Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I NEED STEP BY STEP SOLUTION PLEASE AND THANK YOU Your firm needs to either buy or lease $240,000 worth of vehicles. These vehicles have

I NEED STEP BY STEP SOLUTION PLEASE AND THANK YOU

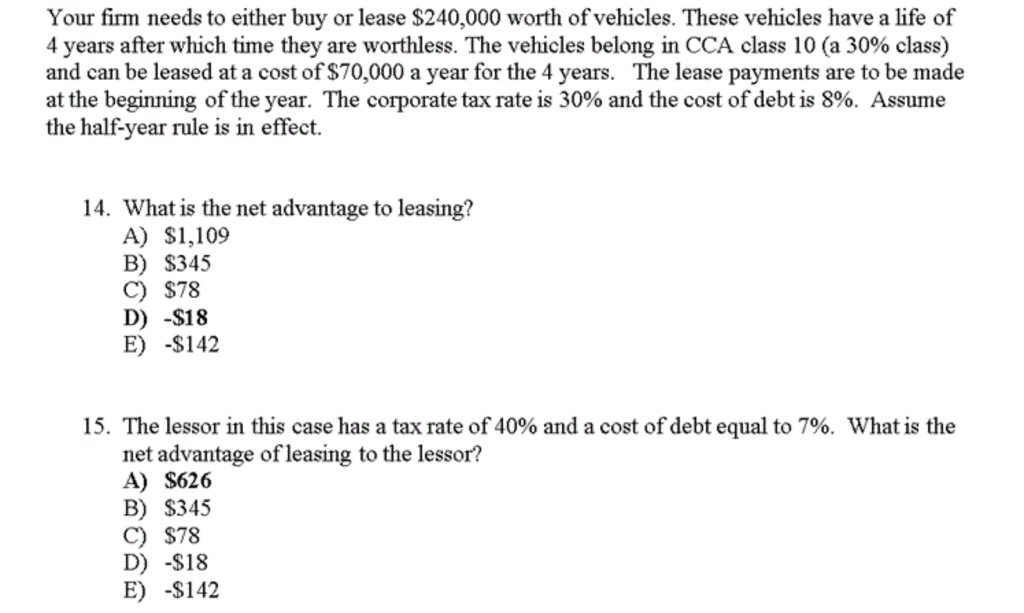

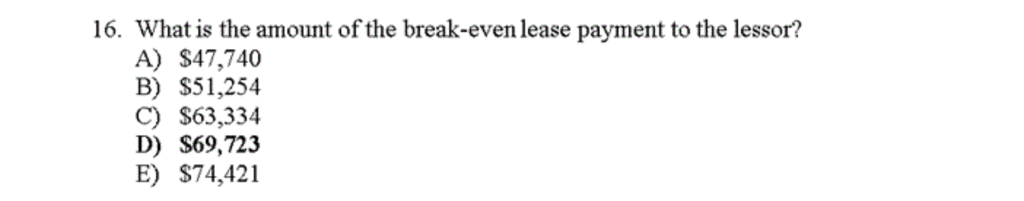

Your firm needs to either buy or lease $240,000 worth of vehicles. These vehicles have a life of 4 years after which time they are worthless. The vehicles belong in CCA class 10 (a 30% class) and can be leased at a cost of $70,000 a year for the 4 years. The lease payments are to be made at the beginning of the year. The corporate tax rate is 30% and the cost of debt is 8%. Assume the half-year rule is in effect. 14. What is the net advantage to leasing? A) $1,109 B) S345 C) $78 D) -$18 E) -$142 15. The lessor in this case has a tax rate of 40% and a cost of debt equal to 7%, what is the net advantage of leasing to the lessor? A) $626 B) S345 C) $78 D) -$18 E) -$142Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started