Question: Which of the following statements is true regarding the variance or standard deviation of a portfolio of two risky securities? Oa- The degree to

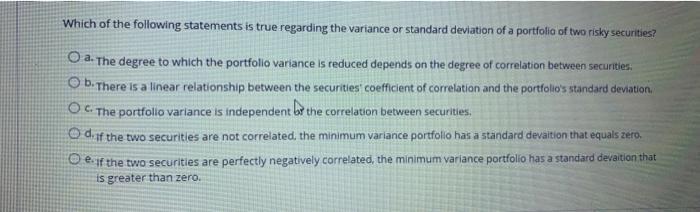

Which of the following statements is true regarding the variance or standard deviation of a portfolio of two risky securities? Oa- The degree to which the portfolio variance is reduced depends on the degree of correlation between securities. b. There is a linear relationship between the securities' coefficient of correlation and the portfolio's standard deviation. OC. The portfolio variance is independent or the correlation between securities. Od if the two securities are not correlated, the minimum variance portfolio has a standard devaition that equals zero. e if the two securities are perfectly negatively correlated, the minimum variance portfolio has a standard devaition that is greater than zero.

Step by Step Solution

There are 3 Steps involved in it

The detailed answer for the above question is provided below The correct statement regarding the variance or standard deviation of a portfolio of two ... View full answer

Get step-by-step solutions from verified subject matter experts