I need PART E and PART F. PLEASE AND THANK YOU !

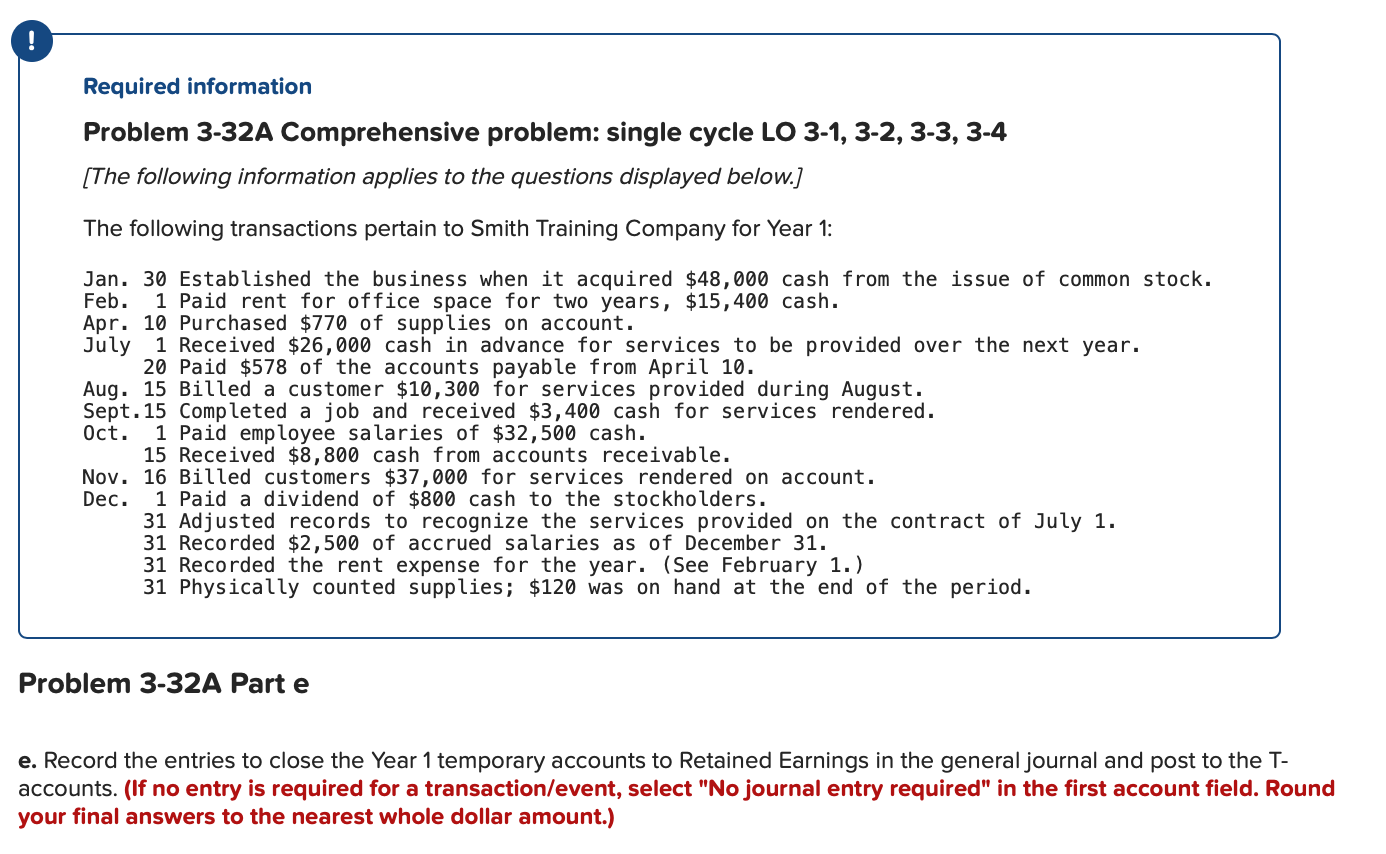

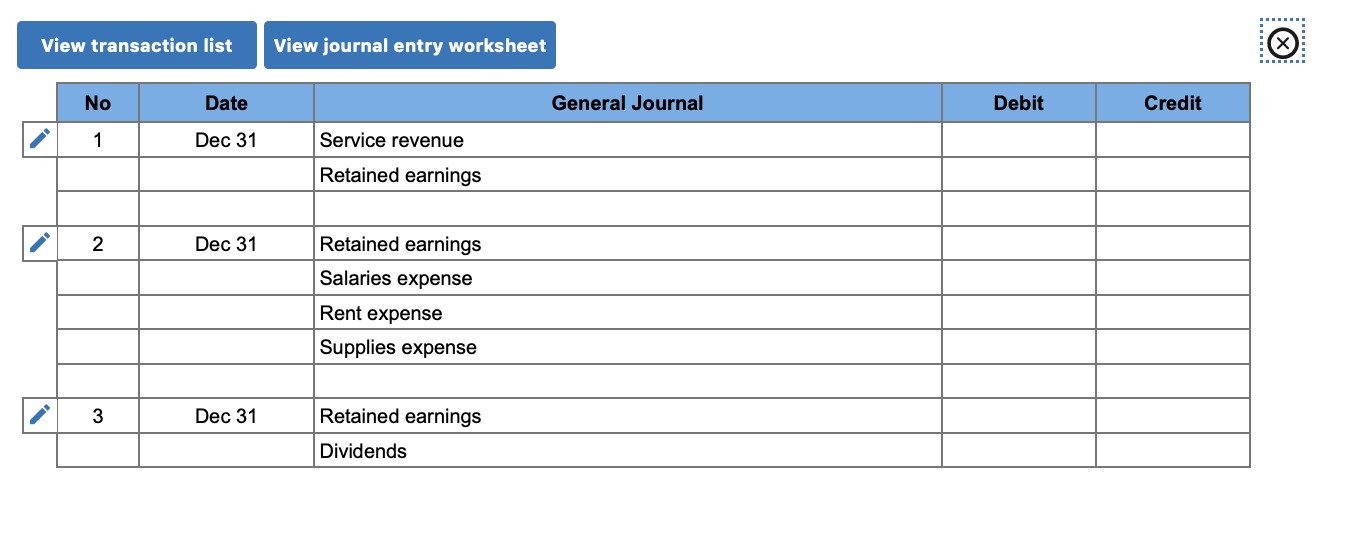

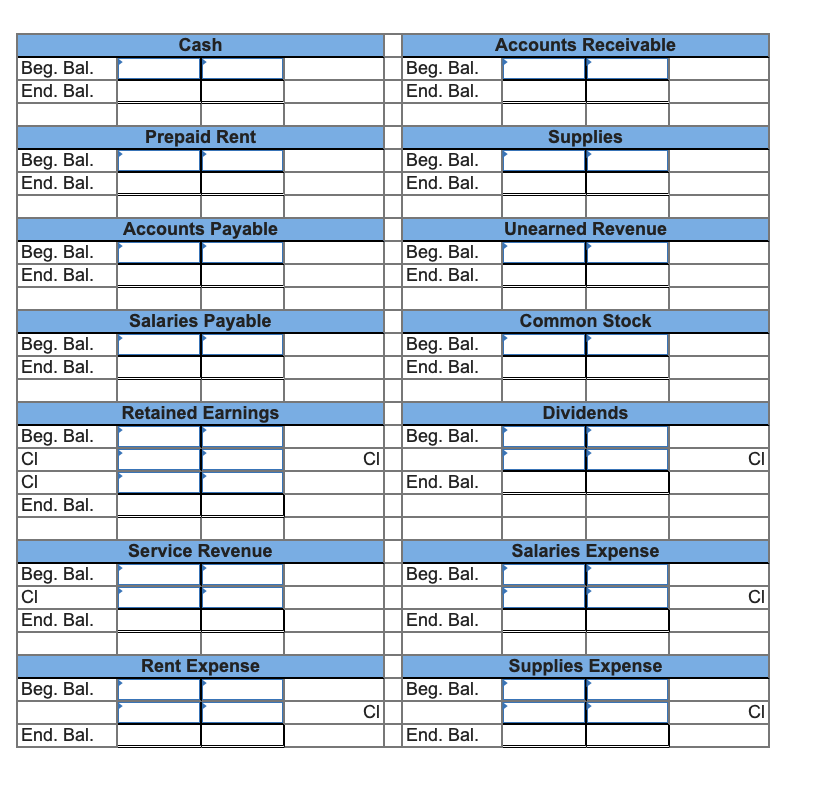

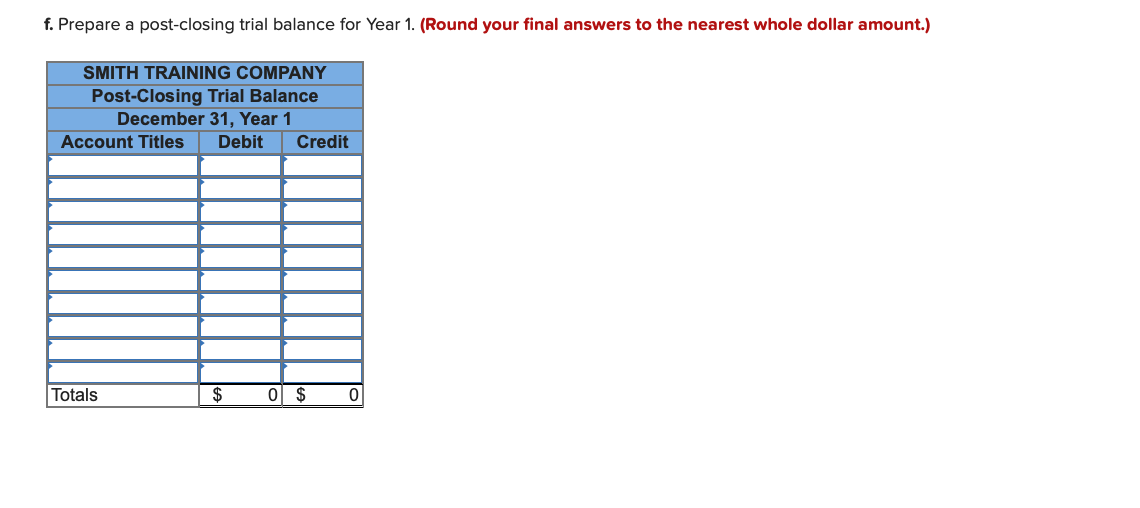

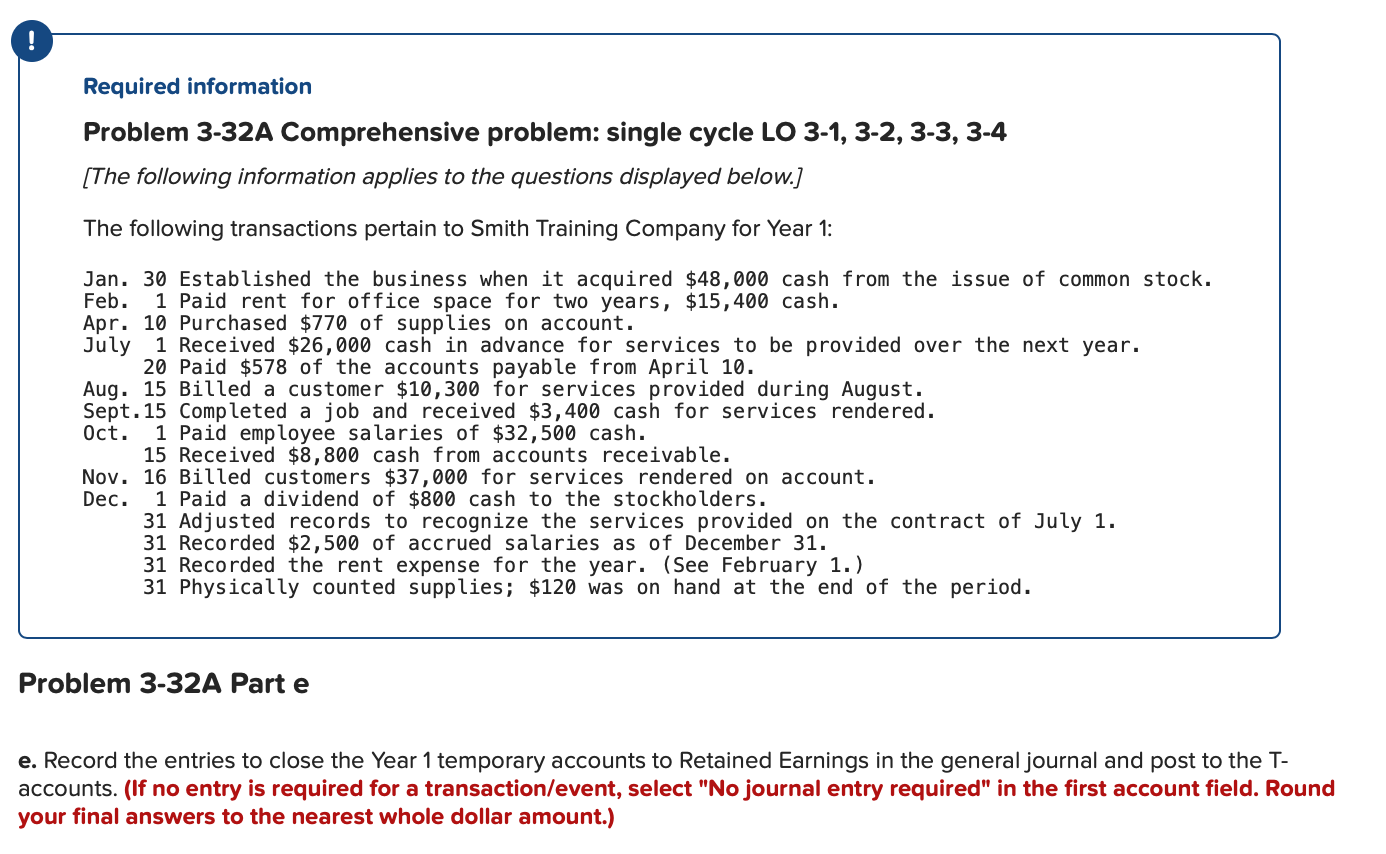

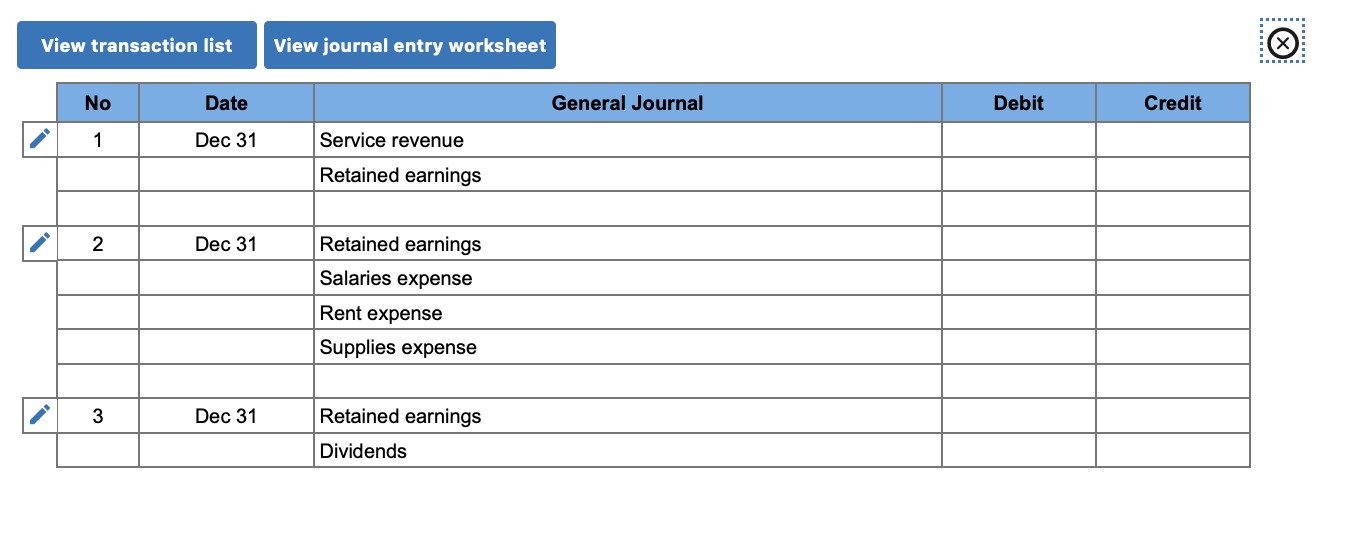

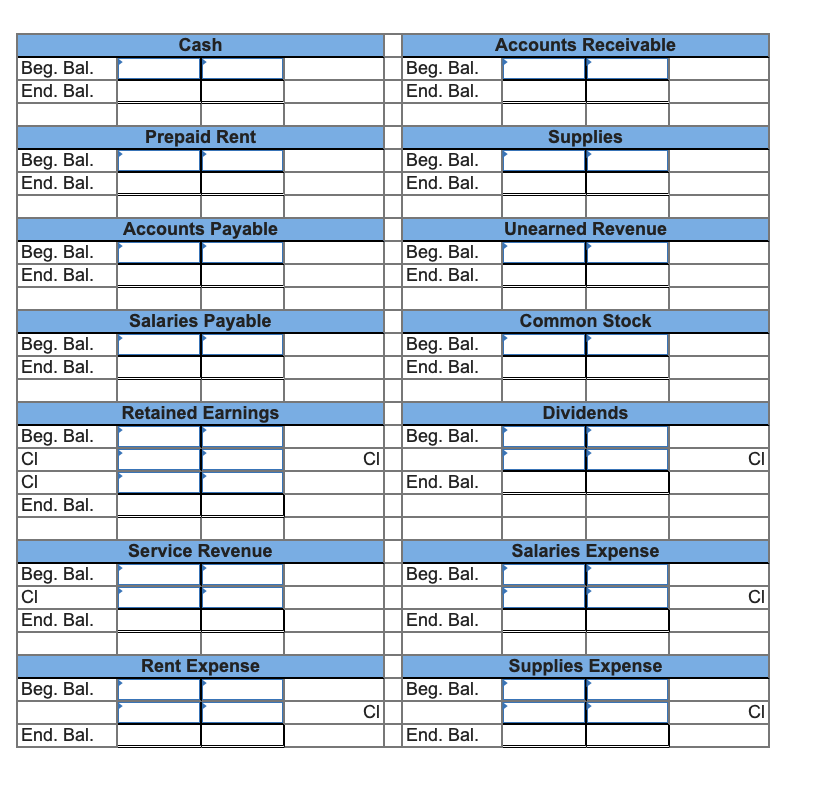

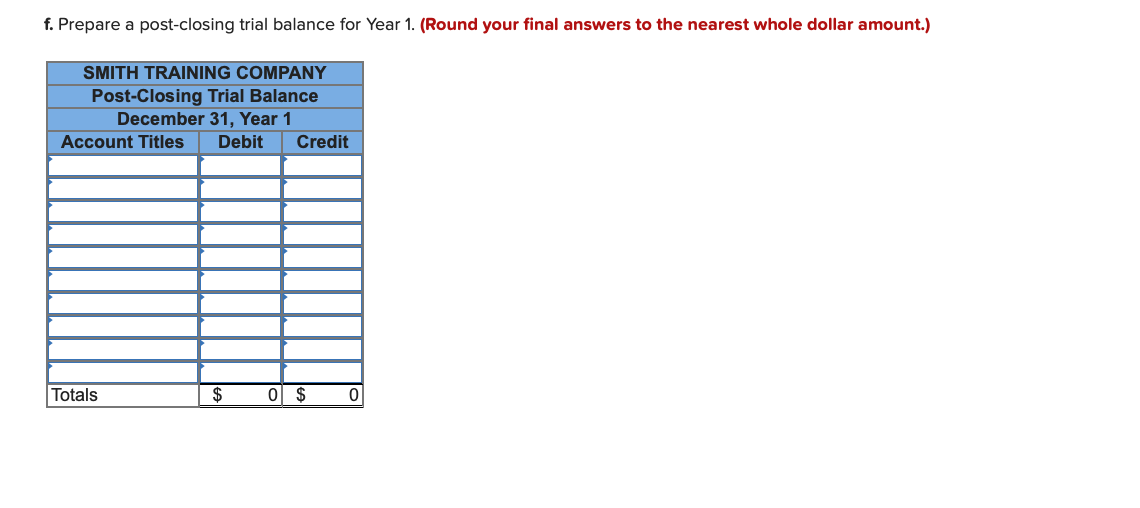

Required information Problem 3-32A Comprehensive problem: single cycle LO 3-1, 3-2, 3-3, 3-4 (The following information applies to the questions displayed below.) The following transactions pertain to Smith Training Company for Year 1: Jan. 30 Established the business when it acquired $48,000 cash from the issue of common stock. Feb. 1 Paid rent for office space for two years, $15,400 cash. Apr. 10 Purchased $770 of supplies on account. July 1 Received $26,000 cash in advance for services to be provided over the next year. 20 Paid $578 of the accounts payable from April 10. Aug. 15 Billed a customer $10,300 for services provided during August. Sept. 15 Completed a job and received $3,400 cash for services rendered. Oct. 1 Paid employee salaries of $32,500 cash. 15 Received $8,800 cash from accounts receivable. Nov. 16 Billed customers $37,000 for services rendered on account. Dec. 1 Paid a dividend of $800 cash to the stockholders. 31 Adjusted records to recognize the services provided on the contract of July 1. 31 Recorded $2,500 of accrued salaries as of December 31. 31 Recorded the rent expense for the year. (See February 1.) 31 Physically counted supplies; $120 was on hand at the end of the period. Problem 3-32A Part e e. Record the entries to close the Year 1 temporary accounts to Retained Earnings in the general journal and post to the T- accounts. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your final answers to the nearest whole dollar amount.) View transaction list View journal entry worksheet No Date General Journal Debit Credit 1 Dec 31 Service revenue Retained earnings 2 Dec 31 Retained earnings Salaries expense Rent expense Supplies expense i 3 Dec 31 Retained earnings Dividends Cash Accounts Receivable Beg. Bal. End. Bal. Beg. Bal. End. Bal. Prepaid Rent Supplies Beg. Bal. End. Bal. Beg. Bal. End. Bal. Accounts Payable Unearned Revenue Beg. Bal. End. Bal. Beg. Bal. End. Bal. Salaries Payable Common Stock Beg. Bal. End. Bal. Beg. Bal. End. Bal. Retained Earnings Dividends Beg. Bal. CI CI Beg. Bal. CI CI End. Bal. End. Bal. Service Revenue Salaries Expense Beg. Bal. Beg. Bal. CI End. Bal. CI End. Bal. Rent Expense Supplies Expense Beg. Bal. Beg. Bal. CI CI End. Bal. End. Bal. f. Prepare a post-closing trial balance for Year 1. (Round your final answers to the nearest whole dollar amount.) SMITH TRAINING COMPANY Post-Closing Trial Balance December 31, Year 1 Account Titles Debit Credit Totals $ 0 $ 0