I need question d) and question e) to explain my results

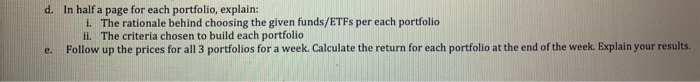

d. In half a page for each portfolio, explain: 1. The rationale behind choosing the given funds/ETFs per each portfolio 11. The criteria chosen to build each portfolio e. Follow up the prices for all 3 portfolios for a week. Calculate the return for each portfolio at the end of the week. Explain your results. 5 MF/ETF Xon total Per MF/ETF Total Amount invested of Shares NAV per share portfolio invested Amount Value 1 week prior Growth ending amount Total ending amount Total Gains Per Portfolio 550.000 5543882843 4 388 550.000 4113.24786 154000 37.44 0.41 155686.4316 4432.93034 34 92 154000 34.74 0.18 154797.9275 1347.62634 66.43 16 38000 65.3 1.138952281776 2931.59609 3377 0.13 938110749 5844 34591 941 10% 55000 55000 0 American funds American Mutual F1 1 Shares Core conservative allocation ETE 2 SPOR Russell 1000 Low Volatility focus LTE 3 Fidelity low volatility factor ETE 4 American Beacon Alpha Quant Dynvestor 28 20% 22% 6 Vanguard Mega Cap 300 index LTE 17 Shares MSCIARE Index Fund 18 Eldelity MSCI Health Care ETE - Shares Core S&P 500 ETE O AB Emerging Markets Multi-Asset Advisor 1112.43705 2227.95065 1381 3311 549.960717 8616 18799 12% 55.215 48.96 23.9 11 56 121000 66000 154000 99000 8382 54.31 47.78 280.02 11.49 1.218 0.905 118 3.88 0.07 111154. 83 123016.2953 67629.9707 1561338475 9060113316 28 1 173.09 DON 2 Vanguard Growth ETE Monksvestment Trust 4 Pola Capital Tech Trust 5 Global Cannabis LTE 16 Eranklin Disruptive Commerce ETE 8.776 24.07 0.604 1.145 25.215 d. In half a page for each portfolio, explain: 1. The rationale behind choosing the given funds/ETFs per each portfolio 11. The criteria chosen to build each portfolio e. Follow up the prices for all 3 portfolios for a week. Calculate the return for each portfolio at the end of the week. Explain your results. 5 MF/ETF Xon total Per MF/ETF Total Amount invested of Shares NAV per share portfolio invested Amount Value 1 week prior Growth ending amount Total ending amount Total Gains Per Portfolio 550.000 5543882843 4 388 550.000 4113.24786 154000 37.44 0.41 155686.4316 4432.93034 34 92 154000 34.74 0.18 154797.9275 1347.62634 66.43 16 38000 65.3 1.138952281776 2931.59609 3377 0.13 938110749 5844 34591 941 10% 55000 55000 0 American funds American Mutual F1 1 Shares Core conservative allocation ETE 2 SPOR Russell 1000 Low Volatility focus LTE 3 Fidelity low volatility factor ETE 4 American Beacon Alpha Quant Dynvestor 28 20% 22% 6 Vanguard Mega Cap 300 index LTE 17 Shares MSCIARE Index Fund 18 Eldelity MSCI Health Care ETE - Shares Core S&P 500 ETE O AB Emerging Markets Multi-Asset Advisor 1112.43705 2227.95065 1381 3311 549.960717 8616 18799 12% 55.215 48.96 23.9 11 56 121000 66000 154000 99000 8382 54.31 47.78 280.02 11.49 1.218 0.905 118 3.88 0.07 111154. 83 123016.2953 67629.9707 1561338475 9060113316 28 1 173.09 DON 2 Vanguard Growth ETE Monksvestment Trust 4 Pola Capital Tech Trust 5 Global Cannabis LTE 16 Eranklin Disruptive Commerce ETE 8.776 24.07 0.604 1.145 25.215