Answered step by step

Verified Expert Solution

Question

1 Approved Answer

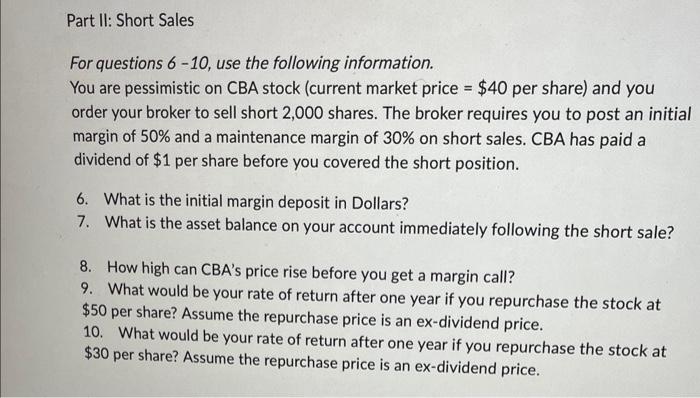

I need questions 1-6, please sorry, I need 6-10 For questions 610, use the following information. You are pessimistic on CBA stock (current market price

I need questions 1-6, please

sorry, I need 6-10

For questions 610, use the following information. You are pessimistic on CBA stock (current market price =$40 per share) and you order your broker to sell short 2,000 shares. The broker requires you to post an initial margin of 50% and a maintenance margin of 30% on short sales. CBA has paid a dividend of $1 per share before you covered the short position. 6. What is the initial margin deposit in Dollars? 7. What is the asset balance on your account immediately following the short sale? 8. How high can CBA's price rise before you get a margin call? 9. What would be your rate of return after one year if you repurchase the stock at $50 per share? Assume the repurchase price is an ex-dividend price. 10. What would be your rate of return after one year if you repurchase the stock at $30 per share? Assume the repurchase price is an ex-dividend price Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started