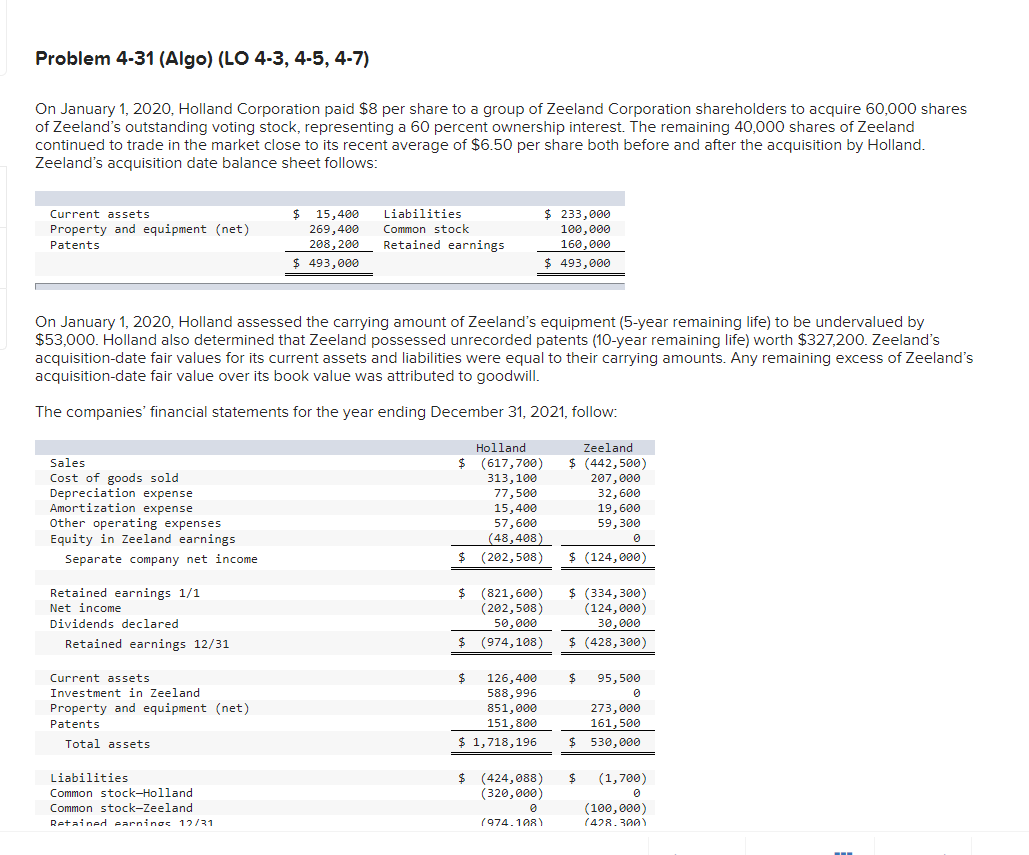

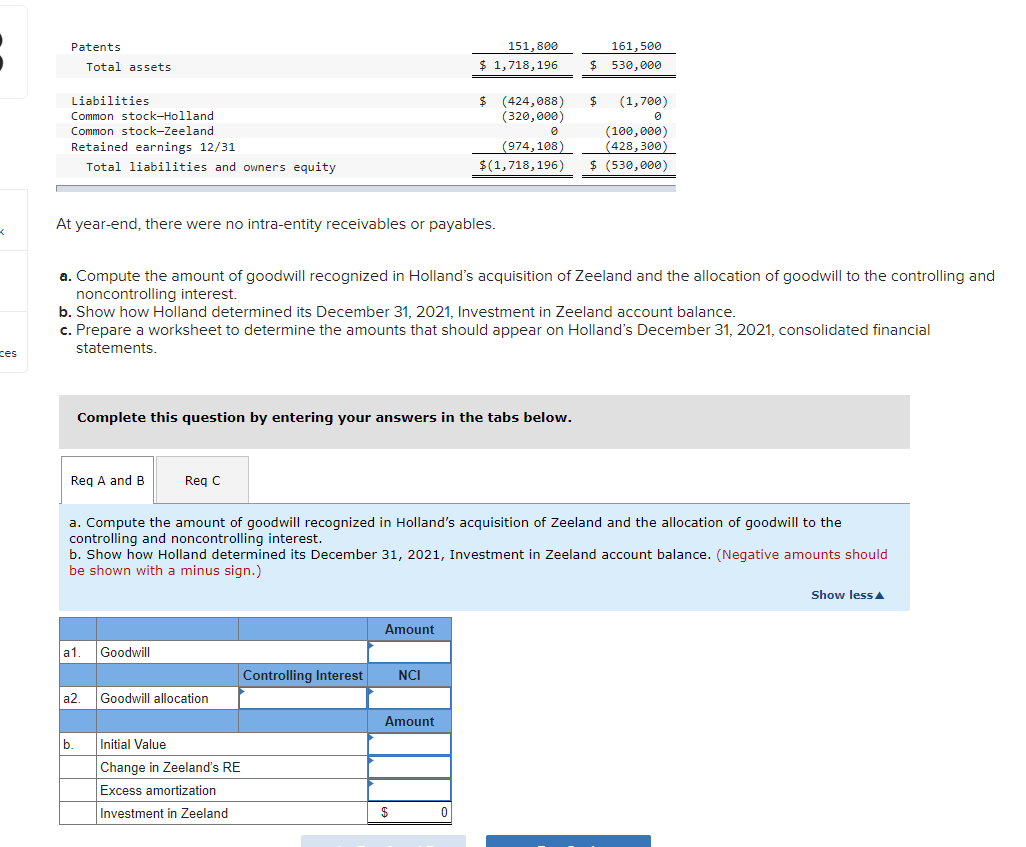

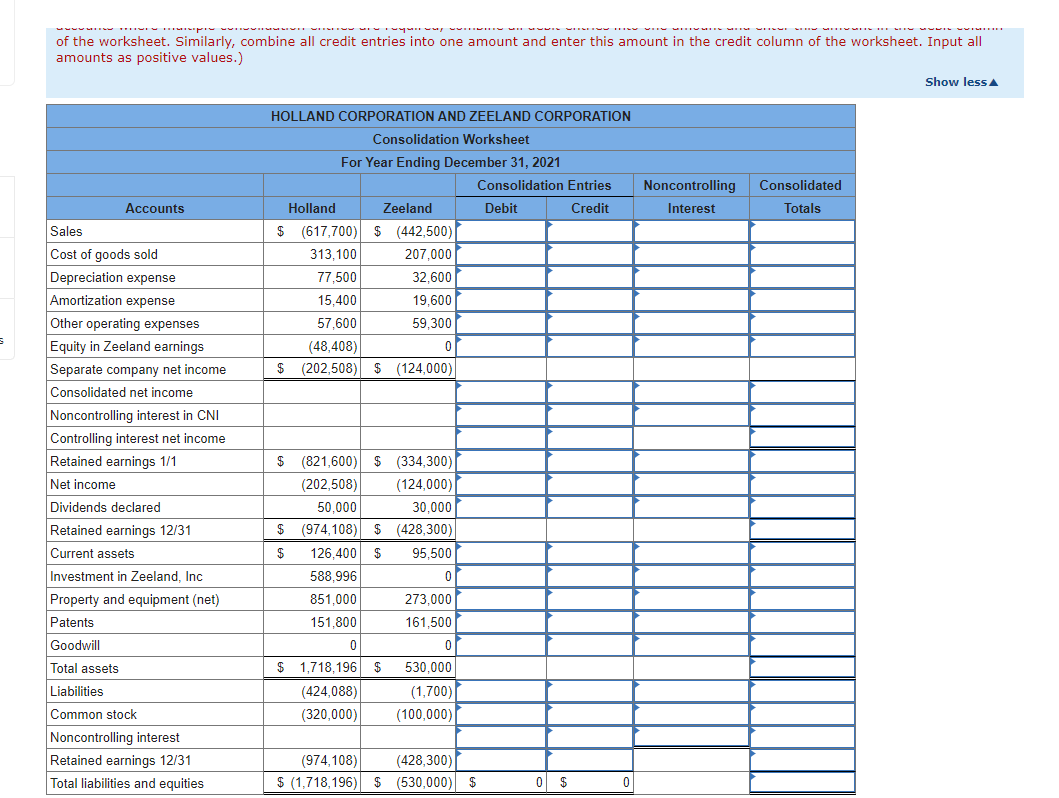

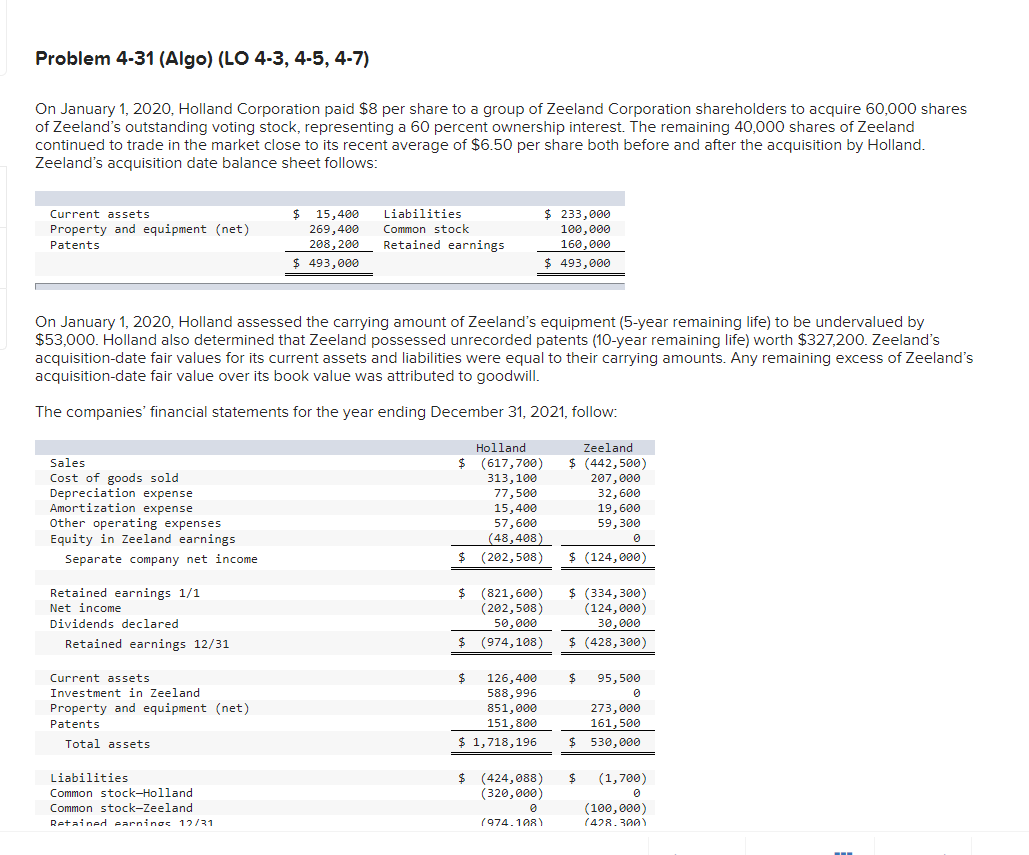

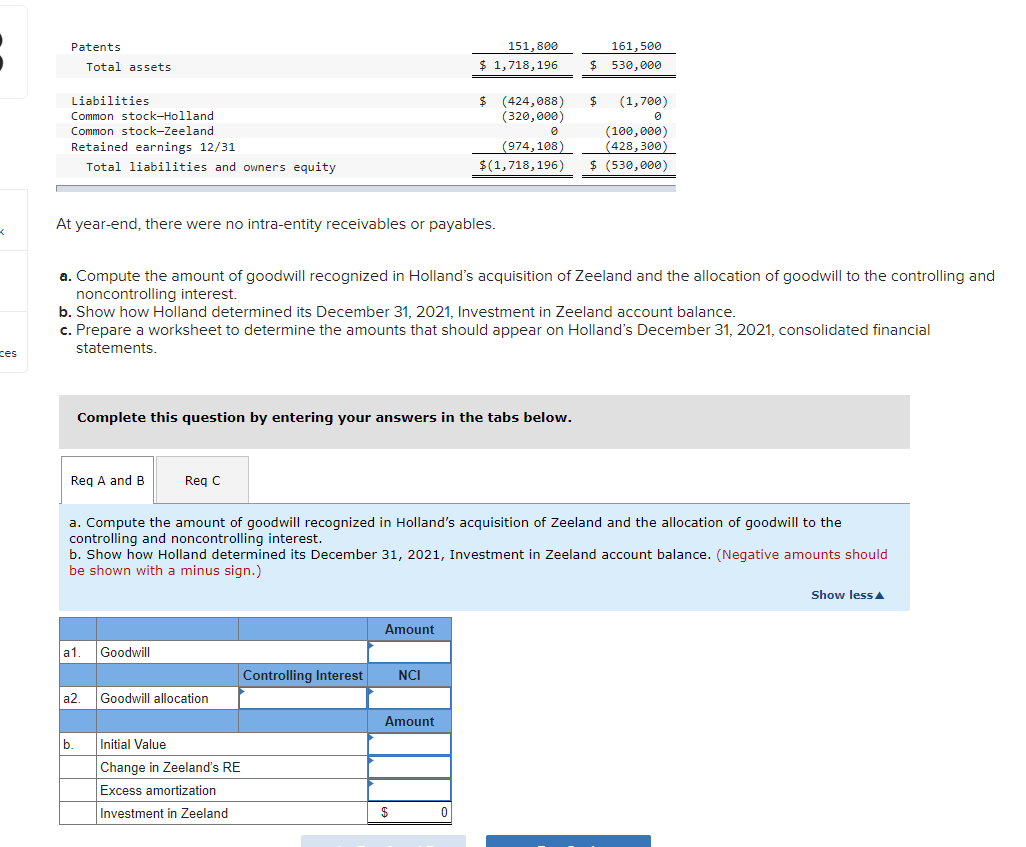

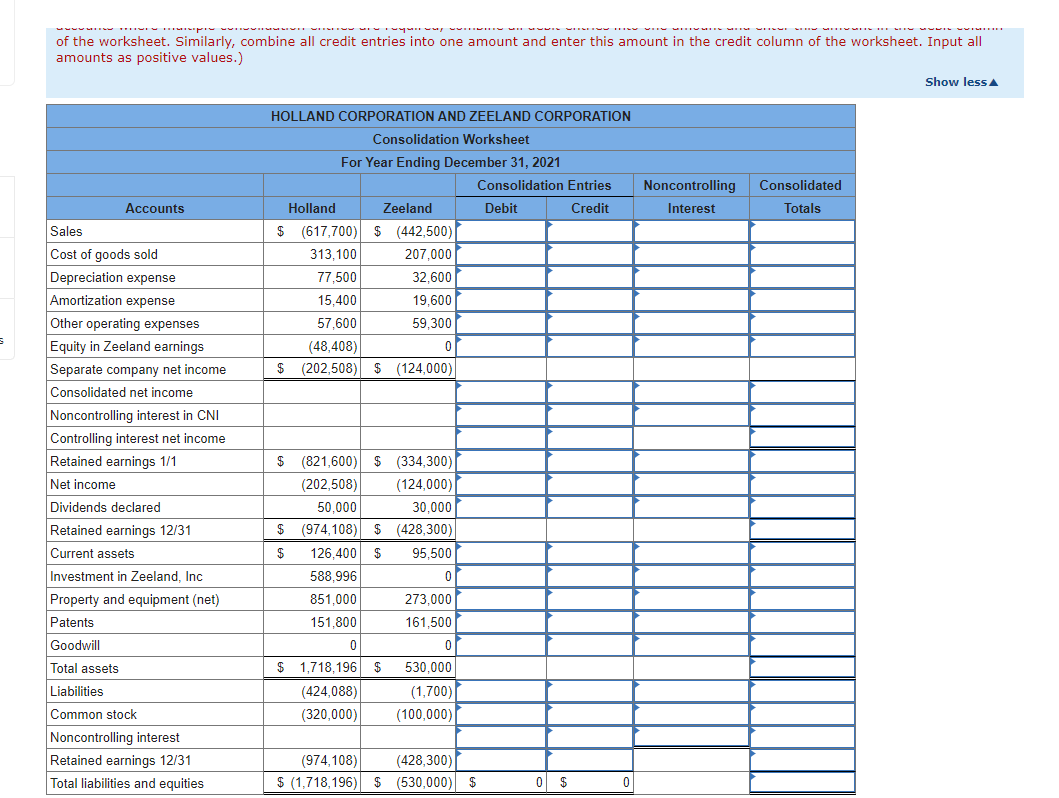

Problem 4-31 (Algo) (LO 4-3, 4-5, 4-7) On January 1, 2020, Holland Corporation paid $8 per share to a group of Zeeland Corporation shareholders to acquire 60,000 shares of Zeeland's outstanding voting stock, representing a 60 percent ownership interest. The remaining 40,000 shares of Zeeland continued to trade in the market close to its recent average of $6.50 per share both before and after the acquisition by Holland. Zeeland's acquisition date balance sheet follows: Current assets Property and equipment (net) Patents $ 15,400 269,400 208,200 $ 493,000 Liabilities Common stock Retained earnings $ 233,000 100,000 160,000 $ 493,000 On January 1, 2020, Holland assessed the carrying amount of Zeeland's equipment (5-year remaining life) to be undervalued by $53,000. Holland also determined that Zeeland possessed unrecorded patents (10-year remaining life) worth $327,200. Zeeland's acquisition-date fair values for its current assets and liabilities were equal to their carrying amounts. Any remaining excess of Zeeland's acquisition-date fair value over its book value was attributed to goodwill. The companies' financial statements for the year ending December 31, 2021, follow: Sales Cost of goods sold Depreciation expense Amortization expense Other operating expenses Equity in Zeeland earnings Separate company net income Holland $ (617,700) 313,100 77,500 15,400 57,600 (48,408) $ (202,508) Zeeland $ (442,500) 207,000 32,600 19,600 59,300 $ (124,000) $ Retained earnings 1/1 Net income Dividends declared Retained earnings 12/31 (821,600) (202,508) 50,000 (974,108) $ (334,300) (124,000) 30,000 $ (428,300) $ $ 95,500 Current assets Investment in Zeeland Property and equipment (net) Patents Total assets $ 126,400 588,996 851,000 151,800 $ 1,718,196 273,000 161,500 $ 530,000 $ (1,700) Liabilities Common stock-Holland Common stock-Zeeland Retained earnings 12/31 $ (424,088) (320,000) 0 1974. 1AR) (100,000) (428.390) Patents Total assets 151,800 $ 1,718, 196 161,500 $ 530,000 $ (424,088) (320,000) Liabilities Common stock-Holland Common stock-Zeeland Retained earnings 12/31 Total liabilities and owners equity $ (1,700) 0 (100,000) (428,300) $ (530,000) (974,108) $(1,718,196) At year-end, there were no intra-entity receivables or payables. a. Compute the amount of goodwill recognized in Holland's acquisition of Zeeland and the allocation of goodwill to the controlling and noncontrolling interest. b. Show how Holland determined its December 31, 2021, Investment in Zeeland account balance. c. Prepare a worksheet to determine the amounts that should appear on Holland's December 31, 2021, consolidated financial statements ces Complete this question by entering your answers in the tabs below. Req A and B Reg C a. Compute the amount of goodwill recognized in Holland's acquisition of Zeeland and the allocation of goodwill to the controlling and noncontrolling interest. b. Show how Holland determined its December 31, 2021, Investment in Zeeland account balance. (Negative amounts should be shown with a minus sign.) Show less A Amount a1 Goodwill Controlling Interest NCI a2. Goodwill allocation Amount b. Initial Value Change in Zeeland's RE Excess amortization Investment in Zeeland $ 0 of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet. Input all amounts as positive values.) Show less Noncontrolling Interest Consolidated Totals HOLLAND CORPORATION AND ZEELAND CORPORATION Consolidation Worksheet For Year Ending December 31, 2021 Consolidation Entries Holland Zeeland Debit Credit $ (617,700) $ (442,500) 313,100 207,000 77,500 32,600 15,400 19,600 57,600 59,300 (48,408) 0 $ (202,508) $ (124,000) Accounts Sales Cost of goods sold Depreciation expense Amortization expense Other operating expenses Equity in Zeeland earnings Separate company net income Consolidated net income Noncontrolling interest in CNI Controlling interest net income Retained earnings 1/1 Net income Dividends declared Retained earnings 12/31 Current assets Investment in Zeeland, Inc Property and equipment (net) Patents Goodwill Total assets Liabilities Common stock Noncontrolling interest Retained earnings 12/31 Total liabilities and equities $ (821,600) $ (334,300) (202,508) (124,000) 50,000 30,000 $ (974,108) $ (428,300) $ 126,400 $ 95,500 588,996 0 851,000 273,000 151,800 161,500 0 $ 1,718,196 $ 530,000 (424,088) (1,700) (320,000) (100,000) (974,108) (428,300) $ (1,718,196) $ (530,000) $ 0 $ 0