Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Elsie is considering the manufacture of a new product which would involve the use of both a new machine (costing $150,000) and an existing

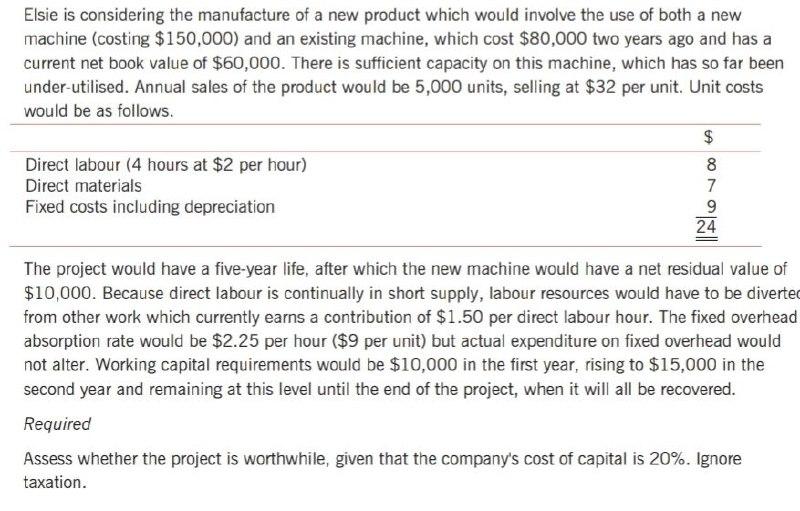

Elsie is considering the manufacture of a new product which would involve the use of both a new machine (costing $150,000) and an existing machine, which cost $80,000 two years ago and has a current net book value of $60,000. There is sufficient capacity on this machine, which has so far been under-utilised. Annual sales of the product would be 5,000 units, selling at $32 per unit. Unit costs would be as follows. Direct labour (4 hours at $2 per hour) Direct materials Fixed costs including depreciation $ 8792 24 The project would have a five-year life, after which the new machine would have a net residual value of $10,000. Because direct labour is continually in short supply, labour resources would have to be diverted from other work which currently earns a contribution of $1.50 per direct labour hour. The fixed overhead absorption rate would be $2.25 per hour ($9 per unit) but actual expenditure on fixed overhead would not alter. Working capital requirements would be $10,000 in the first year, rising to $15,000 in the second year and remaining at this level until the end of the project, when it will all be recovered. Required Assess whether the project is worthwhile, given that the company's cost of capital is 20%. Ignore taxation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To assess the projects worth well use the Net Present Value NPV method Well calculate the projects c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started