Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need someone to check my work please and thank you! ption #2: Preparing J Provide complete answers to the following two problems: 1. Assume

I need someone to check my work please and thank you!

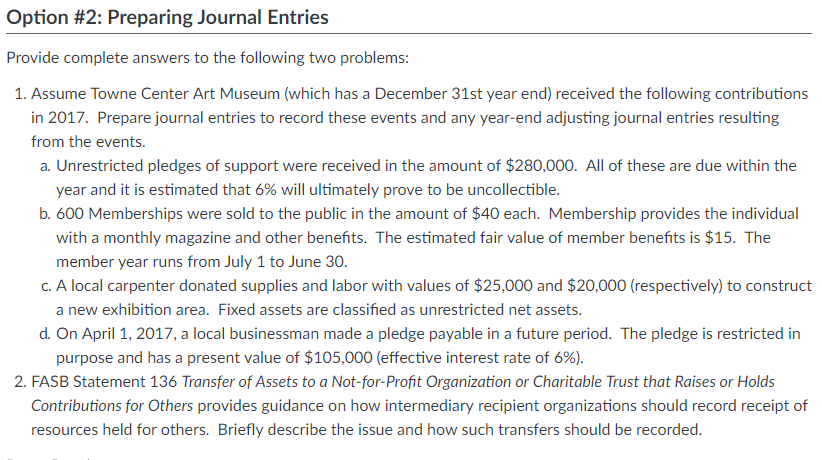

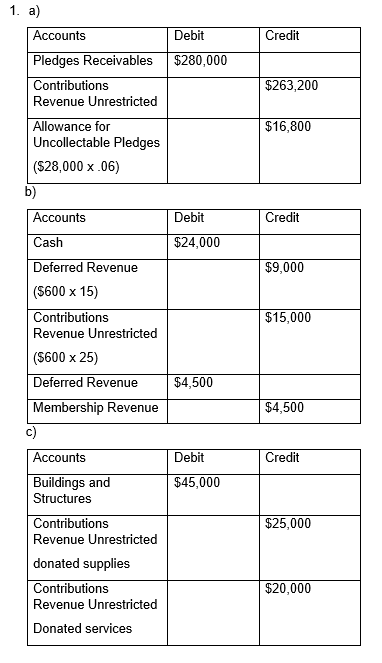

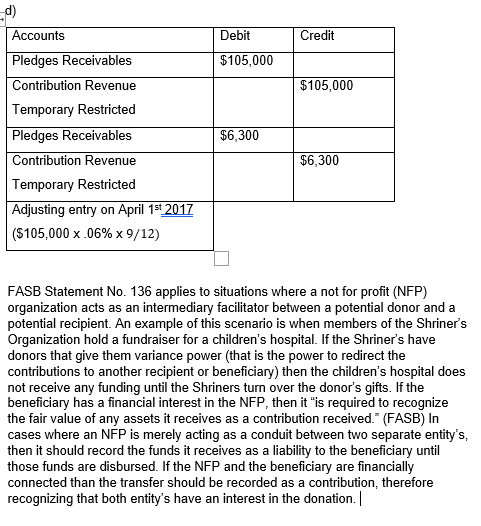

ption #2: Preparing J Provide complete answers to the following two problems: 1. Assume Towne Center Art Museum (which has a December 31st year end) received the following contributions in 2017. Prepare journal entries to record these events and any year-end adjusting journal entries resulting a. Unrestricted pledges of support were received in the amount of $280,000. All of these are due within the b. 600 Memberships were sold to the public in the amount of $40 each. Membership provides the individual from the events. year and it is estimated that 6% will ultimately prove to be uncollectible. with a monthly magazine and other benefits. The estimated fair value of member benefits is $15. The member year runs from July 1 to June 30. C. A local carpenter donated supplies and labor with values of $25,000 and $20,000 (respectively) to construct a new exhibition area. Fixed assets are classified as unrestricted net assets. d. On April 1, 2017, a local businessman made a pledge payable in a future period. The pledge is restricted in purpose and has a present value of $105,000 (effective interest rate of 6%). 2. FASB Statement 136 Transfer of Assets to a Not-for-Profit Organization or Charitable Trust that Raises or Holds Contributions for Others provides guidance on how intermediary recipient organizations should record receipt of resources held for others. Briefly describe the issue and how such transfers should be recorded. Accounts Debit Credit Pledges Receivables $280,000 Contributions Revenue Unrestricted Allowance for Uncollectable Pledges ($28,000 x.06) $263,200 $16,800 b) Accounts Cash Deferred Revenue (5600 x 15) Contributions Revenue Unrestricted ($600 x 25) Deferred Revenue Membership Revenue Debit Credit $24,000 $9,000 $15,000 $4,500 $4,500 Accounts Buildings and Structures Contributions Revenue Unrestricted donated supplies Contributions Revenue Unrestricted Donated services Debit Credit $45,000 $25,000 $20,000 Accounts Pledges Receivables Contribution Revenue Temporary Restricted Pledges Receivables Contribution Revenue Temporary Restricted Adjusting entry on April 1st 2017 ($105,000 x .06% x 9/ 12) Debit Credit $105,000 $105,000 $6,300 $6,300 FASB Statement No. 136 applies to situations where a not for profit (NFP) organization acts as an intermediary facilitator between a potential donor and a potential recipient. An example of this scenario is when members of the Shriner's Organization hold a fundraiser for a children's hospital. If the Shriner's have donors that give them variance power (that is the power to redirect the contributions to another recipient or beneficiary) then the children's hospital does not receive any funding until the Shriners turn over the donor's gifts. If the beneficiary has a financial interest in the NFP, then it "is required to recognize the fair value of any assets it receives as a contribution received." (FASB) In cases where an NFP is merely acting as a conduit between two separate entity's, then it should record the funds it receives as a liability to the beneficiary until those funds are disbursed. If the NFP and the beneficiary are financially connected than the transfer should be recorded as a contribution, therefore recognizing that both entity's have an interest in the donation.|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started