Answered step by step

Verified Expert Solution

Question

1 Approved Answer

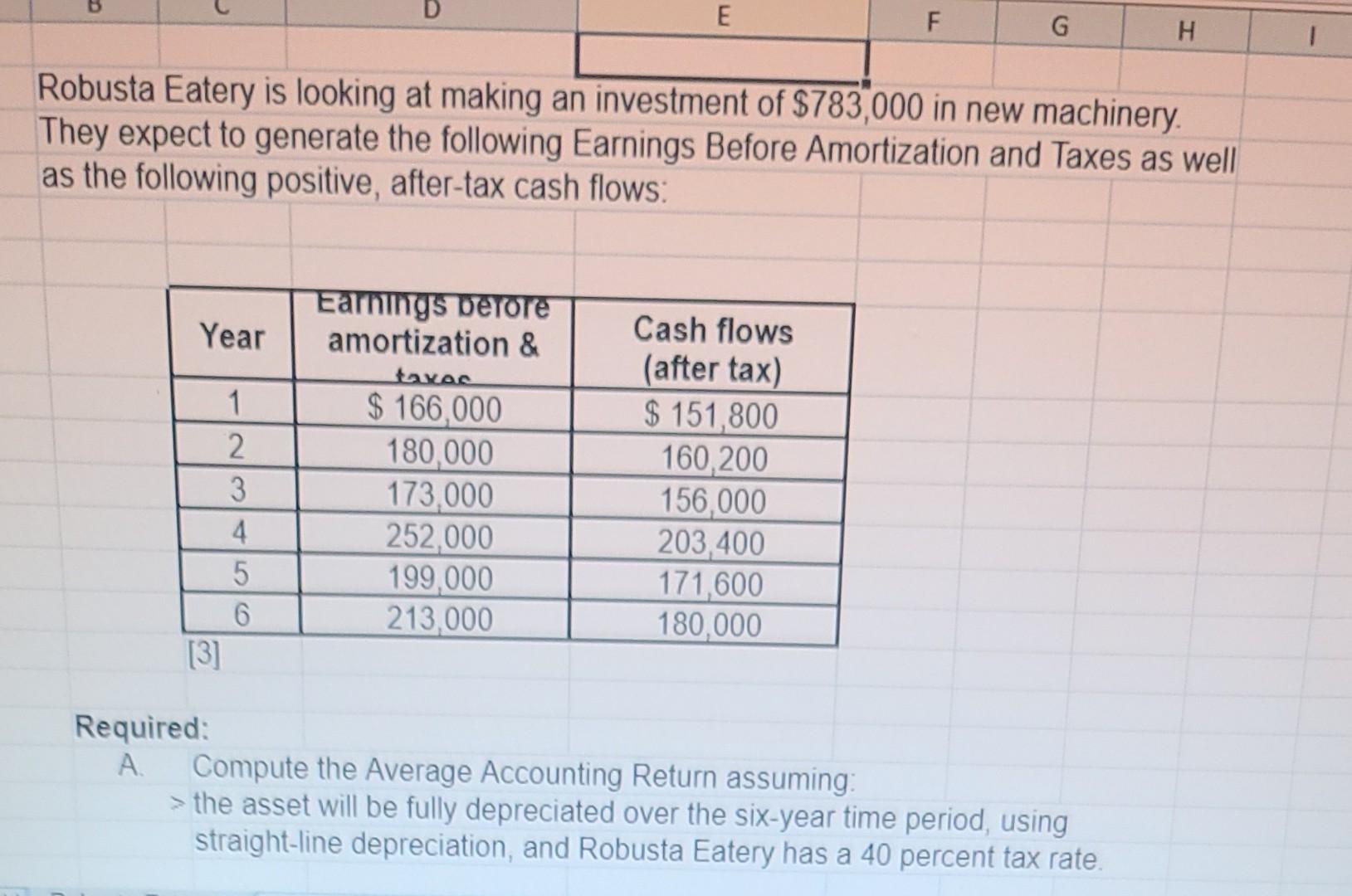

i need step by step explanation plus answer D E F G H Robusta Eatery is looking at making an investment of $783,000 in new

i need step by step explanation plus answer

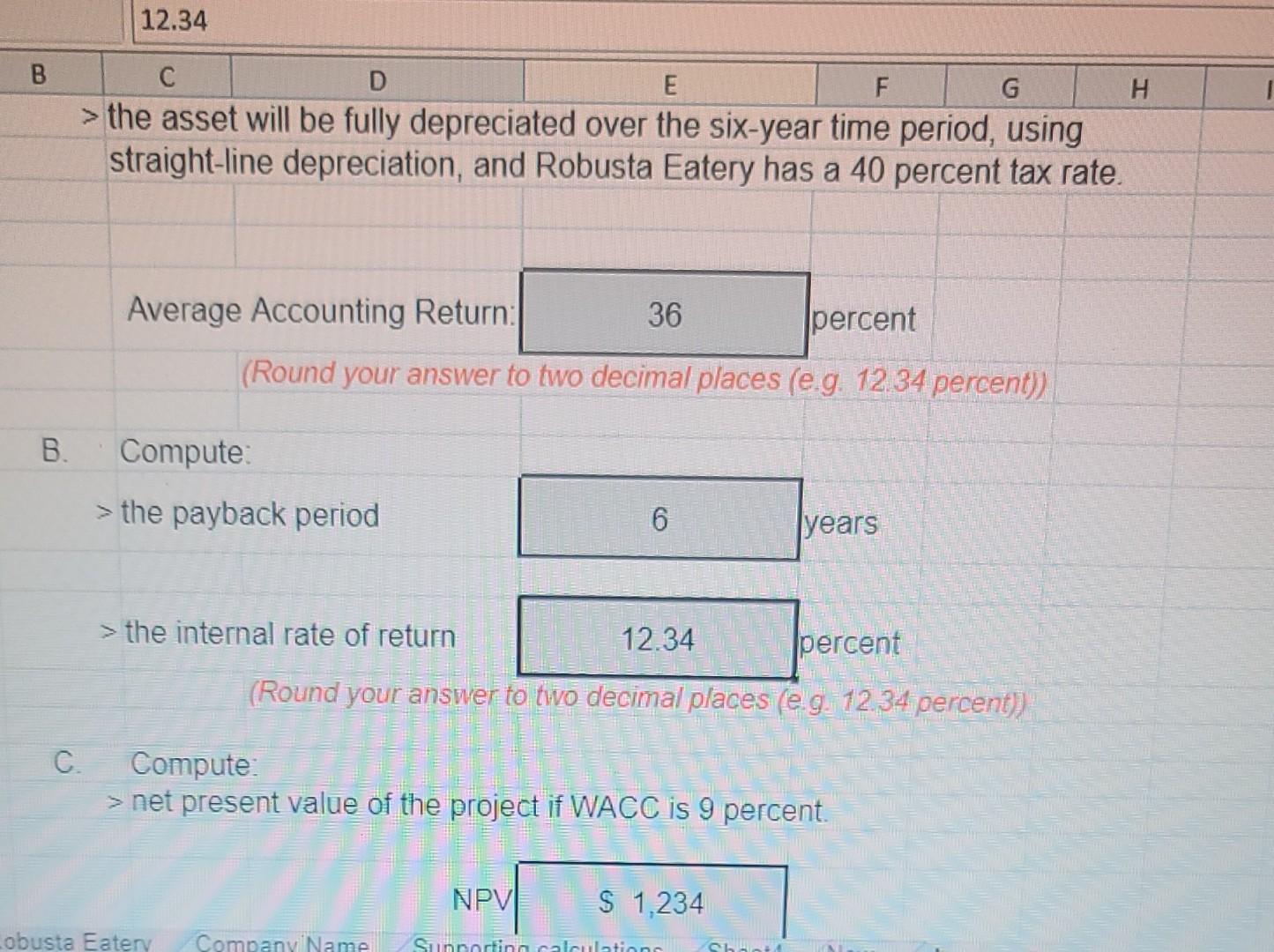

D E F G H Robusta Eatery is looking at making an investment of $783,000 in new machinery They expect to generate the following Earnings Before Amortization and Taxes as well as the following positive, after-tax cash flows: Year Earnings before amortization & taxas 1 2 3 4 5 6 [3] $ 166,000 180 000 173,000 252,000 199,000 213,000 Cash flows (after tax) $ 151,800 160,200 156,000 203.400 171,600 180,000 Required: A Compute the Average Accounting Return assuming > the asset will be fully depreciated over the six-year time period, using straight-line depreciation, and Robusta Eatery has a 40 percent tax rate. 12.34 B C D E F G H > the asset will be fully depreciated over the six-year time period, using straight-line depreciation, and Robusta Eatery has a 40 percent tax rate Average Accounting Return: 36 percent (Round your answer to two decimal places (e.g. 12 34 percent)) B. Compute > the payback period 6 years > the internal rate of return 12.34 percent (Round your answer to two decimal places (e g. 12 34 percent)) . Compute > net present value of the project if WACC is 9 percent NPV S 1.234 obusta Eatery Company Name Sunnorting calculation SotStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started