I need the answer as soon as possible

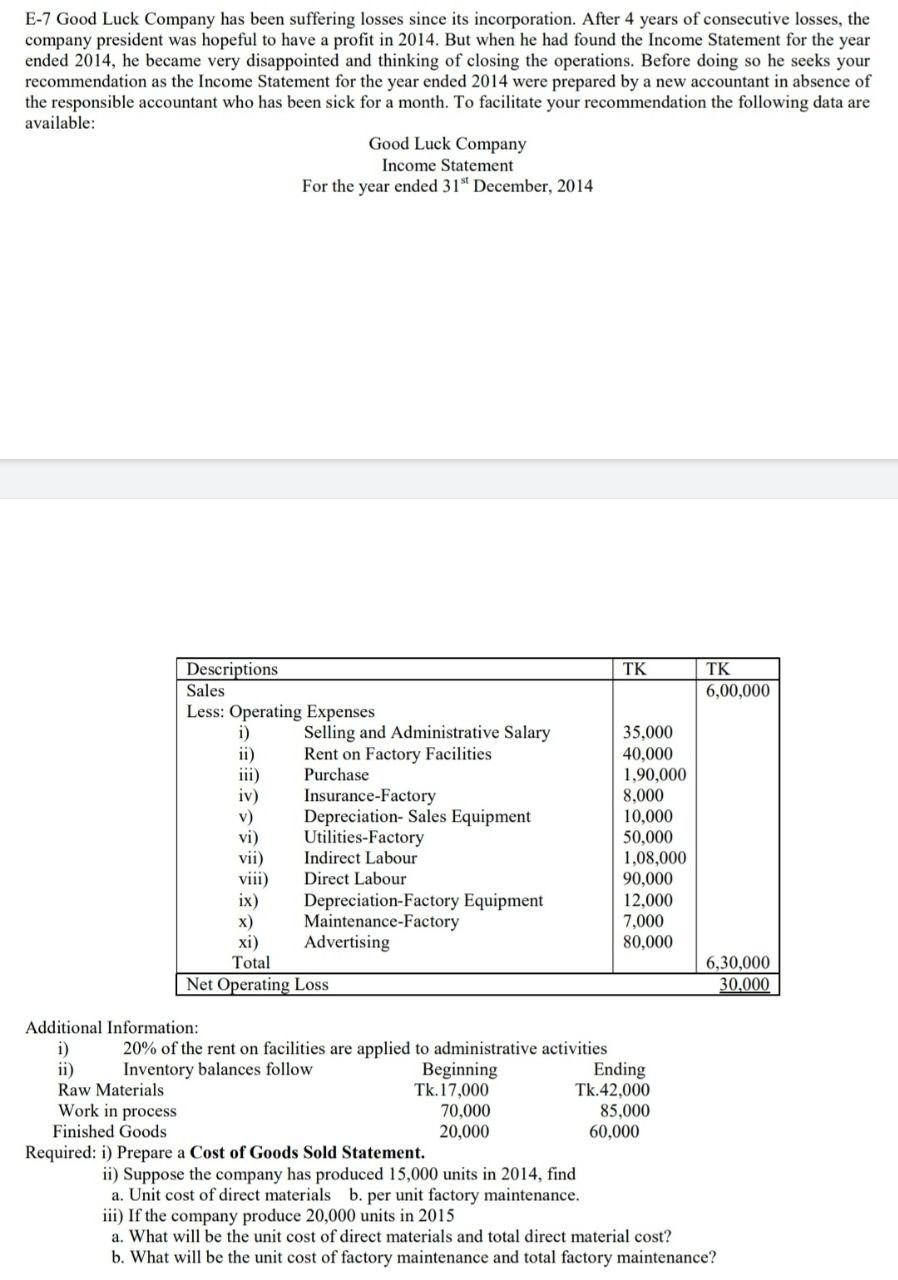

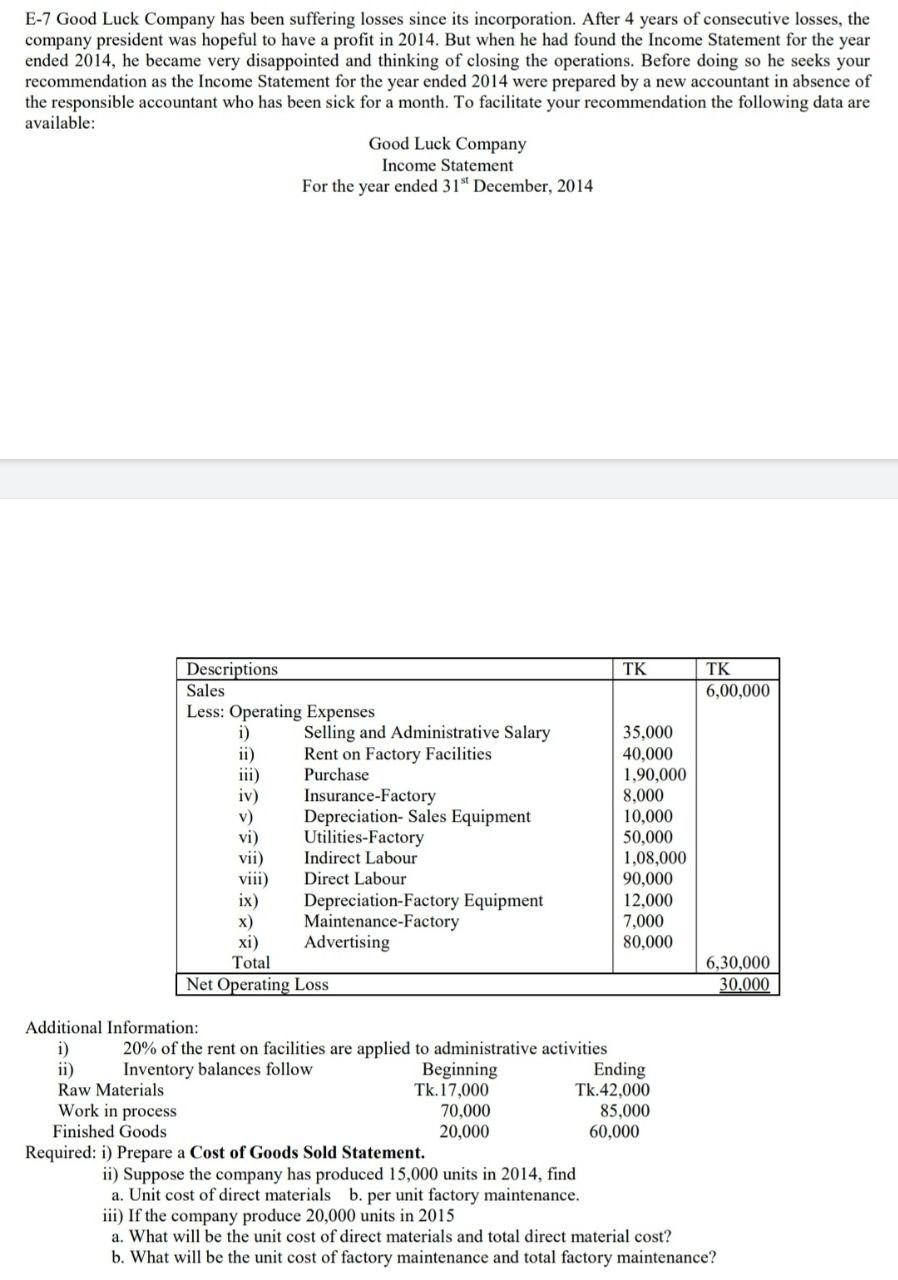

E-7 Good Luck Company has been suffering losses since its incorporation. After 4 years of consecutive losses, the company president was hopeful to have a profit in 2014. But when he had found the Income Statement for the year ended 2014, he became very disappointed and thinking of closing the operations. Before doing so he seeks your recommendation as the Income Statement for the year ended 2014 were prepared by a new accountant in absence of the responsible accountant who has been sick for a month. To facilitate your recommendation the following data are available: Good Luck Company Income Statement For the year ended 31" December, 2014 TK TK 6,00,000 Descriptions Sales Less: Operating Expenses i) Selling and Administrative Salary 11) Rent on Factory Facilities Purchase iv) Insurance-Factory v) Depreciation-Sales Equipment vi) Utilities-Factory vii) Indirect Labour viii) Direct Labour ix) Depreciation-Factory Equipment X) Maintenance-Factory xi) Advertising Total Net Operating Loss 35,000 40,000 1,90,000 8,000 10,000 50,000 1,08,000 90,000 12.000 7,000 80,000 6,30,000 30,000 Additional Information: i) 20% of the rent on facilities are applied to administrative activities ii) Inventory balances follow Beginning Ending Raw Materials Tk.17,000 Tk.42.000 Work in process 70,000 85.000 Finished Goods 20,000 60,000 Required: i) Prepare a Cost of Goods Sold Statement. ii) Suppose the company has produced 15,000 units in 2014, find a. Unit cost of direct materials b. per unit factory maintenance. iii) If the company produce 20,000 units in 2015 a. What will be the unit cost of direct materials and total direct material cost? b. What will be the unit cost of factory maintenance and total factory maintenance? E-7 Good Luck Company has been suffering losses since its incorporation. After 4 years of consecutive losses, the company president was hopeful to have a profit in 2014. But when he had found the Income Statement for the year ended 2014, he became very disappointed and thinking of closing the operations. Before doing so he seeks your recommendation as the Income Statement for the year ended 2014 were prepared by a new accountant in absence of the responsible accountant who has been sick for a month. To facilitate your recommendation the following data are available: Good Luck Company Income Statement For the year ended 31" December, 2014 TK TK 6,00,000 Descriptions Sales Less: Operating Expenses i) Selling and Administrative Salary 11) Rent on Factory Facilities Purchase iv) Insurance-Factory v) Depreciation-Sales Equipment vi) Utilities-Factory vii) Indirect Labour viii) Direct Labour ix) Depreciation-Factory Equipment X) Maintenance-Factory xi) Advertising Total Net Operating Loss 35,000 40,000 1,90,000 8,000 10,000 50,000 1,08,000 90,000 12.000 7,000 80,000 6,30,000 30,000 Additional Information: i) 20% of the rent on facilities are applied to administrative activities ii) Inventory balances follow Beginning Ending Raw Materials Tk.17,000 Tk.42.000 Work in process 70,000 85.000 Finished Goods 20,000 60,000 Required: i) Prepare a Cost of Goods Sold Statement. ii) Suppose the company has produced 15,000 units in 2014, find a. Unit cost of direct materials b. per unit factory maintenance. iii) If the company produce 20,000 units in 2015 a. What will be the unit cost of direct materials and total direct material cost? b. What will be the unit cost of factory maintenance and total factory maintenance