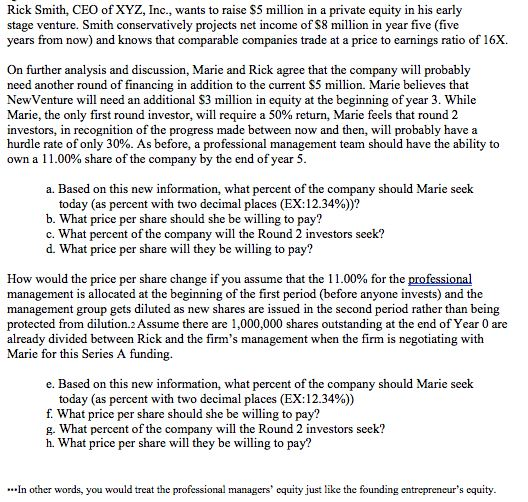

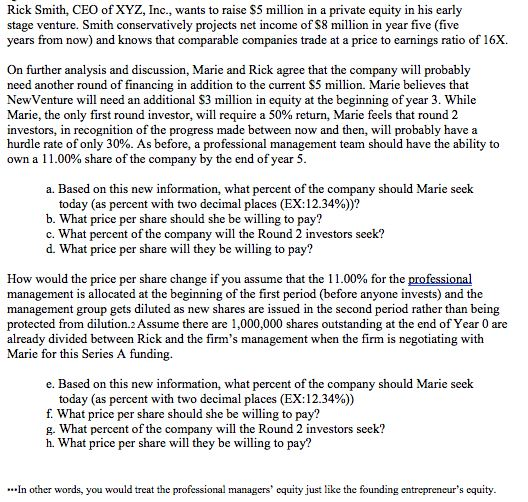

I need part e,f,g,h

Rick Smith, CEO of XYZ, Inc., wants to raise S5 million in a private equity in his early stage venture. Smith conservatively projects net income of S8 million in year five (five years from now) and knows that comparable companies trade at a price to earnings ratio of 16 On further analysis and discussion, Marie and Rick agree that the company will probably need another round of financing in addition to the current S5 million. Marie believes that NewVenture will need an additional S3 million in equity at the beginning of year 3. While Marie, the only first round investor, will require a 50% return, Marie feels that round 2 investors, in recognition of the progress made between now and then, will probably have a hurdle rate of only 30%. As before, a professional management team should have the ability to own a 11.00% share of the company by the end ofyear 5 a. Based on this new information, what percent of the company should Marie seek today (as percent with two decimal places (EX: 12.34%))? b. What price per share should she be willing to pay? c. What percent of the company will the Round 2 investors seek? d. What price per share will they be willing to pay? How would the price per share change if you assume that the 11.00% for the professional management is allocated at the beginning of the first period (before anyone invests) and the management group gets diluted as new shares are issued in the second period rather than being protected from dilution.2 Assume there are 1,000,000 shares outstanding at the end of Year 0 are already divided between Rick and the firm's management when the firm is negotiating with Marie for this Series A funding e. Based on this new information, what percent of the company should Marie seek today (as percent with two decimal places (EX: 12.34%)) f. What price per share should she be willing to pay? g. What percent of the company will the Round 2 investors seek? h. What price per share will they be willing to pay? -In other words, you would treat the professional managers' equity just like the founding entrepreneur's equity