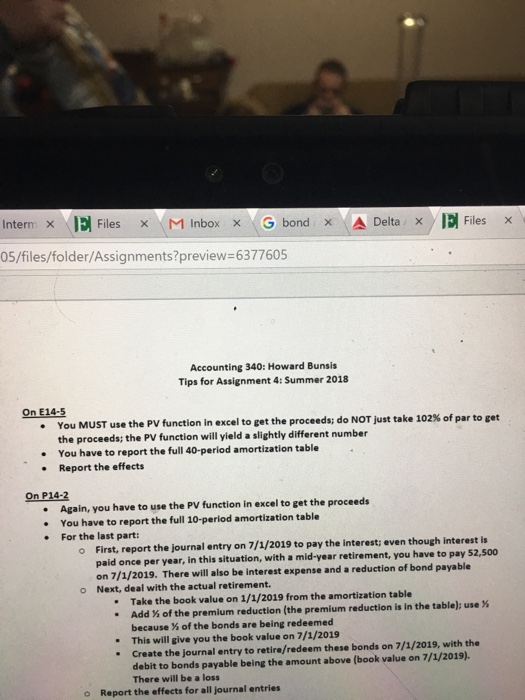

I need the amortization table for 40 years, effective yield of 9.7705% i need it with a pv function in excel that works and gives a number a little higher than 612000 i just need the table

Exase T55 Insficae how each of th s shousd be classified in the financial statements ?4-3 (LOI, Entries fur Bund Transactions, rmwrted below arvtwo independent satunnos I. On January 1, 2017, Simon Company issued s200,000 of 10-year bonds at pas levnterest is payable quarterty on Apra i 2. On June 1. 2017, Garfunkel Company issued $100.000 of 12%, 10-year bondls dlated January 1 at par plus accrued inene July I. October I, and January 1 Intenest is payable semiannually on July 1 amd January 1 For each of these two independent situations, prepare journa journal entries to record the following ta) The issuance of the bonds (b) The payment of interest on July 1. ic) The accrual of interest on December 31 bonds on January 1,2017, at 1 t issued 56o00,000 of 10%20-year bually on July 1 and January 1. Dion Company uses the straight-line method of amortication for bond premium or discount Instruetions Prepare the journal entries to record the following (a) The issuance of the bonds. b) The payment of interest and the related amortization on July 1, 2017 (c) The accrual of interest and the related amortization on December 31, 2017 E14-5 (LO1) EXCEL (Entries for Bond Transactions- Effective-Interest) that Celine Dion Company uses the effective-interest method of amortization for bond premium or discount. Assume an tive yield of 9.7705%. Assume the same information as in E144 effec- Instructions Prepare the journal entries to record the following (Round to the nearest dollar.) (a) The issuance of the bonds. (b) The payment of interest and related amortization on July 1, 2017 (c) The accrual of interest and the related amortization on December 31, 2017 E14-6 (LO1) (Amortization Schedule-Straight-Line) Devon Harris Company sells 10% bonds having a maturity va of $2,000,000 for $1,855,816. The bonds are dated January 1, 2017, and mature January 1, 2022 Interest is payable annu on January 1 Instructions Set up a schedule of interest expense and discount amortization under the straight-line method.(Round answers to the neares 14-7 (LO1) (Amortization Schedule-Effective-Interest) Assume the same information as E14-6 structions t up a schedule of interest expense and discount amortization under the effective-interest method. (Hint: The effectiv e must be computed.) -8 (LO1) GROUPWORK (Determine Proper Amounts in Account Balances) Presented below are two it ations. 2017, and pay interest on July 1 and January 1. If Gershwin uses the straight-line method to amortize bon to be reported on July 1,2017, and December 31, 201 (a) George Gershwin Co. sold $2.000000 of 10%, 10-year bonds at 104 on January 1,2017. The bonds were dat