Answered step by step

Verified Expert Solution

Question

1 Approved Answer

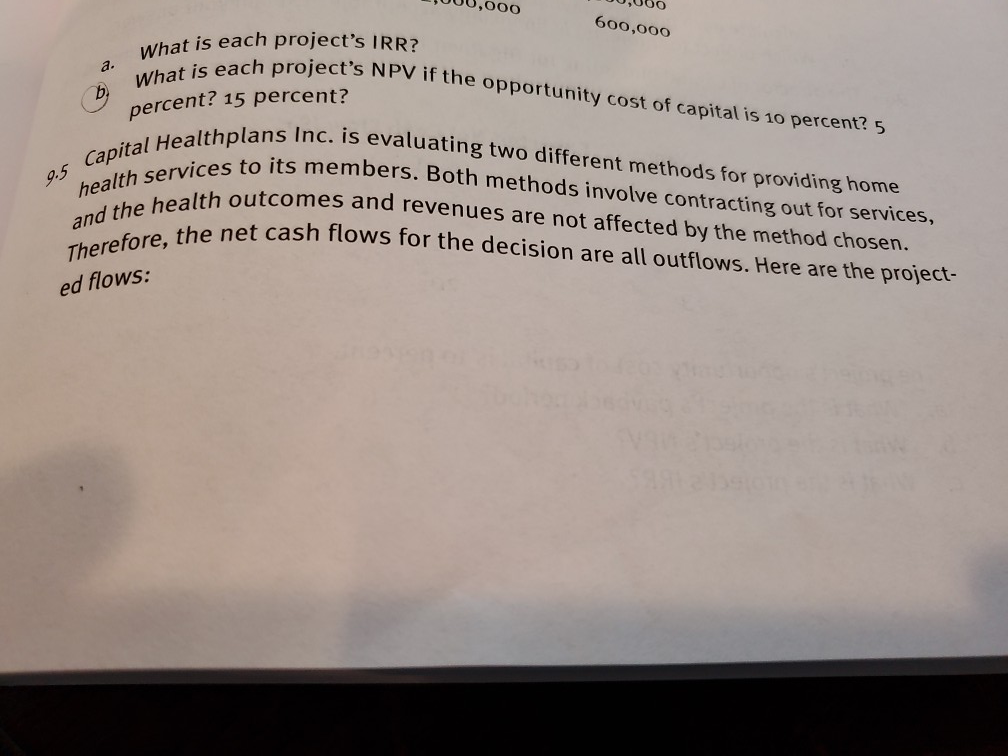

question 9.5 b. What is each project's IRR? What is each project's NPV if the opportunity cost of capital is 10 percent? 5 Capital Healthplans

question 9.5 b.

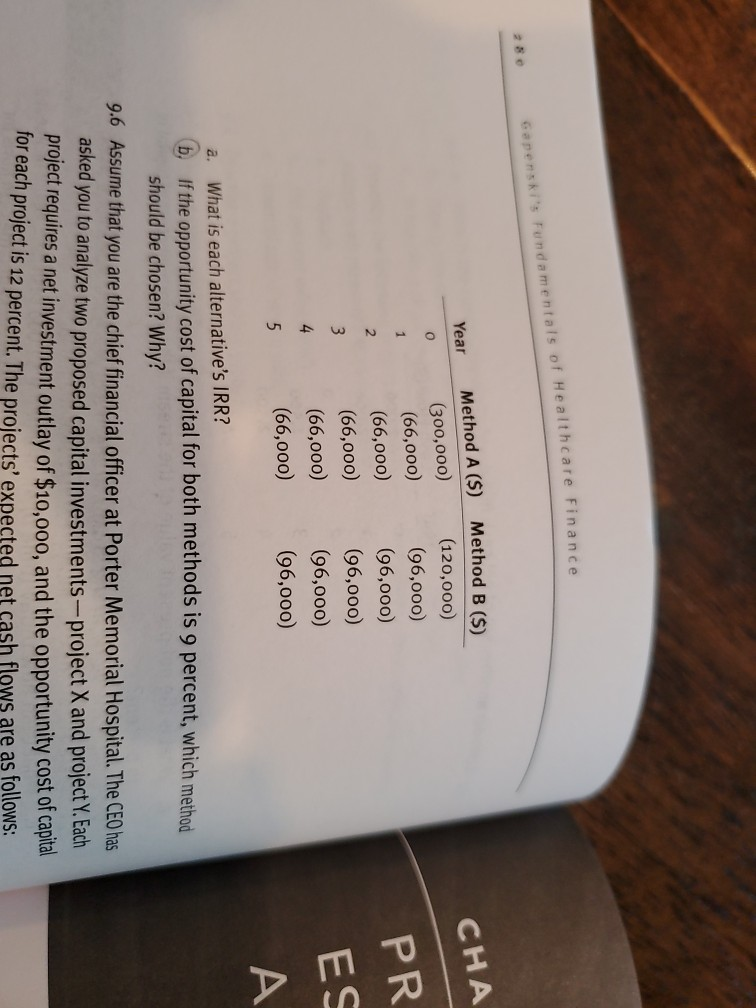

What is each project's IRR? What is each project's NPV if the opportunity cost of capital is 10 percent? 5 Capital Healthplans Inc. is evaluating two different methods for providing home health services to its members. Both methods involve contracting out for services, and the health outcomes and revenues are not affected by the method chosen. Therefore, the net cash flows for the decision are all outflows. Here are the project- 600,000 a b percent? 15 percent? 9.5 ed flows: Gapenski's Fundamentals of Healthcare Finance Year CHA o 1 Method B ($) (120,000) (96,000) (96,000) (96,000) (96,000) (96,000) Method A ($) (300,000) (66,000) (66,000) (66,000) (66,000) (66,000) 2 PR ES 3 4 5 A a. What is each alternative's IRR? If the opportunity cost of capital for both methods is 9 percent, which method should be chosen? Why? 9.6 Assume that you are the chief financial officer at Porter Memorial Hospital. The CEO has asked you to analyze two proposed capital investments-project X and project Y. Each project requires a net investment outlay of $10,000, and the opportunity cost of capital for each project is 12 percent. The projects' expected net cash flows are as followsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started