Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I NEED STEP BY STEP SOLUTION PLEASE AND THANK YOU XYZ Corp. wants to increase is debt-to-equity ratio from 0.25 to 1.0 by issuing debt

I NEED STEP BY STEP SOLUTION PLEASE AND THANK YOU

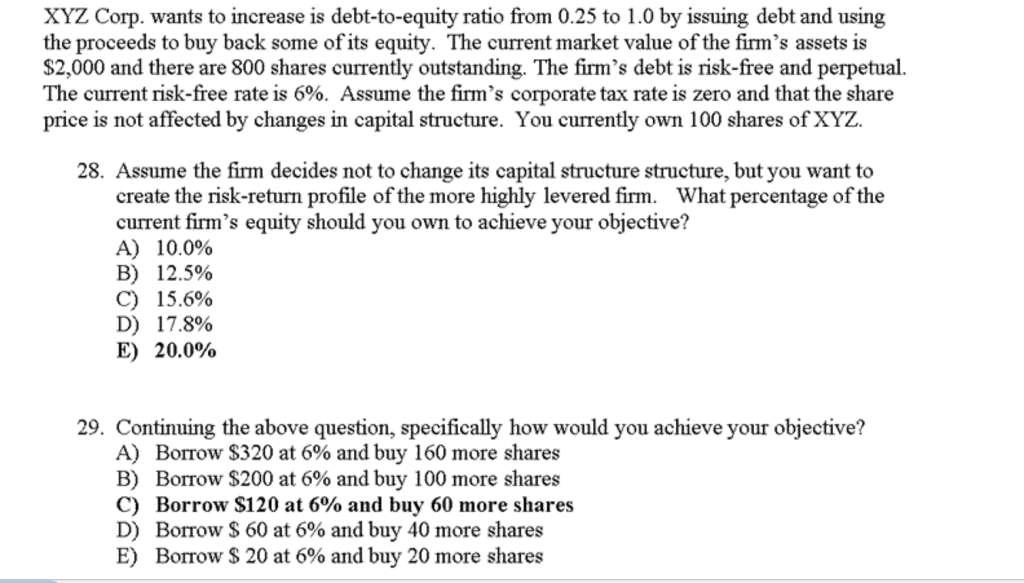

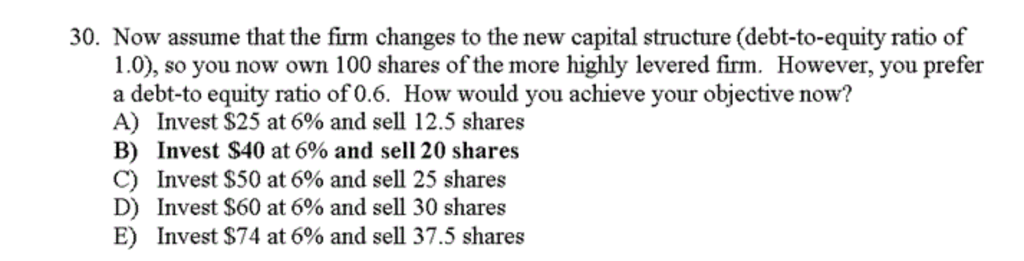

XYZ Corp. wants to increase is debt-to-equity ratio from 0.25 to 1.0 by issuing debt and using the proceeds to buy back some of its equity. The current market value of the firm's assets is $2,000 and there are 800 shares currently outstanding. The firm's debt is risk-free and perpetual. The current risk-free rate is 6%. Assume the firm's corporate tax rate is zero and that the share price is not affected by changes in capital structure. You currently own 100 shares of XYZ 28. Assume the firm decides not to change its capital structure structure, but you want to create the risk-return profile of the more highly levered firm. What percentage of the current firm's equity should you own to achieve your objective? A) 10.0% B) 12.5% C) 15.6% D) 17.8% E) 20.0% 29. Continuing the above question, specifically how would you achieve your objective? A) B) C) D) E) Borrow $320 at 6% and buy 160 more shares Borrow $200 at 6% and buy 100 more shares Borrow $120 at 6% and buy 60 more shares Borrow $ 60 at 6% and buy 40 more shares Borrow $ 20 at 6% and buy 20 more sharesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started