Answered step by step

Verified Expert Solution

Question

1 Approved Answer

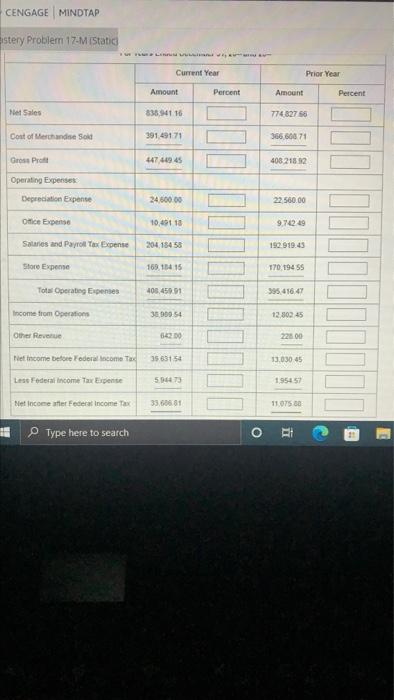

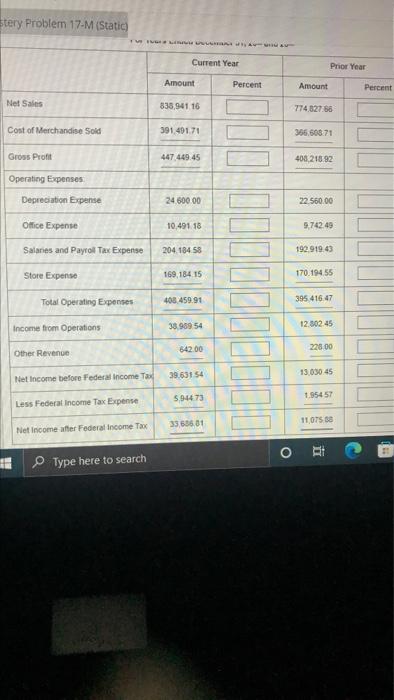

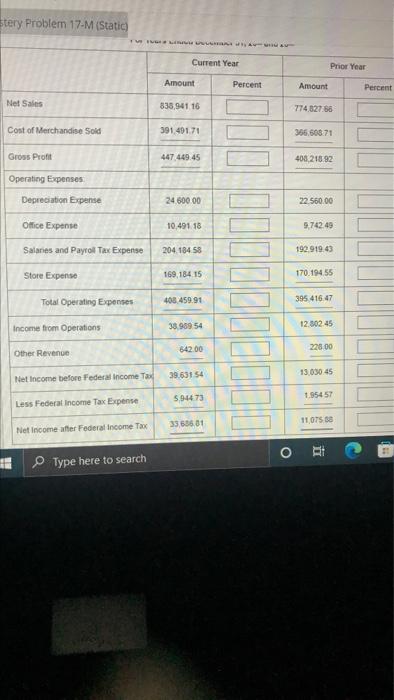

i need some help with this please help please CENGAGE MINDTAP stery Problem 17-M (Static) Net Sales Cost of Merchandise Sold Gross Prof Operating Expenses

i need some help with this please

help please

CENGAGE MINDTAP stery Problem 17-M (Static) Net Sales Cost of Merchandise Sold Gross Prof Operating Expenses L Amount 838,941 16 391,491.71 447,449 45 Depreciation Expense 24,600.00 Office Expense 10,491 10 Salaries and Payroll Tax Expense 204,184 58 Store Expense 169,154 15 Total Operating Expenses 400.459.91 Income from Operations 35,000 54 Other Revenue 64200 Net Income before Federal Income Tax 3563154 Less Federal Income Tax Expense 5.944.75 Net Income after Federal Income Tax 33,60681 Type here to search Current Year Percent Prior Year Amount 774,82766 366,600 71 408 218 92 22,560.00 9,742.49 192.919.43 170,194 55 395,416,47 12,802 45 225.00 13.030 45 1.954.57 11.075.00 E Percent stery Problem 17-M (Static) Net Sales Cost of Merchandise Sold Gross Profit Operating Expenses THE INFLAM Current Year Amount Percent 835,941 16 391,491.71 447 449.45 24.600.00 10,491.18 204.184.58 169,184.15 408.459.91 38,989 54 642.00 39.631.54 5,944.73 33,656.01 Depreciation Expense Office Expense Salaries and Payroll Tax Expense Store Expense Total Operating Expenses Income from Operations Other Revenue Net Income before Federal Income Tax Less Federal Income Tax Expense Net Income after Federal Income Tax Type here to search # O Prior Year Amount 774,827 66 366.608.71 400,218.92 22.560.00 9,742.49 192,919.43 170.194.55 395,416.47 12.302.45 228.00 13,030 45 1.954 57 11,075.08 Percent

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started