Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need some answers on 1 through 08, please preciate it !! In comparing alternatives with different lives by the present worth (PW) method, it

i need some answers on 1 through 08, please preciate it !!

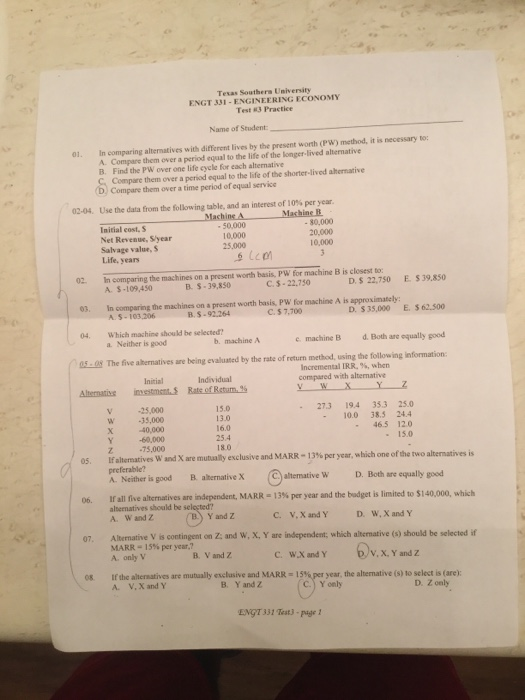

In comparing alternatives with different lives by the present worth (PW) method, it is necessary to: Compare them over a period equal to the life of the longer-lived alternative Find the PW over one life cycle for each alternative Compare them over a period equal to the life of the shorter-lived alternative Compare them over a time period of equal service Use the data from the following table, and an interest of 10 % per year. In comparing the machines on a present worth basis, PW for machine B is closed to: $ - 109,450 $ - 39, 850 $ - 22.750 $ 22,750 $ 39.850 In comparing the machines on a present worth basis, PW for machine A is approximately: $ - 103,206 $ - 92.264 $ 7, 700 $ 35, 000 $ 62.500 Which machine should be selected? Neither is good machine A machine B Both are equally good The five alternatives are being evaluated by the rate of return method, using the following information: If alternatives W and X are mutually exclusive and MARR - 13 % per year and the budget is limited to $140,000, which alternatives should be selected? W and Z Y and Z V, X and Y W, X and Y Alternative V is contingent on Z: and W, X, Y are independent; which alternative (s) should be selected if MARR = 15% per year? Only V V and Z W, X and Y V,x, y? and Z If the alternatives are mutually exclusive and MARR = 15% per year, the alternative (s) to select is (are); V,X and Y Y and Z Y only Z OnlyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started