Question: i need some help thank you Decision Tree Analysis Figure 2.12. Decision tree analysis. Your company needs to decide either to develop a new product

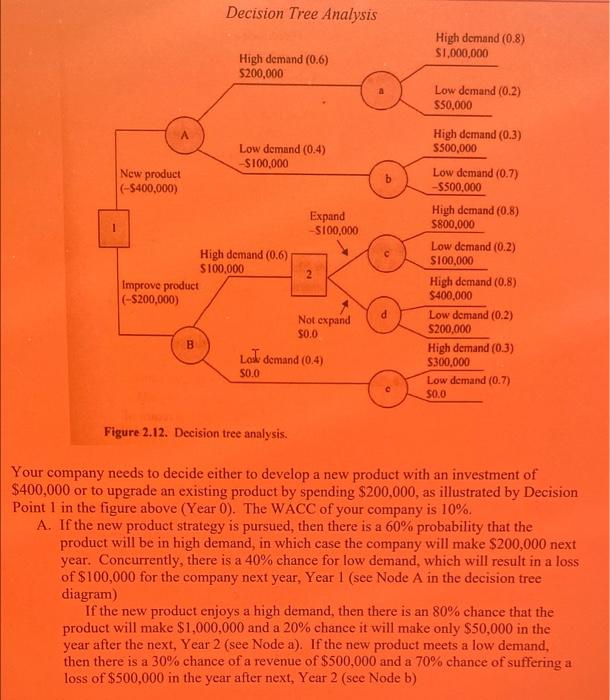

Decision Tree Analysis Figure 2.12. Decision tree analysis. Your company needs to decide either to develop a new product with an investment of $400,000 or to upgrade an existing product by spending $200,000, as illustrated by Decision Point 1 in the figure above (Year0). The WACC of your company is 10%. A. If the new product strategy is pursued, then there is a 60% probability that the product will be in high demand, in which case the company will make $200,000 next year. Concurrently, there is a 40% chance for low demand, which will result in a loss of $100,000 for the company next year, Year 1 (see Node A in the decision tree diagram) If the new product enjoys a high demand, then there is an 80% chance that the product will make $1,000,000 and a 20% chance it will make only $50,000 in the year after the next, Year 2 (see Node a). If the new product meets a low demand, then there is a 30% chance of a revenue of $500,000 and a 70% chance of suffering a loss of $500,000 in the year after next, Year 2 (see Node b) B. If the company follows the strategy of improving the existing product in Year 0 , then there is a 60% chance for high demand, leading to a revenue of $100,000; and a 40% chance of low demand, to yield zero revenue in the first year, Year 1 (see Node B) If the demand is high at the end of the first year, the company needs to make a second decision (Decision Point 2) whether or not to expand the product line. The expansion option will require an investment of $100,000, whereas the option of no HEM-ENG 297A Fall 202 expansion costs nothing. If the Fompany expands the improved product line, then there is an 80% chance that it will reap a revenue of $800,000 and a 20% chance of $100,000 revenue in the year after next, Year 2 (see Node c). If the company elects not to expand at the end of the first year then there is an 80% chance that it will realize a revenue of $400,000 and a 20% chance of a $200,000 revenue (see Node d). Should the improved product of the company see a low demand (at a probability of 40% ) and get zero revenue in the first year, then there is a 30% chance that the product can generate a revenue of $300,000 and a 70% chance of zero revenue. 1. If the company decides to improve the existing product in Decision Point 1 and demand is high at the end of the first year, what decision should the company make at Decision Point 2? 2. Determine what decision at Decision Point 1 (product strategy) the company should make. Decision Tree Analysis Figure 2.12. Decision tree analysis. Your company needs to decide either to develop a new product with an investment of $400,000 or to upgrade an existing product by spending $200,000, as illustrated by Decision Point 1 in the figure above (Year0). The WACC of your company is 10%. A. If the new product strategy is pursued, then there is a 60% probability that the product will be in high demand, in which case the company will make $200,000 next year. Concurrently, there is a 40% chance for low demand, which will result in a loss of $100,000 for the company next year, Year 1 (see Node A in the decision tree diagram) If the new product enjoys a high demand, then there is an 80% chance that the product will make $1,000,000 and a 20% chance it will make only $50,000 in the year after the next, Year 2 (see Node a). If the new product meets a low demand, then there is a 30% chance of a revenue of $500,000 and a 70% chance of suffering a loss of $500,000 in the year after next, Year 2 (see Node b) B. If the company follows the strategy of improving the existing product in Year 0 , then there is a 60% chance for high demand, leading to a revenue of $100,000; and a 40% chance of low demand, to yield zero revenue in the first year, Year 1 (see Node B) If the demand is high at the end of the first year, the company needs to make a second decision (Decision Point 2) whether or not to expand the product line. The expansion option will require an investment of $100,000, whereas the option of no HEM-ENG 297A Fall 202 expansion costs nothing. If the Fompany expands the improved product line, then there is an 80% chance that it will reap a revenue of $800,000 and a 20% chance of $100,000 revenue in the year after next, Year 2 (see Node c). If the company elects not to expand at the end of the first year then there is an 80% chance that it will realize a revenue of $400,000 and a 20% chance of a $200,000 revenue (see Node d). Should the improved product of the company see a low demand (at a probability of 40% ) and get zero revenue in the first year, then there is a 30% chance that the product can generate a revenue of $300,000 and a 70% chance of zero revenue. 1. If the company decides to improve the existing product in Decision Point 1 and demand is high at the end of the first year, what decision should the company make at Decision Point 2? 2. Determine what decision at Decision Point 1 (product strategy) the company should make

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts