Question

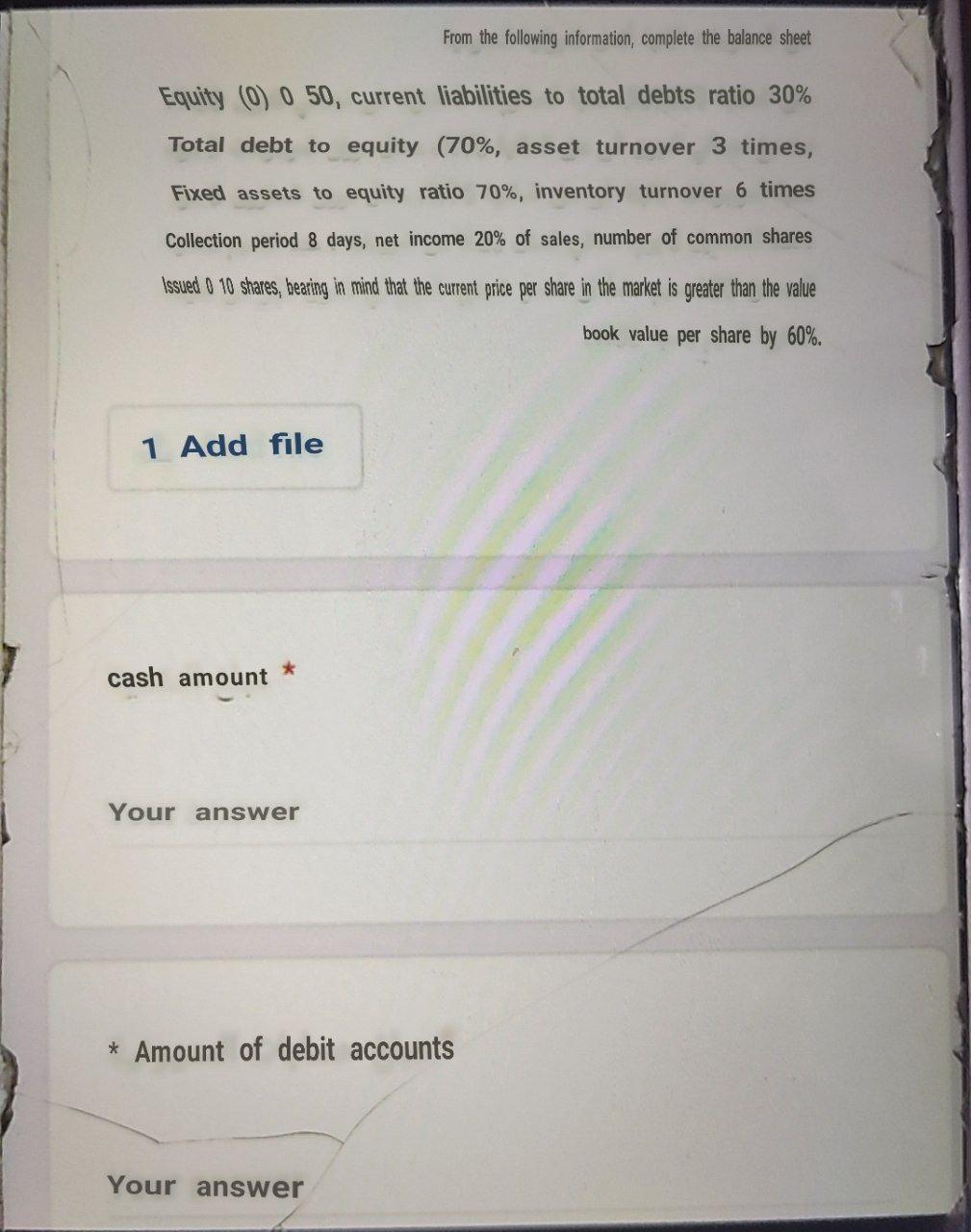

From the following information, complete the balance sheet Equity (0) 0 50, current liabilities to total debts ratio 30% Total debt to equity (70%,

From the following information, complete the balance sheet Equity (0) 0 50, current liabilities to total debts ratio 30% Total debt to equity (70%, asset turnover 3 times, Fixed assets to equity ratio 70%, inventory turnover 6 times Collection period 8 days, net income 20% of sales, number of common shares Issued 0 10 shares, bearing in mind that the current price per share in the market is greater than the value book value per share by 60%. 1 Add file cash amount * Your answer *Amount of debit accounts Your answer

Step by Step Solution

3.35 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Balance Sheet Assets Cash 0 Current Assets 0 Fixed Assets 0 Inventory 0 Total Assets 0 Liabilities C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Corporate Finance

Authors: Stephen A. Ross, Randolph W. Westerfield, Bradford D.Jordan

8th Edition

978-0073530628, 978-0077861629

Students also viewed these Corporate Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App