Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need the answer as soon as possible please Question 19: Foreign Currency Transactions [10 Marks Suggested Time: You should spend about 30 minutes on

I need the answer as soon as possible please

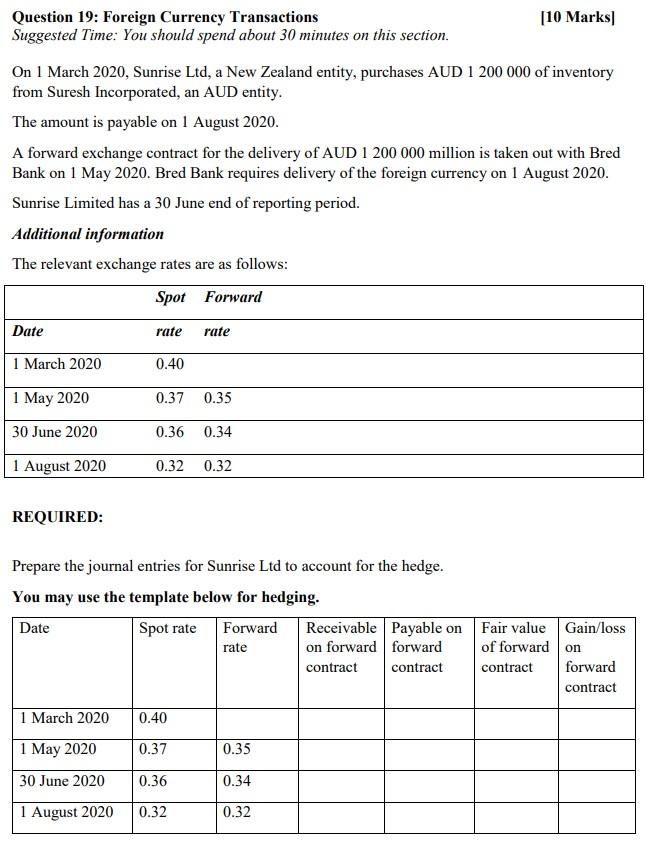

Question 19: Foreign Currency Transactions [10 Marks Suggested Time: You should spend about 30 minutes on this section. On 1 March 2020, Sunrise Ltd, a New Zealand entity, purchases AUD 1 200 000 of inventory from Suresh Incorporated, an AUD entity. The amount is payable on 1 August 2020. A forward exchange contract for the delivery of AUD 1 200 000 million is taken out with Bred Bank on 1 May 2020. Bred Bank requires delivery of the foreign currency on 1 August 2020. Sunrise Limited has a 30 June end of reporting period. Additional information The relevant exchange rates are as follows: Spot Forward Date rate rate 1 March 2020 0.40 1 May 2020 0.37 0.35 30 June 2020 0.36 0.34 1 August 2020 0.32 0.32 REQUIRED: Prepare the journal entries for Sunrise Ltd to account for the hedge. You may use the template below for hedging. Date Spot rate Forward Receivable Payable on Fair value Gain/loss rate on forward forward of forward on contract contract contract forward contract 1 March 2020 0.40 1 May 2020 0.37 0.35 30 June 2020 0.36 0.34 1 August 2020 0.32 0.32Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started