Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need requirement 15 please! with calculations pen recovered workbooks? Your recent changes were saved. Do you want to continue working where you left off?

I need requirement 15 please! with calculations

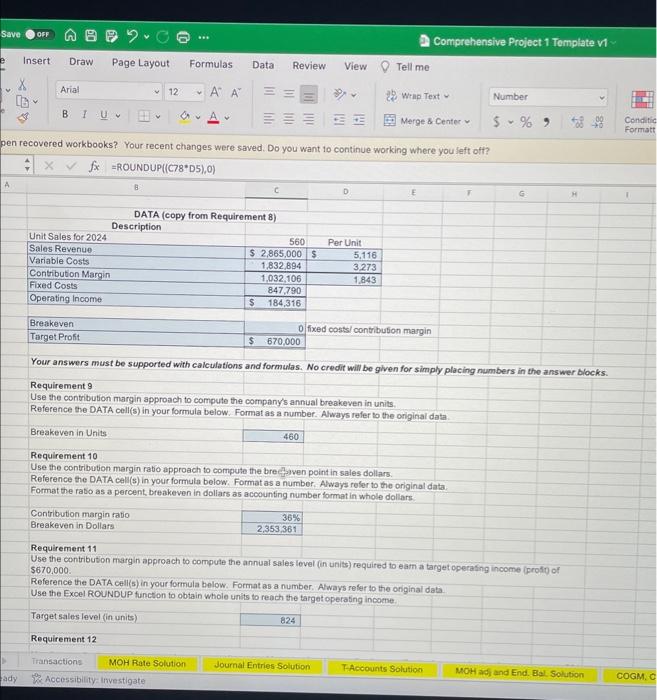

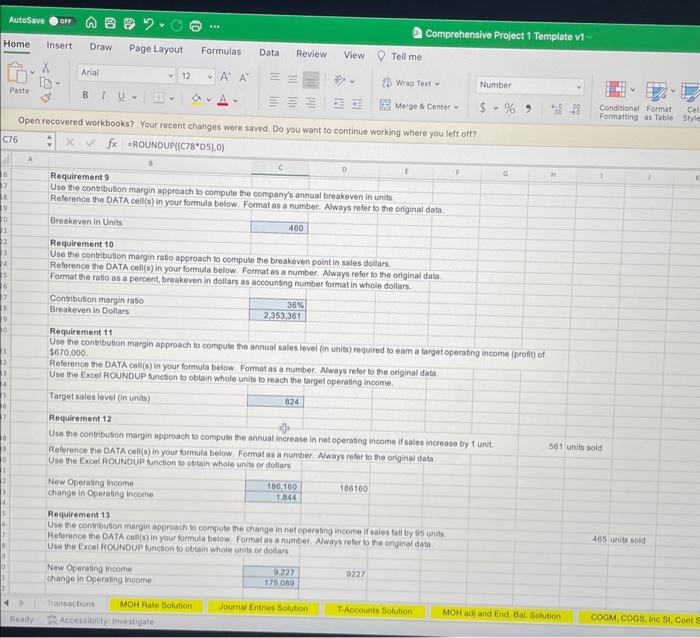

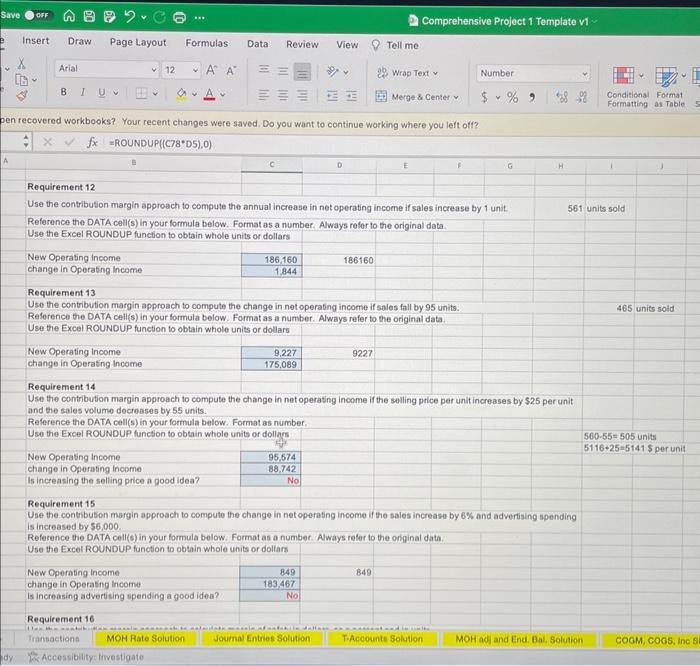

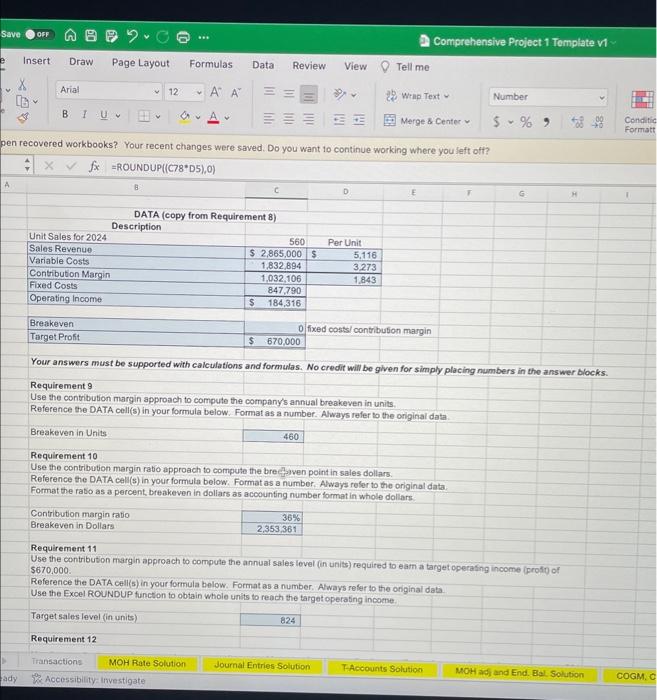

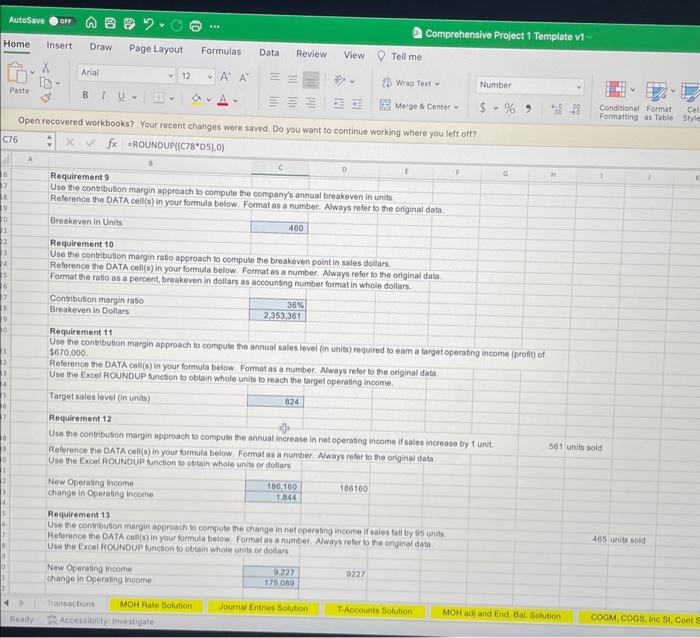

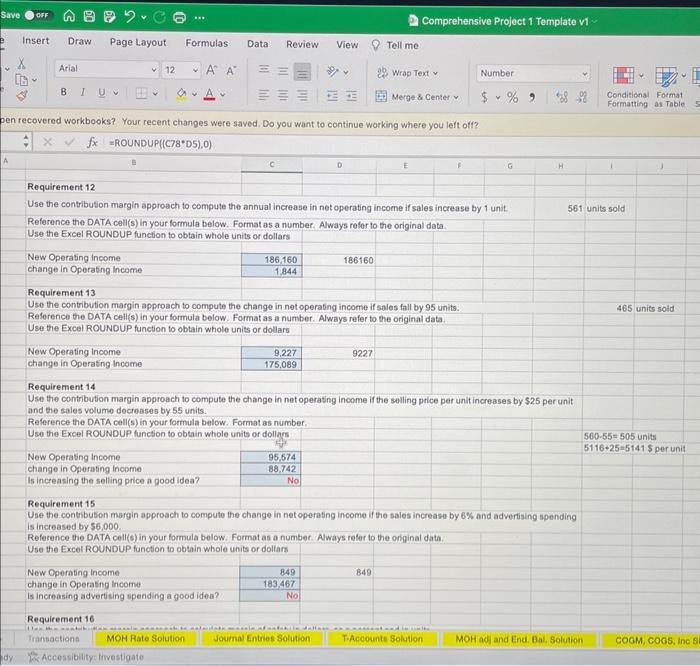

pen recovered workbooks? Your recent changes were saved. Do you want to continue working where you left off? Youranswersmustbesupportedwithcalculationsandformulas.Nocreditwillbegivenforsimplyplacingnumbersintheanswerblocks. Requirement 9 Use the contribution margin approach to compute the company's annual breakeven in units, Reference the DATA cell(s) in your formula below. Format as a number. Always refer to the original data. Breakeven in Units Requirement 10 Use the contribution margin ratio approach to compute the brechaven point in sales dollars. Reference the DATA cell(s) in your formula below. Format as a number. Always rofer to the original data. Format the rato as a percent, breakeven in dollars as accounting number format in whole dollars. \begin{tabular}{l|r|} \hline Contribution margin ratio & 36% \\ \hline Breakeven in Dollats & 2,353,361 \\ \hline \end{tabular} Requirement 11 Use the contribution margin approach to compute the annual sales lovel (in units) required to eam a target operasing income (profin of $670,000. Reference the DATA cell(s) in your formula below. Format as a number. Always refer to the original data Use the Excel ROUNDUP function to oblain whole units to reach the target operating income. \begin{tabular}{|l|l|} \hline Target sales level (in units) & 824 \\ \hline \end{tabular} Requirement 12 Use the contribusion margin approach to compute the company's annual breakeven in units. Reference the DATA cell (0) in your formula below. Format as a number. Always refer to the original data. Breakeven in Units Requirement 10 Use the contribution margin rato approach to compute the breakeven point in sales dollars. Reference the DATA cell(s) in your formula below. Format as a number. Always fefor to the original data. Format the ratio as a percent, breakeven in dollars as accounsing number format in whole dollars. requirement 11 Use the contribution margin approach to compute the snnual sales level (in units) required to eam a target operating income (proft) of 5670,000 . Reference the DATA cell (o) in your formula below. Format as a number. Aways teler to the original data. Use the Excel ROUNDUP function to obtain whole units to reach the tarpet operating income. Target sales level (in units) Requirement 12 Uso the contribusion margin approach to compuse the annual increase in net operating income if salos increase by 1 unit. Reference the DATA cell(b) in your formula below. Format as a number. Always refer to the original data. Use the Excel ROUNDUP function to obtain whole units of dollarn Requiremient 13 Use the contritution inargin approach to compute the change in natoperating income if aales fall by 95 chits. Refernnce the DATA cels(o) in your formula below. Format as a number. Aways refor to the original data Use the Excel ROUNDUP tinction to obeain whole unas of ispliars. pen recovered workbooks? Your recent changes were saved, Do you want to continue working where you left off? fx=ROUNDUP((C78D5),0) A. Requirement 12 Use the contribution margin approach to compute the annual increase in net operating income if sales incre Reference the DATA cell(s) in your formula below. Format as a number. Always refor to the original data. Use the Excel ROUNDUP function to obtain whole tinits or dollars

pen recovered workbooks? Your recent changes were saved. Do you want to continue working where you left off? Youranswersmustbesupportedwithcalculationsandformulas.Nocreditwillbegivenforsimplyplacingnumbersintheanswerblocks. Requirement 9 Use the contribution margin approach to compute the company's annual breakeven in units, Reference the DATA cell(s) in your formula below. Format as a number. Always refer to the original data. Breakeven in Units Requirement 10 Use the contribution margin ratio approach to compute the brechaven point in sales dollars. Reference the DATA cell(s) in your formula below. Format as a number. Always rofer to the original data. Format the rato as a percent, breakeven in dollars as accounting number format in whole dollars. \begin{tabular}{l|r|} \hline Contribution margin ratio & 36% \\ \hline Breakeven in Dollats & 2,353,361 \\ \hline \end{tabular} Requirement 11 Use the contribution margin approach to compute the annual sales lovel (in units) required to eam a target operasing income (profin of $670,000. Reference the DATA cell(s) in your formula below. Format as a number. Always refer to the original data Use the Excel ROUNDUP function to oblain whole units to reach the target operating income. \begin{tabular}{|l|l|} \hline Target sales level (in units) & 824 \\ \hline \end{tabular} Requirement 12 Use the contribusion margin approach to compute the company's annual breakeven in units. Reference the DATA cell (0) in your formula below. Format as a number. Always refer to the original data. Breakeven in Units Requirement 10 Use the contribution margin rato approach to compute the breakeven point in sales dollars. Reference the DATA cell(s) in your formula below. Format as a number. Always fefor to the original data. Format the ratio as a percent, breakeven in dollars as accounsing number format in whole dollars. requirement 11 Use the contribution margin approach to compute the snnual sales level (in units) required to eam a target operating income (proft) of 5670,000 . Reference the DATA cell (o) in your formula below. Format as a number. Aways teler to the original data. Use the Excel ROUNDUP function to obtain whole units to reach the tarpet operating income. Target sales level (in units) Requirement 12 Uso the contribusion margin approach to compuse the annual increase in net operating income if salos increase by 1 unit. Reference the DATA cell(b) in your formula below. Format as a number. Always refer to the original data. Use the Excel ROUNDUP function to obtain whole units of dollarn Requiremient 13 Use the contritution inargin approach to compute the change in natoperating income if aales fall by 95 chits. Refernnce the DATA cels(o) in your formula below. Format as a number. Aways refor to the original data Use the Excel ROUNDUP tinction to obeain whole unas of ispliars. pen recovered workbooks? Your recent changes were saved, Do you want to continue working where you left off? fx=ROUNDUP((C78D5),0) A. Requirement 12 Use the contribution margin approach to compute the annual increase in net operating income if sales incre Reference the DATA cell(s) in your formula below. Format as a number. Always refor to the original data. Use the Excel ROUNDUP function to obtain whole tinits or dollars

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started