Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need q10 but q9 information is required Question 10: Black-Scholes Model Fisher Black and Myron Scholes receives the 1997 Nobel Prize in Economic Science

I need q10 but q9 information is required

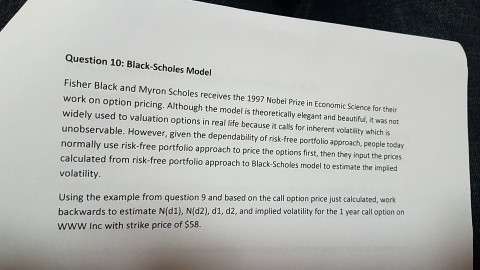

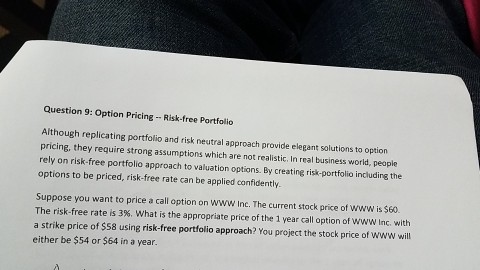

Question 10: Black-Scholes Model Fisher Black and Myron Scholes receives the 1997 Nobel Prize in Economic Science for work on option pricing. Although the modelis theoretically their widely used to valuation options in elegant and beautiful, it was not unobservable. However, given the real tie because itcals for volatity which is dependability of risk-free portfolio approach people today normally use risk-free portfolio approach to price the options first, then they input the prices calculated from risk-free portfolio approach to Black-Scholes model to estimate the implied volatility Using the example from question 9 and based on the call option price just calculated, work backwards to estimate NId1), Nd2), d1, d2, and implied wola y for the 1 year call option on WWW Inc with strike price of $58Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started