Answered step by step

Verified Expert Solution

Question

1 Approved Answer

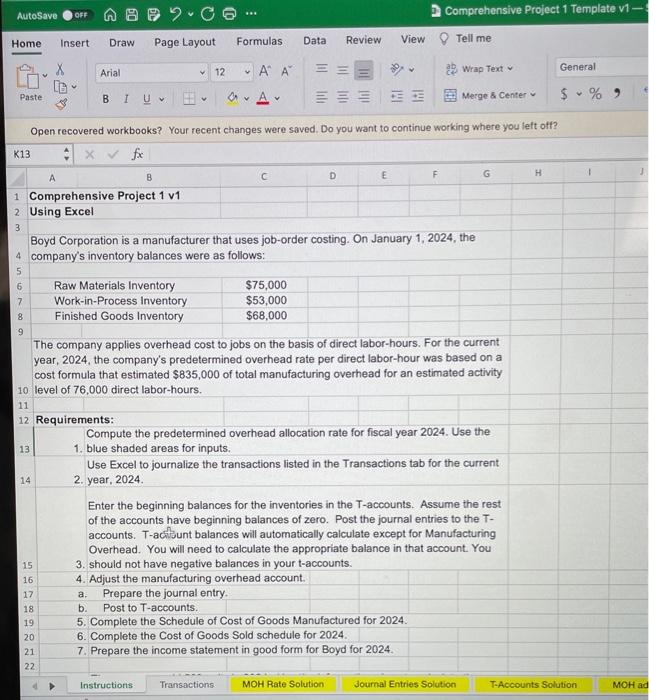

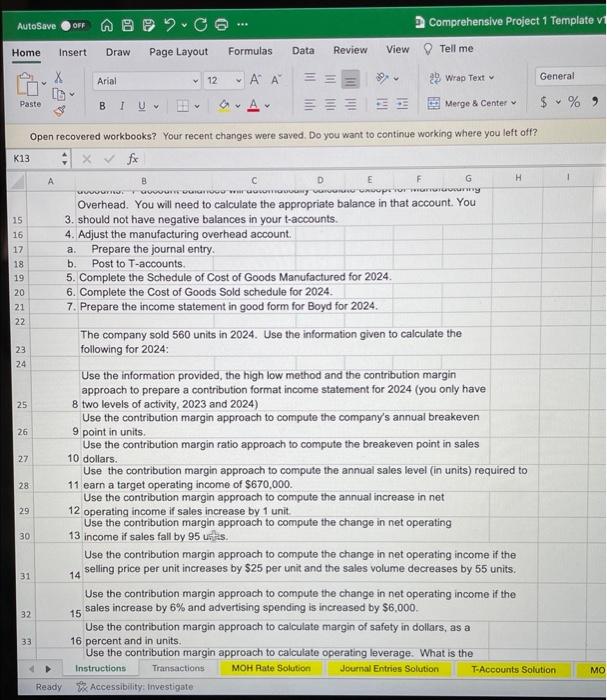

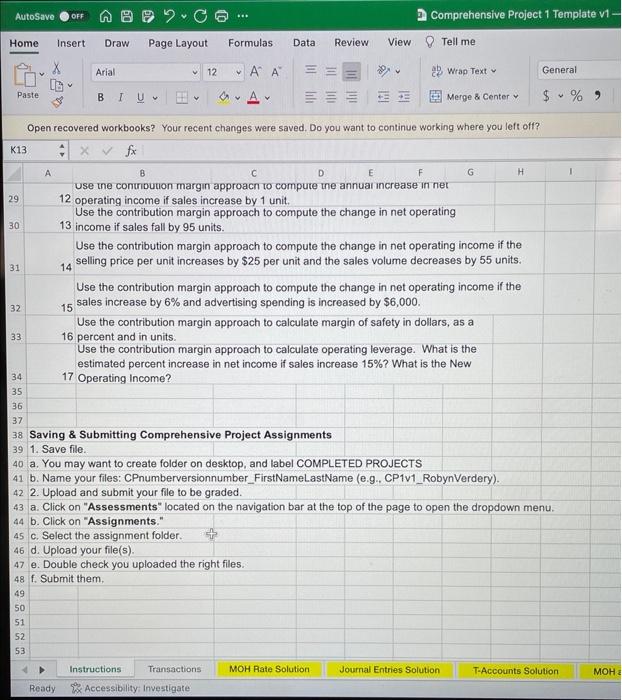

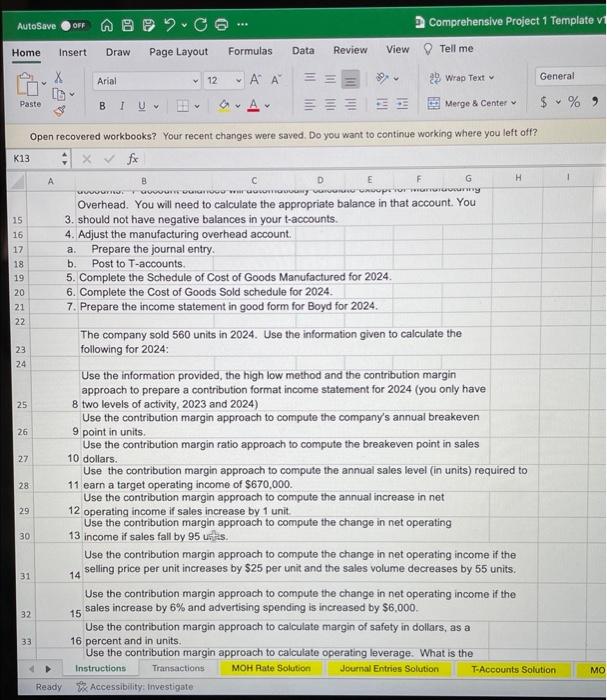

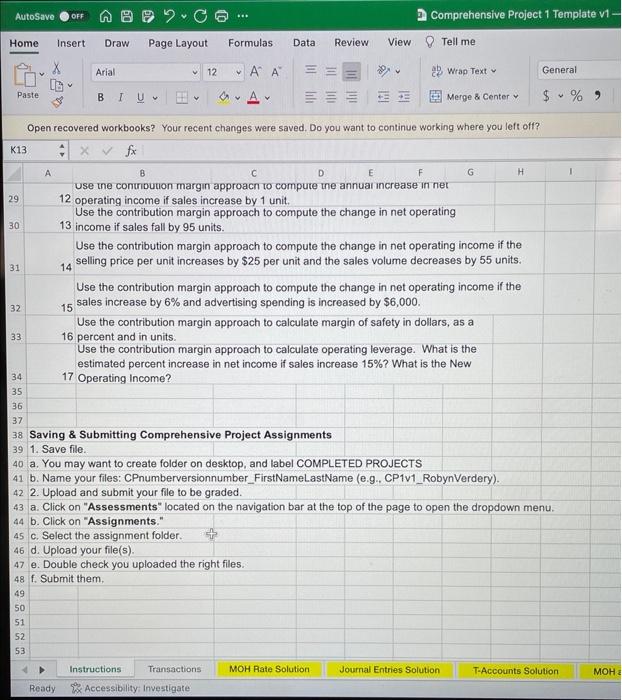

i need requirements 12-14 please. With calculations . This is ALL the information provided. Is urgent please! thank you! Open recovered workbooks? Your recent changes

i need requirements 12-14 please. With calculations . This is ALL the information provided. Is urgent please!

Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left off? Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left off? Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left oft? Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left oft? 117 A f Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left off? Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left off? C27.5fffx=520001MOH Rate Solution'lB12 Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left oft? Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left off? Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left off? 1 Requirement 5: Complete the Schedule of Cost of Goods Manufactured. \begin{tabular}{|l|l|} \hline 3 & \multicolumn{2}{|c|}{ Boyd Corporation } \\ \hline 4 & \multicolumn{2}{|c|}{ Schedule of Cost of Coods } \\ \hline 5 & \\ \hline 6 & \\ 7 & For the Year 202 \\ \hline 8 & Beginning Work-in-Process linventory \\ \hline 9 & Direct Materials Used \\ \hline 10 & Direct Labor \\ \hline 11 & Manufacturing Overhead \\ \hline 12 & Total Manufacturing Costs lncurred during Period \\ \hline 13 & Ending Working-in-Process Inventory \\ \hline 14 & Cost of Goods Manufactured \\ \hline \end{tabular} 15 Requirement 6: Complete the Cost of Goods Sold schedule. 17 \begin{tabular}{|l|l|} \hline 18 & \multicolumn{1}{|c|}{ Boyd Corporation } \\ \hline 19 & \multicolumn{1}{|c|}{ Schedule of Cost of Goods Sold } \\ \hline 20 & \multicolumn{1}{|c|}{ For the Year 2024 } \\ \hline 21 & \\ 22 & Beginning Finished Goods Inventory \\ 23 & Cost of Goods Manufactured \\ \hline 24 & Cost of Goods Available for Sale \\ \hline 25 & Ending Finished Goods lnventory \\ 26 & Cost of Goods Sold \\ \hline 27 & Over/Under Applied Overtiead \\ \hline 28 & Adjusted Cost of Goods Sold \\ \hline 29 & \end{tabular} 29 30 Requirement 7: Complete the Income Statement. Use the information provided, the high low method and the contribution margin approach to prepare a contribution format income statement for 2024 (you only have two levels of activity, 2023 and 2024) Use your mixed cost formulas to create your contribution format statement. Reference the DATA cell(s) as provided to complete your statement below. Format as numbers. Round to 2 decimal places where appropriate Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left off? Use the contribution margin ratio approach to compute the breakeven point in sales dollars. Reference the DATA cell(s) in your formula below. Format as a number. Always refor to the original data. Format the ratio as a percent, breakeven in dollars as accounting number format in whole dollars. Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left off? Use the contribution margin approach to compute the annual increase in net operating income if sales increase by 1 unit. Reference the DATA cell(s) in your formula below. Format as a number. Always refer to the original data Use the Excel ROUNDUP function to obtain whole units or dollars Requirement 13 Use the contribution margin approach to compute the change in net operating income if sales fall by 95 units. Reference the DATA cell(s) in your formula below. Format as a number. Always refer to the original data. Use the Excel ROUNDUP tunction to obtain whole units or dollars Now Operating incom change in Operating Requirement 14 Use the contribution margin approach to compute the change in net operating income if the selling price per unit increases by $25 per unit and the sales volume decreases by 55 units. Reference the DATA cels(s) in your formula below. Format as number. Use the Excel ROUNDUP function to obtain whole units or dollars New Operating income change in Operating income is increasing the selling price a good idea? Requirement 15 Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left off? Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left off? Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left oft? Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left oft? 117 A f Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left off? Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left off? C27.5fffx=520001MOH Rate Solution'lB12 Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left oft? Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left off? Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left off? 1 Requirement 5: Complete the Schedule of Cost of Goods Manufactured. \begin{tabular}{|l|l|} \hline 3 & \multicolumn{2}{|c|}{ Boyd Corporation } \\ \hline 4 & \multicolumn{2}{|c|}{ Schedule of Cost of Coods } \\ \hline 5 & \\ \hline 6 & \\ 7 & For the Year 202 \\ \hline 8 & Beginning Work-in-Process linventory \\ \hline 9 & Direct Materials Used \\ \hline 10 & Direct Labor \\ \hline 11 & Manufacturing Overhead \\ \hline 12 & Total Manufacturing Costs lncurred during Period \\ \hline 13 & Ending Working-in-Process Inventory \\ \hline 14 & Cost of Goods Manufactured \\ \hline \end{tabular} 15 Requirement 6: Complete the Cost of Goods Sold schedule. 17 \begin{tabular}{|l|l|} \hline 18 & \multicolumn{1}{|c|}{ Boyd Corporation } \\ \hline 19 & \multicolumn{1}{|c|}{ Schedule of Cost of Goods Sold } \\ \hline 20 & \multicolumn{1}{|c|}{ For the Year 2024 } \\ \hline 21 & \\ 22 & Beginning Finished Goods Inventory \\ 23 & Cost of Goods Manufactured \\ \hline 24 & Cost of Goods Available for Sale \\ \hline 25 & Ending Finished Goods lnventory \\ 26 & Cost of Goods Sold \\ \hline 27 & Over/Under Applied Overtiead \\ \hline 28 & Adjusted Cost of Goods Sold \\ \hline 29 & \end{tabular} 29 30 Requirement 7: Complete the Income Statement. Use the information provided, the high low method and the contribution margin approach to prepare a contribution format income statement for 2024 (you only have two levels of activity, 2023 and 2024) Use your mixed cost formulas to create your contribution format statement. Reference the DATA cell(s) as provided to complete your statement below. Format as numbers. Round to 2 decimal places where appropriate Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left off? Use the contribution margin ratio approach to compute the breakeven point in sales dollars. Reference the DATA cell(s) in your formula below. Format as a number. Always refor to the original data. Format the ratio as a percent, breakeven in dollars as accounting number format in whole dollars. Open recovered workbooks? Your recent changes were saved. Do you want to continue working where you left off? Use the contribution margin approach to compute the annual increase in net operating income if sales increase by 1 unit. Reference the DATA cell(s) in your formula below. Format as a number. Always refer to the original data Use the Excel ROUNDUP function to obtain whole units or dollars Requirement 13 Use the contribution margin approach to compute the change in net operating income if sales fall by 95 units. Reference the DATA cell(s) in your formula below. Format as a number. Always refer to the original data. Use the Excel ROUNDUP tunction to obtain whole units or dollars Now Operating incom change in Operating Requirement 14 Use the contribution margin approach to compute the change in net operating income if the selling price per unit increases by $25 per unit and the sales volume decreases by 55 units. Reference the DATA cels(s) in your formula below. Format as number. Use the Excel ROUNDUP function to obtain whole units or dollars New Operating income change in Operating income is increasing the selling price a good idea? Requirement 15 thank you!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started