Answered step by step

Verified Expert Solution

Question

1 Approved Answer

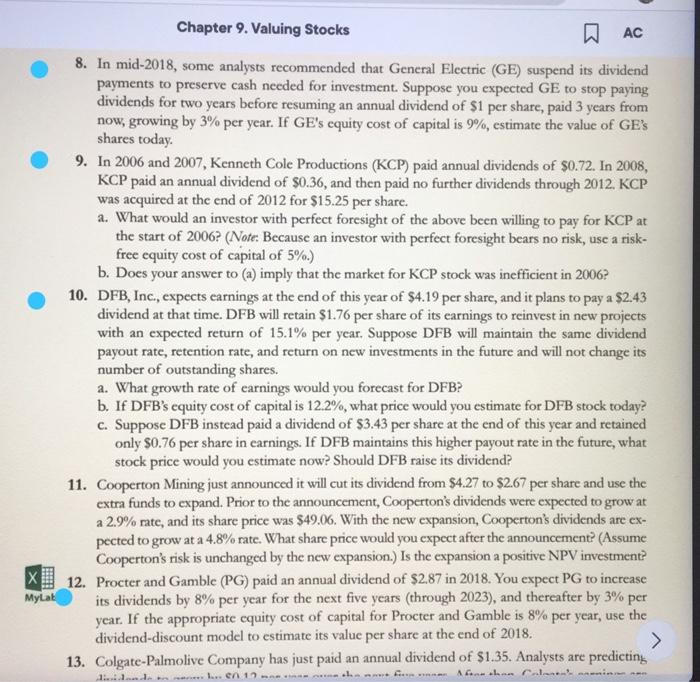

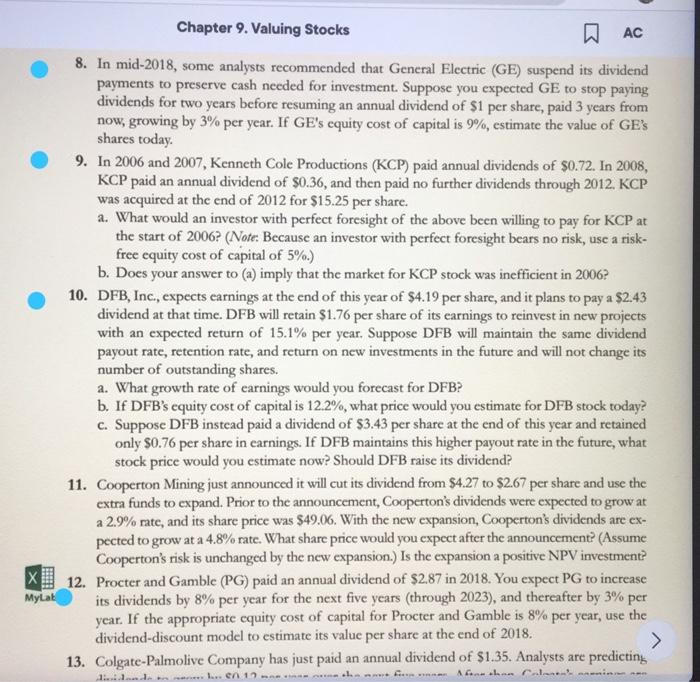

i need solutions of 8-9-10-12 Chapter 9. Valuing Stocks AC 8. In mid-2018, some analysts recommended that General Electric (GE) suspend its dividend payments to

i need solutions of 8-9-10-12

Chapter 9. Valuing Stocks AC 8. In mid-2018, some analysts recommended that General Electric (GE) suspend its dividend payments to preserve cash needed for investment. Suppose you expected GE to stop paying dividends for two years before resuming an annual dividend of $1 per share, paid 3 years from now, growing by 3% per year. If GE's equity cost of capital is 9%, estimate the value of GE's shares today. 9. In 2006 and 2007, Kenneth Cole Productions (KCP) paid annual dividends of $0.72. In 2008, KCP paid an annual dividend of $0.36, and then paid no further dividends through 2012. KCP was acquired at the end of 2012 for $15.25 per share. a. What would an investor with perfect foresight of the above been willing to pay for KCP at the start of 2006? (Note: Because an investor with perfect foresight bears no risk, use a risk- free equity cost of capital of 5%.) b. Does your answer to (a) imply that the market for KCP stock was inefficient in 2006? 10. DFB, Inc., expects earnings at the end of this year of $4.19 per share, and it plans to pay a $2.43 dividend at that time. DFB will retain $1.76 per share of its earnings to reinvest in new projects with an expected return of 15.1% per year. Suppose DFB will maintain the same dividend payout rate, retention rate, and return on new investments in the future and will not change its number of outstanding shares. a. What growth rate of earnings would you forecast for DFB? b. If DFB's equity cost of capital is 12.2%, what price would you estimate for DFB stock today? c. Suppose DFB instead paid a dividend of $3.43 per share at the end of this year and retained only $0.76 per share in earnings. If DFB maintains this higher payout rate in the future, what stock price would you estimate now? Should DFB raise its dividend? 11. Cooperton Mining just announced it will cut its dividend from $4.27 to $2.67 per share and use the extra funds to expand. Prior to the announcement, Cooperton's dividends were expected to grow at a 2.9% rate, and its share price was $49.06. With the new expansion, Cooperton's dividends are ex- pected to grow at a 4.8% rate. What share price would you expect after the announcement? (Assume Cooperton's risk is unchanged by the new expansion.) Is the expansion a positive NPV investment? X 12. Procter and Gamble (PG) paid an annual dividend of $2.87 in 2018. You expect PG to increase its dividends by 8% per year for the next five years (through 2023), and thereafter by 3% per year. If the appropriate equity cost of capital for Procter and Gamble is 8% per year, use the dividend-discount model to estimate its value per share at the end of 2018. MyLab > 13. Colgate-Palmolive Company has just paid an annual dividend of $1.35. Analysts are predicting Aforth Calon's dividende.. 12 the f

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started