i need question 7 & 8 please

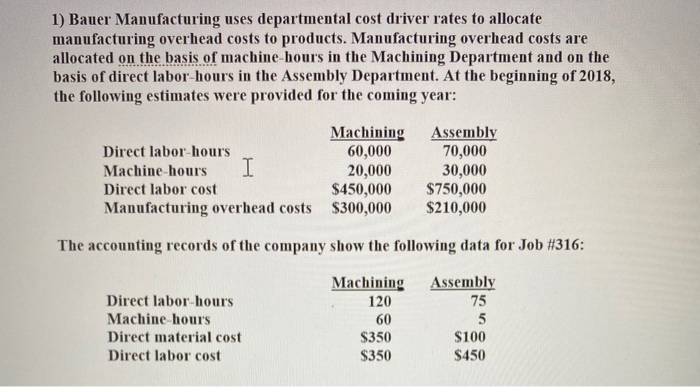

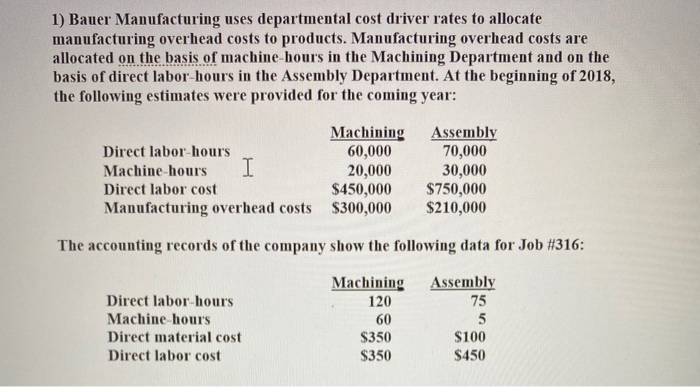

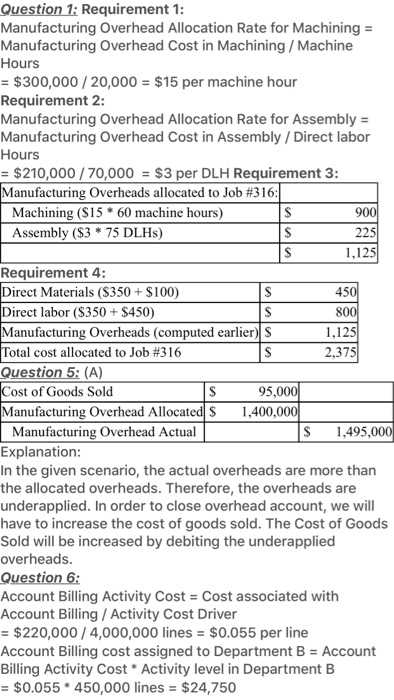

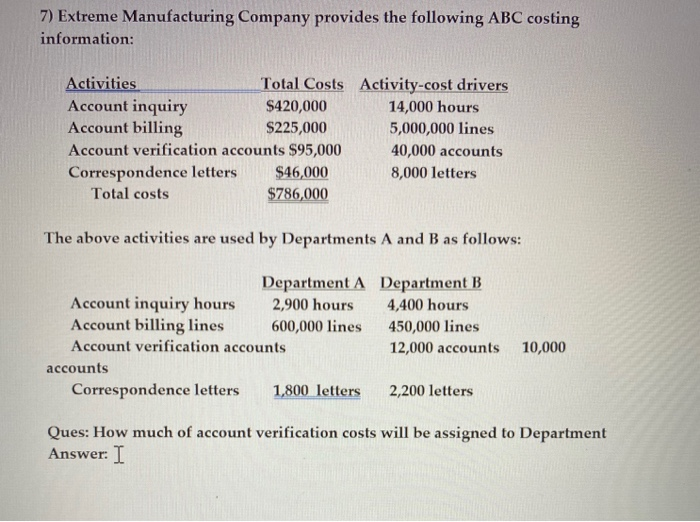

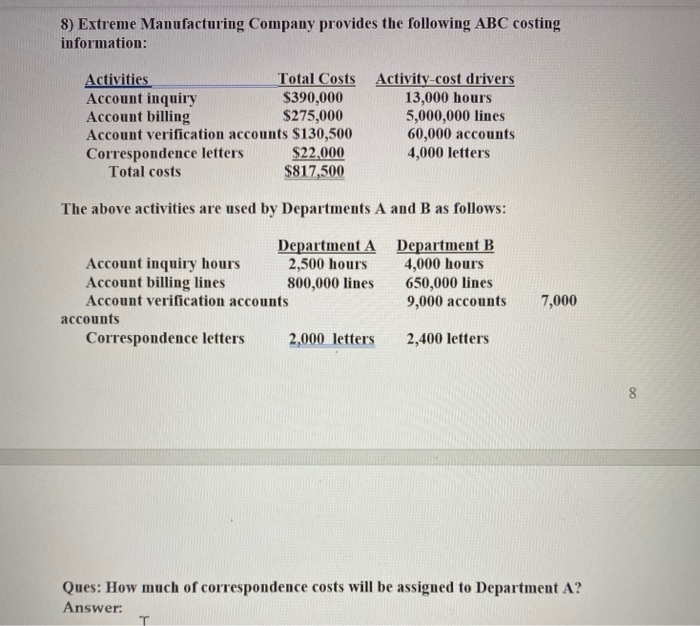

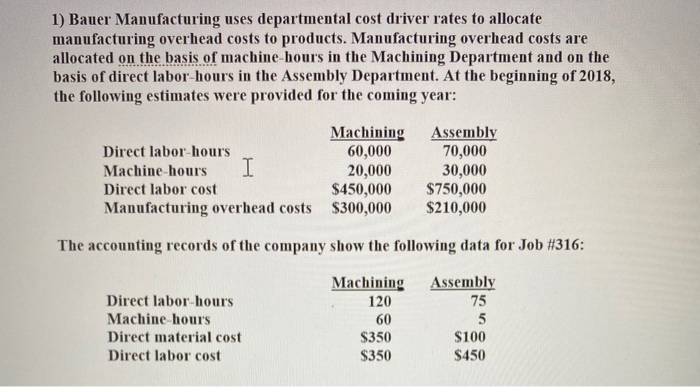

1) Bauer Manufacturing uses departmental cost driver rates to allocate manufacturing overhead costs to products. Manufacturing overhead costs are allocated on the basis of machine-hours in the Machining Department and on the basis of direct labor-hours in the Assembly Department. At the beginning of 2018, the following estimates were provided for the coming year: Direct labor-hours Machine-hours I Direct labor cost Manufacturing overhead costs Machining 60,000 20,000 $450,000 $300,000 Assembly 70,000 30,000 $750,000 $210,000 The accounting records of the company show the following data for Job #316: Direct labor-hours Machine hours Direct material cost Direct labor cost Machining 120 60 $350 $350 Assembly 75 5 $100 $450 S S 800 Question 1: Requirement 1: Manufacturing Overhead Allocation Rate for Machining = Manufacturing Overhead Cost in Machining / Machine Hours = $300,000 / 20,000 = $15 per machine hour Requirement 2: Manufacturing Overhead Allocation Rate for Assembly = Manufacturing Overhead Cost in Assembly / Direct labor Hours = $210,000 / 70,000 = $3 per DLH Requirement 3: Manufacturing Overheads allocated to Job #316: Machining ($15 * 60 machine hours) S 900 Assembly ($3 * 75 DLHS) S 225 1,125 Requirement 4: Direct Materials ($350 + $ 100) S 450 Direct labor ($350+ $450) Manufacturing Overheads (computed earlier) 1,125 Total cost allocated to Job #316 S 2,375 Question 5: (A) Cost of Goods Sold S 95,000 Manufacturing Overhead Allocated $ 1,400,000 Manufacturing Overhead Actual $ 1,495,000 Explanation: In the given scenario, the actual overheads are more than the allocated overheads. Therefore, the overheads are underapplied. In order to close overhead account, we will have to increase the cost of goods sold. The Cost of Goods Sold will be increased by debiting the underapplied overheads. Question 6: Account Billing Activity Cost = Cost associated with Account Billing / Activity Cost Driver = $ 220,000 / 4,000,000 lines = $0.055 per line Account Billing cost assigned to Department B = Account Billing Activity Cost * Activity level in Department B = $0.055* 450,000 lines = $24,750 7) Extreme Manufacturing Company provides the following ABC costing information: Activities Total Costs Activity-cost drivers Account inquiry $420,000 14,000 hours Account billing $225,000 5,000,000 lines Account verification accounts $95,000 40,000 accounts Correspondence letters $46,000 8,000 letters Total costs $786,000 The above activities are used by Departments A and B as follows: Department A Department B Account inquiry hours 2,900 hours 4,400 hours Account billing lines 600,000 lines 450,000 lines Account verification accounts 12,000 accounts accounts Correspondence letters 1,800 letters 2,200 letters 10,000 Ques: How much of account verification costs will be assigned to Department Answer: I 8) Extreme Manufacturing Company provides the following ABC costing information: Activities Total Costs Activity-cost drivers Account inquiry $390,000 13,000 hours Account billing $275,000 5,000,000 lines Account verification accounts $130,500 60,000 accounts Correspondence letters $22,000 4,000 letters Total costs $817,500 The above activities are used by Departments A and B as follows: Department A Account inquiry hours 2,500 hours Account billing lines 800,000 lines Account verification accounts accounts Correspondence letters 2,000 letters Department B 4,000 hours 650,000 lines 9,000 accounts 7,000 2,400 letters 8 Ques: How much of correspondence costs will be assigned to Department A? Answer: T