Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need Q18 answers in 50 mins i will give you thumb up Olivier Blanchard, the French economist and the previous chief economist at the

i need Q18 answers in 50 mins i will give you thumb up

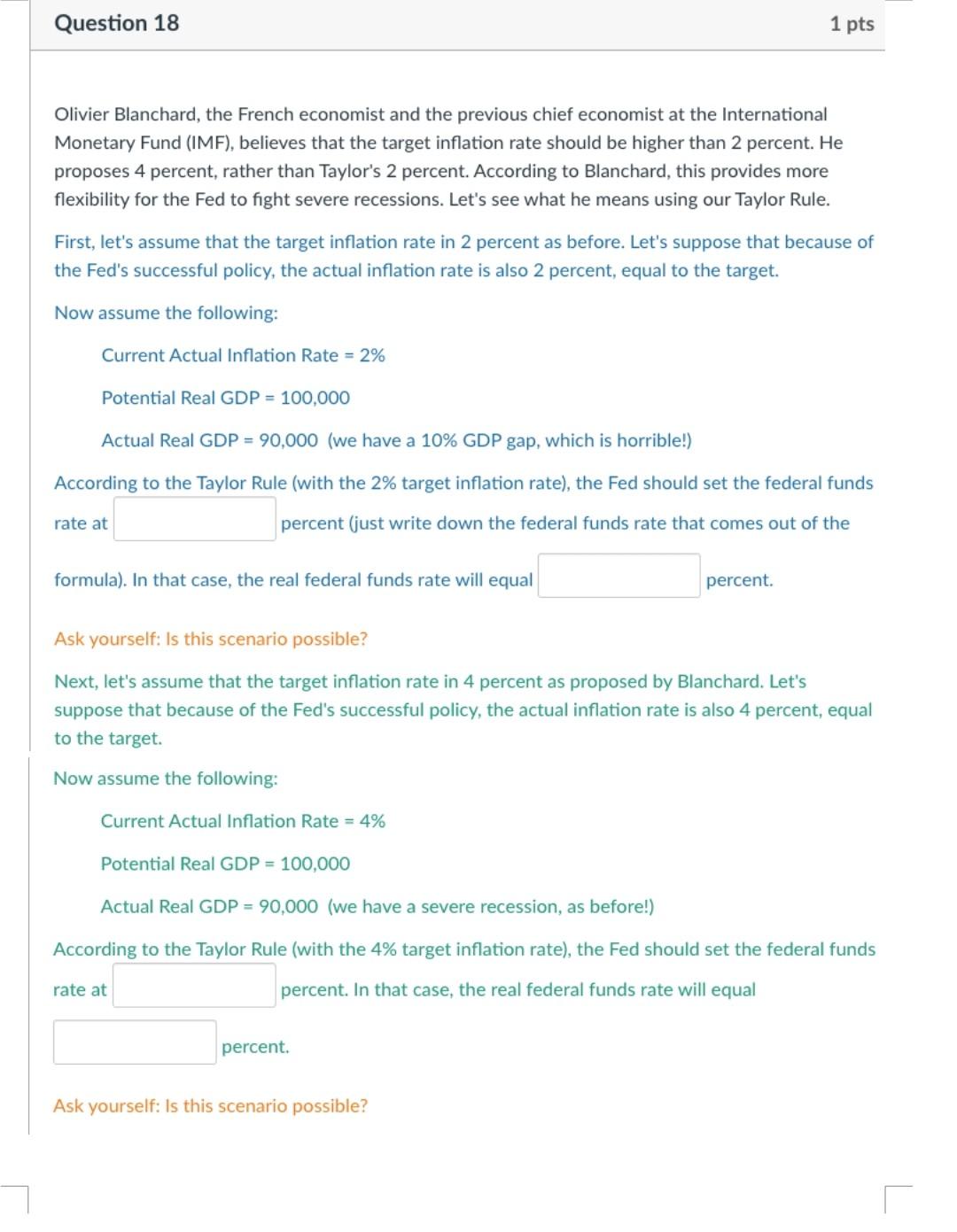

Olivier Blanchard, the French economist and the previous chief economist at the International Monetary Fund (IMF), believes that the target inflation rate should be higher than 2 percent. He proposes 4 percent, rather than Taylor's 2 percent. According to Blanchard, this provides more flexibility for the Fed to fight severe recessions. Let's see what he means using our Taylor Rule. First, let's assume that the target inflation rate in 2 percent as before. Let's suppose that because of the Fed's successful policy, the actual inflation rate is also 2 percent, equal to the target. Now assume the following: Current Actual Inflation Rate =2% Potential Real GDP = 100,000 Actual Real GDP =90,000 (we have a 10\% GDP gap, which is horrible!) According to the Taylor Rule (with the 2% target inflation rate), the Fed should set the federal funds rate at percent (just write down the federal funds rate that comes out of the formula). In that case, the real federal funds rate will equal percent. Ask yourself: Is this scenario possible? Next, let's assume that the target inflation rate in 4 percent as proposed by Blanchard. Let's suppose that because of the Fed's successful policy, the actual inflation rate is also 4 percent, equal to the target. Now assume the following: Current Actual Inflation Rate =4% Potential Real GDP =100,000 Actual Real GDP =90,000 (we have a severe recession, as before!) According to the Taylor Rule (with the 4% target inflation rate), the Fed should set the federal funds rate at percent. In that case, the real federal funds rate will equal percent. Ask yourself: Is this scenario possible? Olivier Blanchard, the French economist and the previous chief economist at the International Monetary Fund (IMF), believes that the target inflation rate should be higher than 2 percent. He proposes 4 percent, rather than Taylor's 2 percent. According to Blanchard, this provides more flexibility for the Fed to fight severe recessions. Let's see what he means using our Taylor Rule. First, let's assume that the target inflation rate in 2 percent as before. Let's suppose that because of the Fed's successful policy, the actual inflation rate is also 2 percent, equal to the target. Now assume the following: Current Actual Inflation Rate =2% Potential Real GDP = 100,000 Actual Real GDP =90,000 (we have a 10\% GDP gap, which is horrible!) According to the Taylor Rule (with the 2% target inflation rate), the Fed should set the federal funds rate at percent (just write down the federal funds rate that comes out of the formula). In that case, the real federal funds rate will equal percent. Ask yourself: Is this scenario possible? Next, let's assume that the target inflation rate in 4 percent as proposed by Blanchard. Let's suppose that because of the Fed's successful policy, the actual inflation rate is also 4 percent, equal to the target. Now assume the following: Current Actual Inflation Rate =4% Potential Real GDP =100,000 Actual Real GDP =90,000 (we have a severe recession, as before!) According to the Taylor Rule (with the 4% target inflation rate), the Fed should set the federal funds rate at percent. In that case, the real federal funds rate will equal percent. Ask yourself: Is this scenario possibleStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started