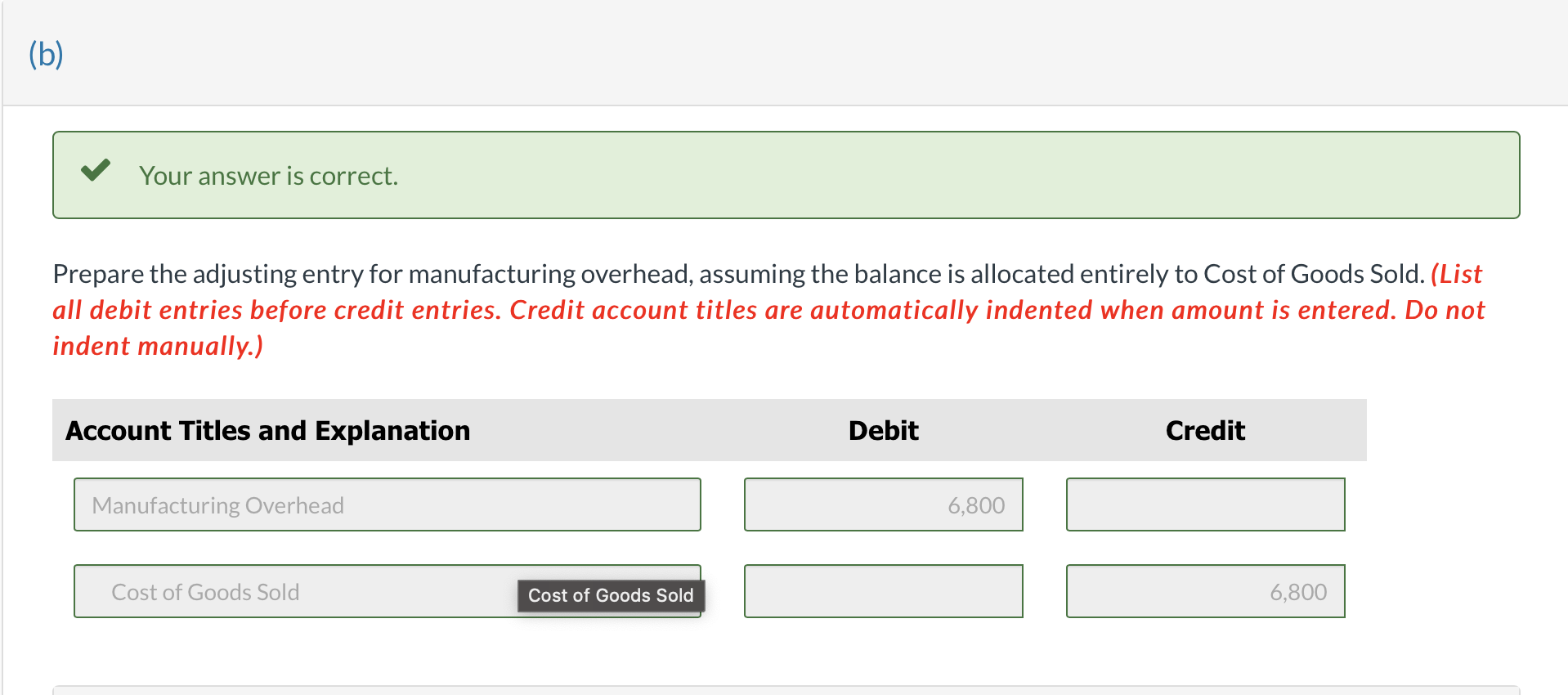

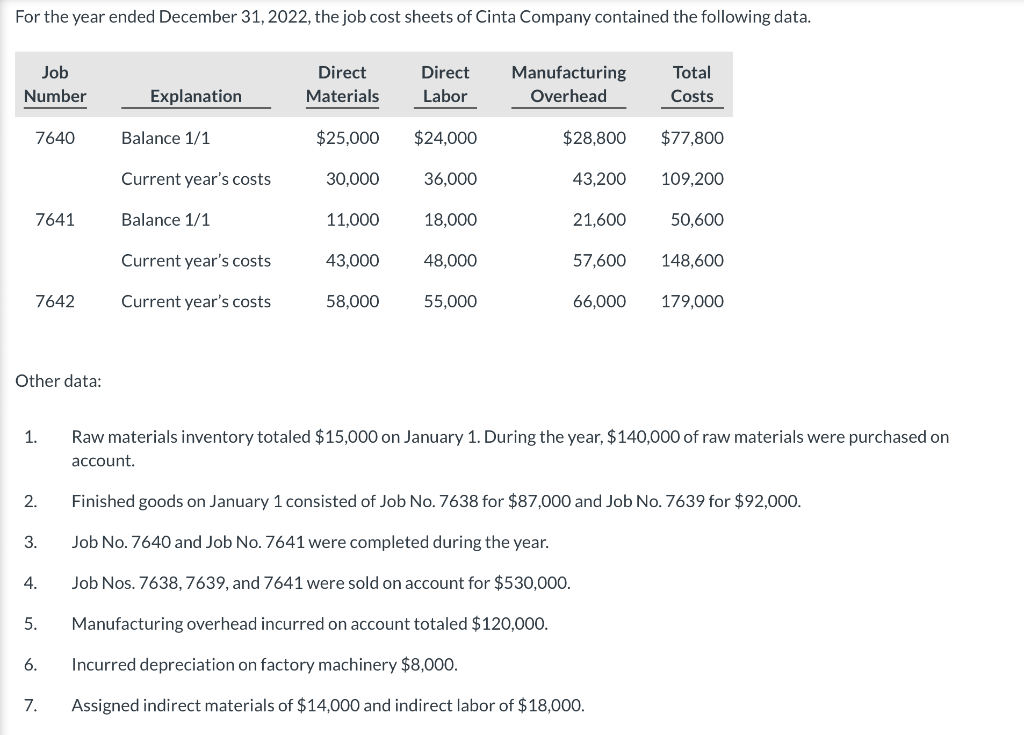

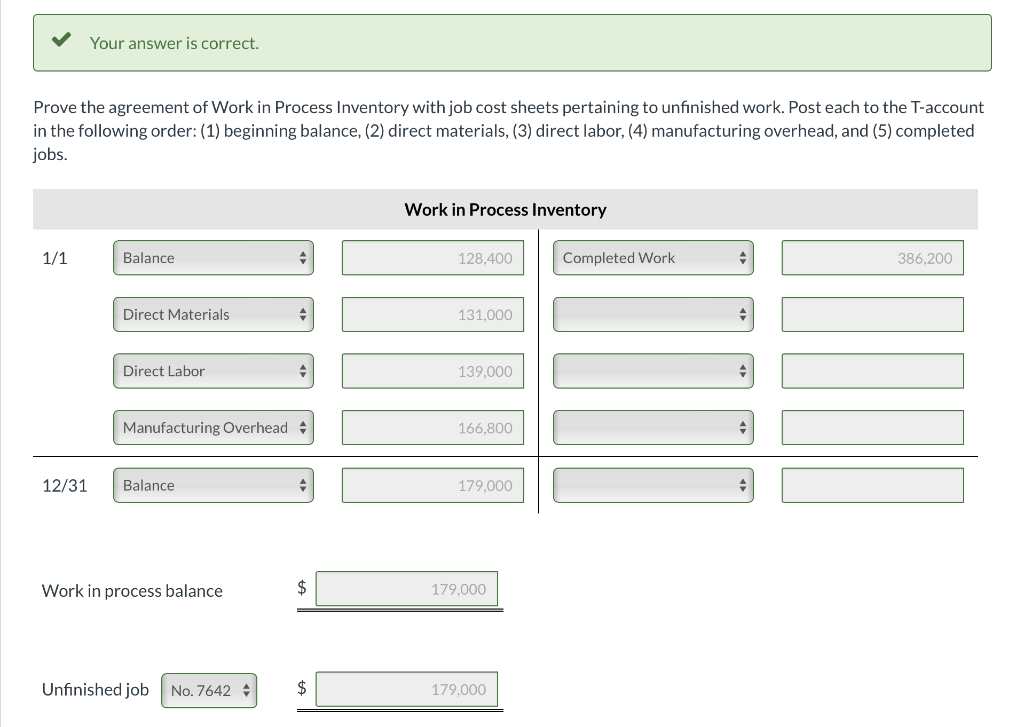

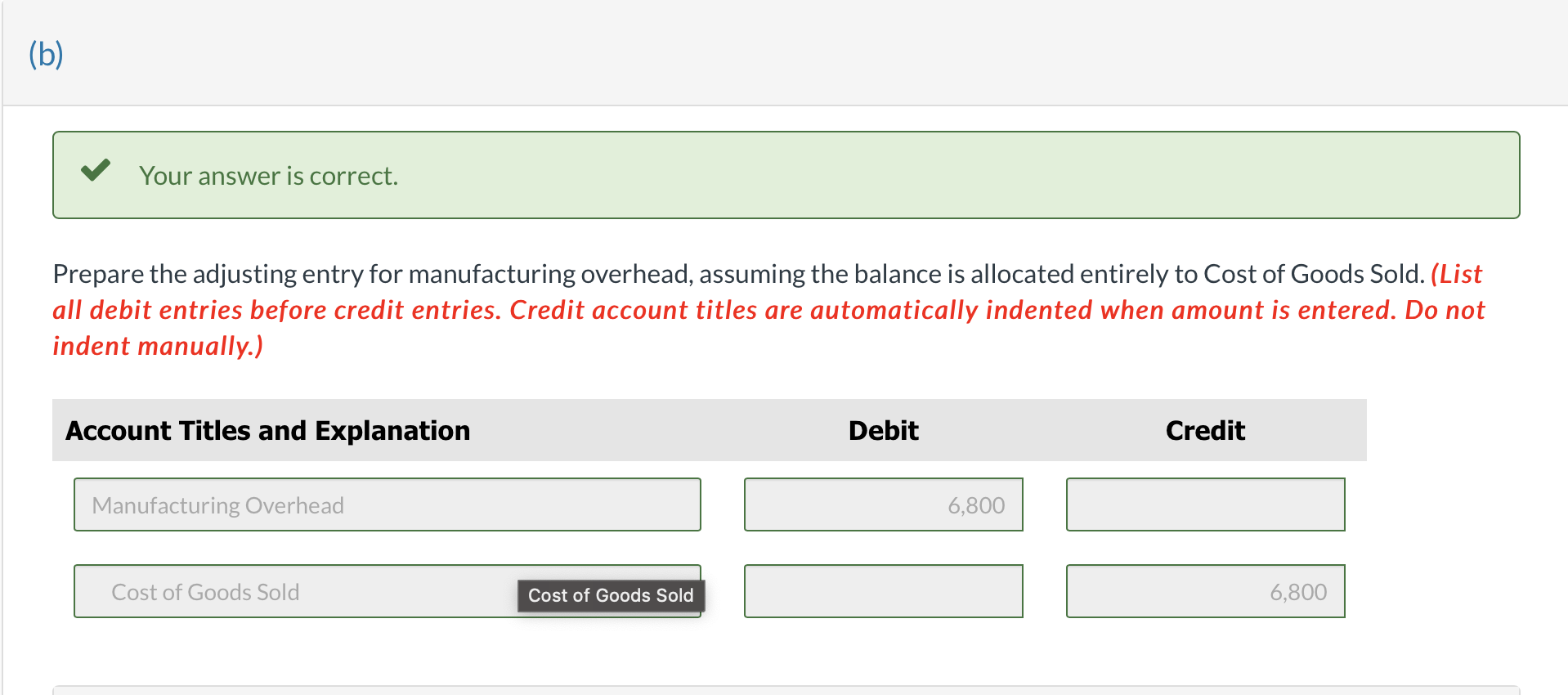

1. Raw materials inventory totaled $15,000 on January 1. During the year, $140,000 of raw materials were purchased on account. 2. Finished goods on January 1 consisted of Job No. 7638 for $87,000 and Job No. 7639 for $92,000. 3. Job No. 7640 and Job No. 7641 were completed during the year. 4. Job Nos. 7638,7639 , and 7641 were sold on account for $530,000. 5. Manufacturing overhead incurred on account totaled $120,000. 6. Incurred depreciation on factory machinery $8,000. 7. Assigned indirect materials of $14,000 and indirect labor of $18,000. Your answer is correct. Prove the agreement of Work in Process Inventory with job cost sheets pertaining to unfinished work. Post each to the T-account in the following order: (1) beginning balance, (2) direct materials, (3) direct labor, (4) manufacturing overhead, and (5) completed jobs. Prepare the adjusting entry for manufacturing overhead, assuming the balance is allocated entirely to Cost of Goods Sold. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Prenare an inrome ctatement through ornce nrofit for 902 ? 1. Raw materials inventory totaled $15,000 on January 1. During the year, $140,000 of raw materials were purchased on account. 2. Finished goods on January 1 consisted of Job No. 7638 for $87,000 and Job No. 7639 for $92,000. 3. Job No. 7640 and Job No. 7641 were completed during the year. 4. Job Nos. 7638,7639 , and 7641 were sold on account for $530,000. 5. Manufacturing overhead incurred on account totaled $120,000. 6. Incurred depreciation on factory machinery $8,000. 7. Assigned indirect materials of $14,000 and indirect labor of $18,000. Your answer is correct. Prove the agreement of Work in Process Inventory with job cost sheets pertaining to unfinished work. Post each to the T-account in the following order: (1) beginning balance, (2) direct materials, (3) direct labor, (4) manufacturing overhead, and (5) completed jobs. Prepare the adjusting entry for manufacturing overhead, assuming the balance is allocated entirely to Cost of Goods Sold. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Prenare an inrome ctatement through ornce nrofit for 902