I need some assistance: With the 2 bonds quotation issued by Coca Cola which i have attached, please help me answer the following questions: Thanks in advance...

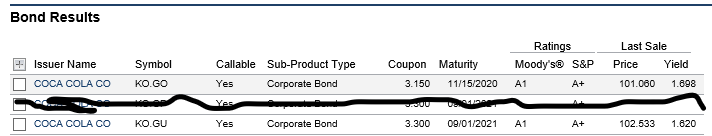

- Assume that par value of the bond is $1,000. What were the last prices of the bonds in $$$ (listed in the Price column)?Show your work please.

- Assume that par value of the bond is $1,000. Calculate the annual coupon interest payments.Show your work please.

- Assume that par value of the bond is $1,000. Calculate the current yield of the bonds.Show your work please.

- How much is the YTM listed in quotations is for the bonds? Explain the meaning of YTM.

- which bond would be preferable to buy? Why?

- Are these bonds callable? If the bonds chosen are callable (non-callable), will it change the decision to buy them?

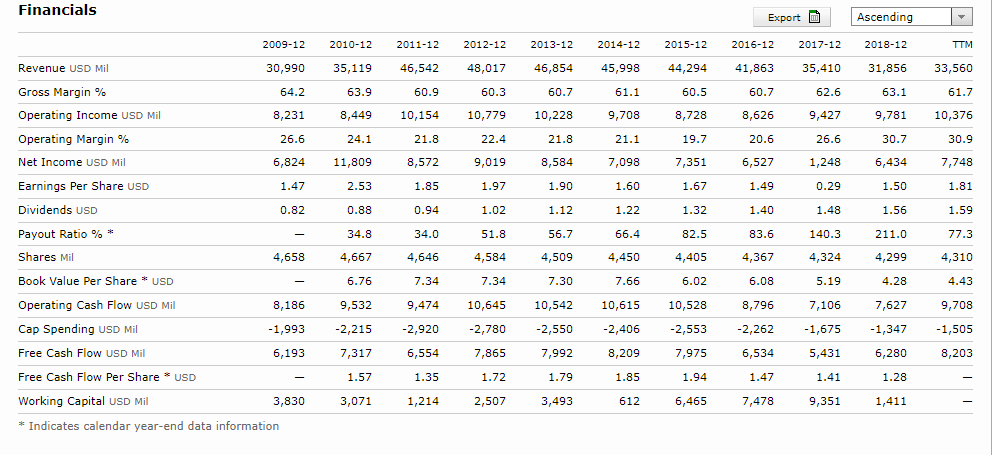

- If you are an investor who is looking for a bond to invest in, are you going to buy a bond that you chose? Take a look at the balance sheet and income statement of the company. What data or ratios support your decision to buy this bond or not?.

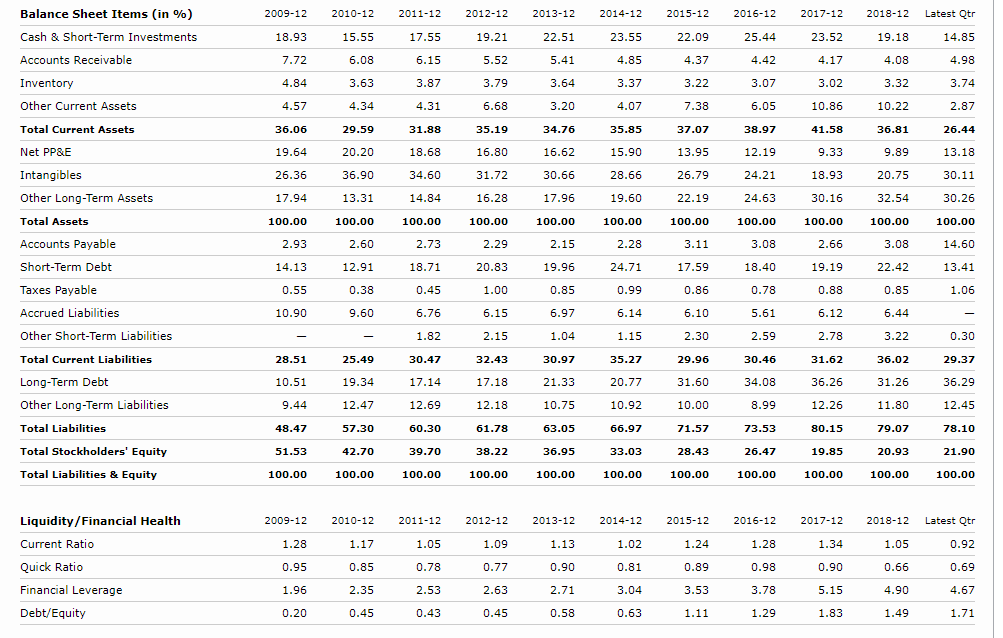

Balance Sheet Items (in %) 2009-12 2010-12 2011-12 2012-12 2013-12 2014-12 2015-12 2016-12 2017-12 2018-12 Latest Qtr Cash & Short-Term Investments 18.93 15.55 17.55 19.21 22.51 23.55 22.09 25.44 23.52 19.18 14.85 Accounts Receivable 7.72 6.08 6.15 5.52 5.41 4.85 4.37 4.42 4.17 4.08 Inventory 4.84 3.63 3.87 3.79 3.64 3.37 3.22 3.07 3.02 3.32 3.74 Other Current Assets 4,34 4,31 6.68 3.20 4.07 7.38 6.05 10.86 10.22 2.87 Total Current Assets 36.06 29.59 31.88 35.19 34.76 35.85 37.07 38.97 41.58 36.81 26.44 Net PP&E 19.64 20.20 18.68 16.80 16.62 15.90 13.95 12.19 9.33 9.89 13.18 Intangibles 26.36 36.90 34.60 31.72 30.66 28.66 26.79 24.21 18.93 20.75 30.11 Other Long-Term Assets 17.94 13.31 14.84 16.28 17.96 19.60 22.19 24.63 30.16 32.54 30.26 Total Assets 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 Accounts Payable 2.93 2.60 2.29 2.15 2.28 3.11 3.08 2.66 3.08 14.60 Short-Term Debt 14.13 12.91 18.71 20.83 19.96 24.71 17.59 18.40 19.19 22.42 13.41 Taxes Payable 0.55 0.38 0.45 1.00 0.85 0.99 0.86 0.78 0.88 0.85 1.06 Accrued Liabilities 10.90 9.60 6.76 6.15 6.97 6.14 6.10 5.61 6.44 Other Short-Term Liabilities 1.82 2.15 1.04 1.15 2.30 2.59 2.78 3.22 0.30 Total Current Liabilities 28.51 25.49 30.47 32.43 30.97 35.27 29.96 30.46 31.62 36.02 29.37 Long-Term Debt 10.51 19.34 17.14 17.18 21.33 20.77 31.60 34.08 36.26 31.26 36.29 Other Long-Term Liabilities 9.44 12.47 12.69 12.18 10.75 10.92 10.00 8.99 12.26 11.80 12.45 Total Liabilities 48.47 57.30 60.30 61.78 63.05 66.97 71.57 73.53 80.15 79.07 78.10 Total Stockholders' Equity 51.53 42.70 39.70 38.22 36.95 33.03 28.43 26.47 19.85 20.93 21.90 Total Liabilities & Equity 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 Liquidity/ Financial Health 2009-12 2010-12 2011-12 2012-12 2013-12 2014-12 2015-12 2016-12 2017-12 2018-12 Latest Qtr Current Ratio 1.28 1.17 1.05 1.09 1.13 1.02 1.24 1.28 1.34 1.05 0.92 Quick Ratio 0.95 0.85 0.78 0.90 0.81 0.89 0.98 0.90 0.66 0.69 Financial Leverage 1.96 2.35 2.53 2.63 2.71 3.04 3.53 3.78 5.15 4.90 4.67 Debt/Equity 0.20 0.45 0.43 0.58 0.63 1.11 1.83 1.49 1.71Bond Results Ratings Last Sale Issuer Name Symbol Callable Sub-Product Type Coupon Maturity Moody's@ S&P Price Yield COCA COLA CO KO.GO Yes Corporate Bond 3.150 11/15/2020 A1 At 101.060 1.898 COCA COLA CO KO.GU Yes Corporate Bond 3.300 09/01/2021 A1 A+ 102.533 1.820Financials Export mi Ascending 2009-12 2010-12 2011-12 2012-12 2013-12 2014-12 2015-12 2016-12 2017-12 2018-12 TTM Revenue USD Mil 30,990 35,119 46,542 48,017 46,854 45,998 44,294 41,863 35,410 31,856 33,560 Gross Margin % 64.2 63.9 60.9 60.3 60.7 61.1 60.5 60.7 62.6 63.1 61.7 Operating Income USD Mil 8,231 8,449 10,154 10,779 10,228 9,708 8,728 8,626 9,427 9,781 10,376 Operating Margin % 26.6 24.1 21.8 22.4 21.8 21.1 19.7 20.6 26.6 30.7 30.9 Net Income USD Mil 6,824 11,809 8,572 9,019 8,584 7,098 7,351 6,527 1,248 6,434 7,748 Earnings Per Share USD 1.47 2.53 1.85 1.97 1.90 1.60 1.67 1.49 0.29 1.50 1.81 Dividends USD 0.82 0.88 0.94 1.02 1.12 1.22 1.32 1.40 1.48 1.56 1.59 Payout Ratio % * 34.8 34.0 51.8 56.7 66.4 82.5 83.6 140.3 211.0 77.3 Shares Mil 4,658 4,667 4,646 4,584 4,509 4,450 4,405 4,367 4,324 4,299 4,310 Book Value Per Share * USD 6.76 7.34 7.34 7.30 7.66 6.02 6.08 5.19 4.28 4.43 Operating Cash Flow USD Mil 8,186 9,532 9,474 10,645 10,542 10,615 10,528 8,796 7,106 7,627 9,708 Cap Spending USD Mil -1,993 -2,215 -2,920 -2,780 -2,550 -2,406 -2,553 -2,262 -1,675 -1,347 -1,505 Free Cash Flow USD Mil 6,193 7,317 6,554 7,865 7,992 8,209 7,975 6,534 5,431 6,280 8,203 Free Cash Flow Per Share * USD 1.57 1.35 1.72 1.79 1.85 1.94 1.47 1.41 1.28 Working Capital USD Mil 3,830 3,071 1,214 2,507 3,493 612 6,465 7,478 9,351 1,411 * Indicates calendar year-end data information